Alibaba shares fell May 13 after the company missed fourth-quarter earnings forecasts, but revenue growth expedited for the fourth straight quarter, rising 77% to $28.6 billion.

Previously, sellers dropped Alibaba stock on Nov. 3 after the IPO of Ant Group, Alibaba's $34.5 billion fintech unit, was suspended in Shanghai and Hong Kong. The decision to suspend the IPO came after Shanghai Exchange officials said the exchange would suspend the listing due to the company's inability to meet conditions amid regulatory changes.

Sellers pounced on Alibaba stock again on Nov. 5 after the company reported earnings and missed sales.

BABA shares plummeted another 8% on Nov. 10 after Chinese regulators stated new outline antitrust rules for Chinese online platforms such as Alibaba and JD.com, among others.

Alibaba's third-quarter earnings report in February showed another quarter of strong bottom-line and top-line growth.

Adjusted earnings rose 30% to $3.38 per share. Revenue growth accelerated for the third consecutive quarter, rising 46% to $33.87 billion. The company's cloud computing revenue grew 50% year over year to $2.47 billion.

"Our cloud computing business continues to expand market leadership and is showing strong growth, reflecting the enormous potential of China's nascent cloud computing market as well as our multi-year investment in technology," Alibaba CEO Daniel Zhang said in a press release.

China's e-commerce market is valued at $2.1 trillion and is the largest in the world. Its compound annual growth rate (CAGR) is expected to be 12.4% and reach $3 trillion by 2024.

Alibaba is a great way to bet on this opportunity because its dominant market share in consumer-to-consumer (B2C) e-commerce is about 50%. That compares to JD.com and

Pinduoduo's B2C shares of 27% and 13%, respectively.

A day after the earnings report, Alibaba shares dropped 3.5% on Feb. 3 after the company's fintech unit, Ant Group, reached an agreement with Chinese regulators to restructure and become a financial holding company. Ant Group operates a suite of financial products, including Alipay, China's widely used digital wallet.

It's hard to find a company with a more impressive growth record than Alibaba. Over five years, the company's annual revenue growth rate was 29% and its sales growth rate was 46%.

Expectations were high for Alibaba's annual Singles Day event in November, the largest shopping day in China. The company did not disappoint, with sales nearly doubling from a year earlier to $74 billion.

The company managed to maintain its growth mode despite a slowdown in its core e-commerce business.

Alibaba's business in China is a lot like Amazon's business in the United States. Alibaba's cloud computing business is showing strong growth, as is Amazon's thriving Web services business.

Alibaba is anticipated to make $9.93 per share in the current fiscal year 2022, unchanged from 2021. In 2023, however, it is expected to grow faster, 28% to $12.69.

Alibaba's subsidiaries Taobao and Tmall use third-party business models. Instead of buying inventory and retailing to consumers, they operate marketplaces that host and promote other companies' online sales for a fee. This strategy helps save operating costs and provides Alibaba with significantly higher margins than its closest competitor JD.com, which uses a first-party business model.

In 2020, Alibaba's operating profit margin was 13%, much higher than JD.com's operating profit margin, which was just 1.7% during the same period.

But Alibaba is not limited to e-commerce. The company is also looking to transform retail with a concept known as "New Retail," which includes digitizing the personal shopping experience.

Alibaba has executed this strategy through its Freshippo grocery store chain, which offers advanced features such as digital price tags, robotic food transportation, and robotic waiters.

The company also spent $3.6 billion to acquire a majority stake in the Sun Art hypermarket retail chain to expand its physical presence.

With such a huge market share, Alibaba attracted the attention of Chinese antitrust authorities, who fined it $2.8 billion for allegedly restricting competition and encroaching on the business of its merchants.

The company imposed a " choose one" requirement that prohibited some customers from working with other e-commerce platforms. Company executives agreed with the fine and said they planned to enforce the requirements in the future.

It's not that clear whether compliance will have a long-term impact on Alibaba's operating results (the fine, which is only 12% of 2020 net income, probably won't). But given Alibaba's high growth rate and its low valuation, any potential weakness looks justified.

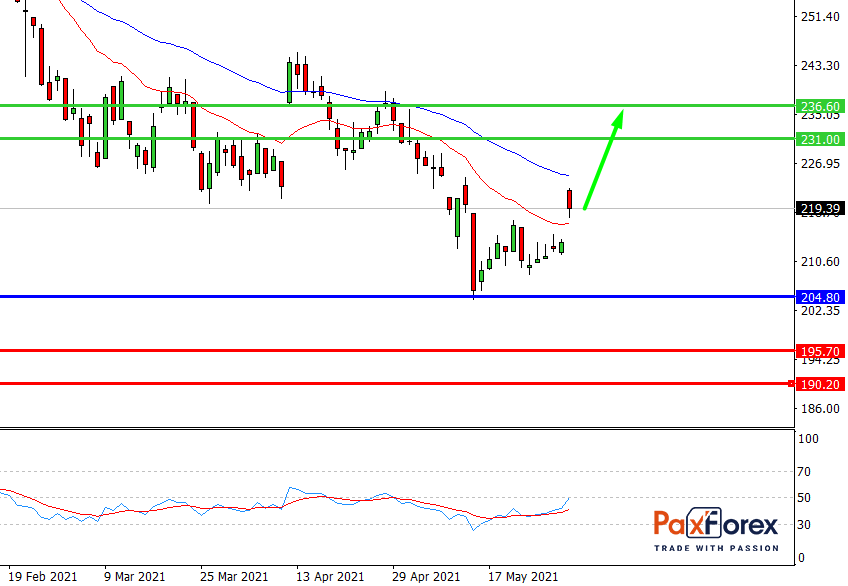

While the price is above 204.80, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 213.96

- Take Profit 1: 231.00

- Take Profit 2: 236.60

Alternative scenario:

If the level 204.80 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 204.80

- Take Profit 1: 195.70

- Take Profit 2: 190.20

GBP/USD | British Pound to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis