The only problem with that claim is that it is well documented that Amazon delivery truckers frequently urinate in bottles, and even warehouse workers control their drink consumption because of productivity quotas and distant bathrooms. Several journalists responded to this statement with evidence.

The news cycle that resulted made Amazon look silly and in denial about the reality faced by the company's frontline workers.

Even more surprising was that the directive to mock critics came from Amazon's head, CEO Jeff Bezos. According to the Recode report, Jeff Bezos told executives that they needed to be more assertive in pushing back against criticism of the company as it faces a crucial test in the biggest union election in its history, in Alabama.

In the short term, Amazon's biggest challenge seems to be the threat of unionization in Alabama, which could set off a chain reaction that would force the company to pay higher wages in other warehouses and make other accommodations to meet union demands, such as providing sufficient bathroom breaks.

Still, remarks from Amazon executives and the Amazon News account, led by Bezos, unveil something else about the company that may be more indicative. Despite praise for customer satisfaction and corporate status, the company seems rather vulnerable about its reputation in the world, revealing one of its biggest problems. Amazon has long been a lightning rod for criticism of everything from the way it treats its warehouse workers to its history of tax avoidance and monopolistic business practices that include copying best-selling products from third-party suppliers in its market.

As Amazon gets bigger, these difficulties are expected to get more serious. The company ended last year with $386.1 billion in revenue, and if it proceeds to expand at its current rate, it could overtake Walmart and become the largest company in the world by revenue in two to three years. That would make Amazon even more attractive to Bernie Sanders and antitrust lawyers around the world.

Amazon's reputation was already worth it to some extent: It was reluctant to withdraw its New York " HQ2 " in 2019, in part due to being a corporate bully and as an unworthy contender for billions in tax breaks.

It was also a warning that corporate privileges can alter promptly, and Amazon may want to recall similar examples from the recent past.

Facebook was once a favorite of both tech media and individual consumers, but its reputation quickly changed after the 2016 election and the Cambridge Analytica scandal. Last summer, dozens of major corporations joined the StopHateForProfit campaign, which boycotted Facebook in July (and in some cases longer). Twitter's #DeleteFacebook campaigns are not uncommon either, and now it seems almost mainstream to believe that Facebook is bad for democracy.

Although Facebook's growth has recovered from the boycott, its reputation will probably never overcome the slanders of the past few years. And it has stifled its growth in a variety of ways, including its potential for new acquisitions as well as enhanced government supervision, leading to a $5 billion fine from the FTC in 2019. Its stock also trades lower, notwithstanding its high growth rate, probably because of its poor track record.

New York Times columnist Ben Smith noticed correlations between Amazon and Facebook, another sign that Amazon may be careless in its corporate prestige.

Possibly the best illustration of the company's exploding reputation was the backlash against Uber Technologies, which followed an attempt to disrupt a strike by New York City cab drivers who were reacting to former President Donald Trump's ban on most Muslims entering the country. After this incident, the number of downloads of the Lyft app increased, and Uber's main competitor quickly increased its market share to about 30 percent.

Amazon may never experience the kind of valuation that Facebook and Uber have, and it may not even matter if it does, since both companies are trading near all-time highs today.

Nevertheless, it's worth keeping an eye on its corporate behavior, especially since the upcoming CEO transition later this year will test the company's leadership in a new and unforeseen environment, and events such as Uber's backlash and Facebook's boycott could come seemingly out of nowhere.

Regardless of how the union election in Alabama goes, the problem of treating workers won't go away for Amazon. While the company may still be a consumer favorite, it faces far more competition than it did five or ten years ago. Today, the tech giant has more to lose than ever.

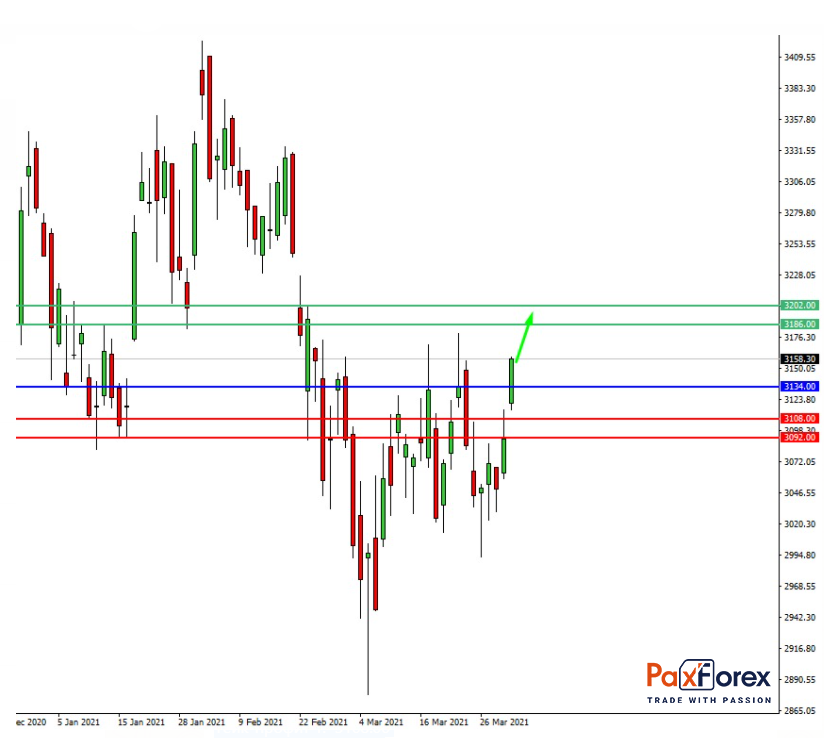

While the price is above 3134.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 3160.30

- Take Profit 1: 3186.00

- Take Profit 2: 3202.00

Alternative scenario:

- If the level 3134.00 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 3134.00

- Take Profit 1: 3108.00

- Take Profit 2: 3092.00

US30 | Trading Analysis of Dow Jones 30 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis