Meantime, the corporation stands for potential liability due to the fact that it previously made PFAS compounds. Let's take a closer look at what you need to comprehend before purchasing this company's stock.

After going astray and losing its premium valuation rating, 3M executives started last year intending to restructure the company for growth. At that point, anyone who wanted to make an investment-grade might have thought to just settle down and watch the company progress. In particular, investors were looking for improvements in the previously lagging consumer and medical segments.

3M's period of poor operating performance caused the market to strip it of its previous premium valuation rating. It refers to the ratio of enterprise value (market value plus net debt) to earnings before interest, taxes, depreciation, and amortization (EBITDA) as well as the ratio of price to free cash flow.

Unluckily, the COVID-19 pandemic had other plans, and because of its negative impact on 3M's sales, it is difficult to determine how strong 3M's restructuring attempts were.

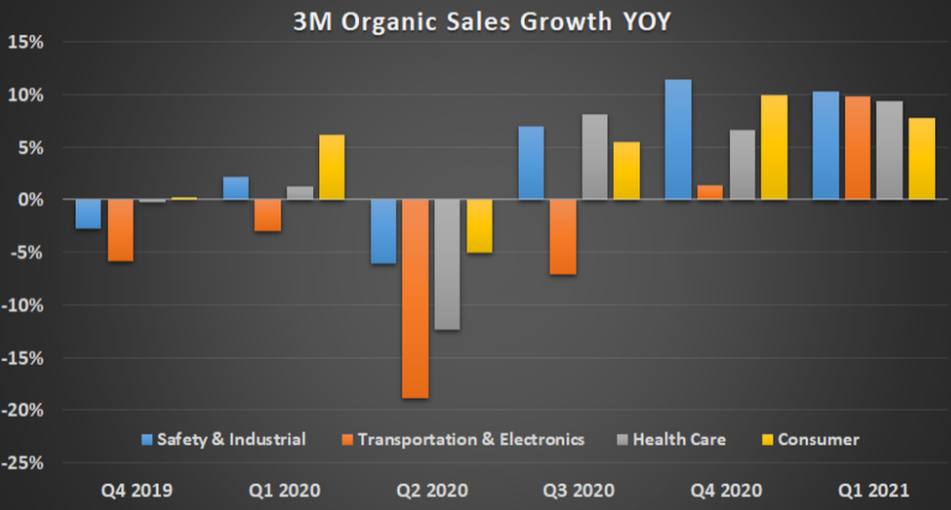

The chart below shows the impact in the second quarter of 2020 when the economy came to a halt. At that time, 3M respirators (safety and industrial segment) and infection control and respiratory products (healthcare) grew strongly due to the pandemic. In addition, sales of 3M home care and home improvement products (consumer segment) grew thanks to the lockdown and quarantine restrictions. At the same time, the transportation and electronics segment continued to suffer.

All of 3M's segments are in growth mode in 2021, and many companies will easily match its 2020 performance. Therefore, management expects organic local-currency sales growth in the 3% to 6% range in 2021. The midpoint of this range is higher than all of 3M's performance since 2015, except for 2017.

The big question is, what can investors expect from 3M during 2021 and then in a post-pandemic environment? Many of the businesses (respirators, etc.) that benefited from the pandemic may see a slowdown or decline in growth. Meantime, raw material and logistics costs are increasing, and management now expects costs to be $0.30-0.50 per share in 2021, up from the previous forecast of $0.20. By comparison, the company projects 2021 earnings per share (EPS) of $9.20-$9.70.

In addition, 3M's automotive-related sales (spread across all non-consumer segments) may slow due to reduced production at automotive facilities due to semiconductor shortages. It is one of the reasons why management has such a wide range (low to high single-digit growth) for its full-year organic sales growth forecast for the transportation and electronics segment.

Nonetheless, 3M also has several areas facing cyclical recovery and could take the baton from businesses that benefited from the pandemic.

Performance in the healthcare segment is probably the most important criterion for 3M's restructuring efforts. Management sold 3M's drug delivery business in 2020 and bought the health information systems business and the wound care business in 2019.

At the company-wide level, CEO Mike Roman oversaw a reduction in business segments from five to four. Costs have been reduced and 3M's business groups are now managed globally rather than by country.

Because of its superior cash flow generation, 3M is a great value option. For instance, Wall Street experts anticipate $18.6 billion in free cash flow over the next three years, equivalent to almost 16% of the company's current market value. It should give Roman enough money to continue restructuring the business and prepare for any potential PFAS liabilities.

Cautious investors will continue to wait for strong evidence of improvement, especially in the healthcare segment, as multi-billion-dollar acquisitions continue to gain traction. For most investors, however, 3M continues to be an attractive investment option.

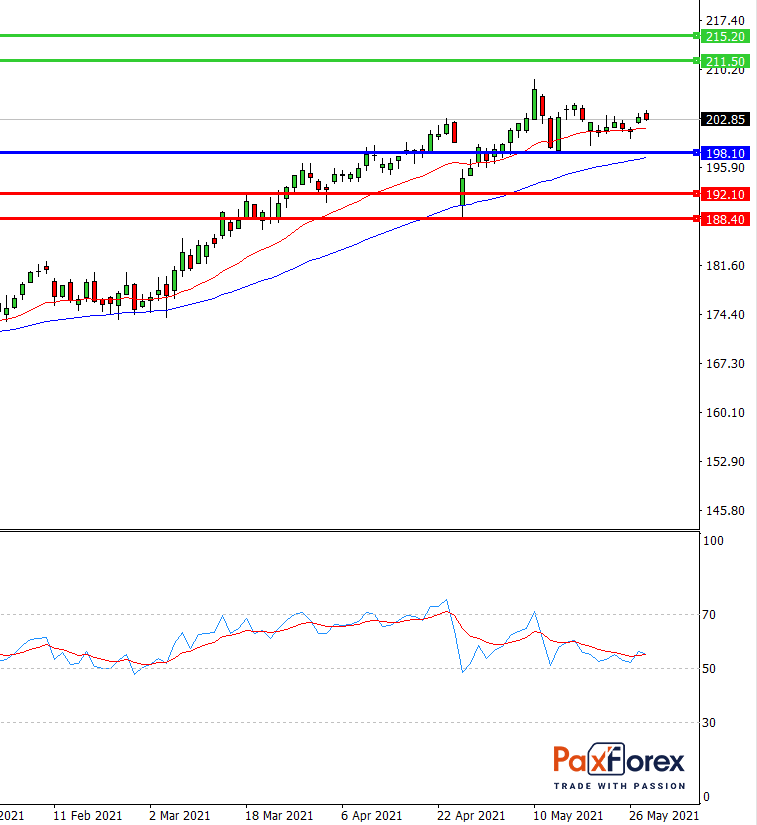

Provided that the company is traded above 198.10, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 203.04

- Take Profit 1: 211.50

- Take Profit 2: 215.20

Alternative scenario:

In case of breakdown of the level 198.10, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 198.10

- Take Profit 1: 192.10

- Take Profit 2: 188.40

Nas100 | Trading Analysis of Nasdaq 100 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis