Nevertheless, the decline in the stock price gives investors a chance to buy it now, which could provide long-term gain, directed by multi-year growth from the 5G smartphone revolution.

Let's see why investing in Apple stock right now is the best decision.

The success of the 5G iPhone propelled the company to the top of the smartphone sales list last quarter. The company should be able to build on that success as demand for the iPhone 12 keeps outpacing supply. DigiTimes says that Apple could deliver more than 60 million smartphones in the first quarter of 2021, and IDC expects that Apple shipped 36.7 million devices in the first quarter of 2020, showing that the company is about to report another incredible quarter.

What's more, Apple's sales momentum could exceed one quarter. Based on the Wall Street chatter, Apple could place an initial order for 100 million units of its 2021 iPhone model, up from 80 million iPhone 12 orders placed last year. AppleInsider says that JPMorgan Chase analyst William Yang holds a similar view. Yang believes as many as 90 million 2021 iPhone units could be released in the second half of the year, opposed to an expected 76 million iPhone 12 builds last year.

A significant surge in initial iPhone 13 builds also wouldn't be surprising, as 5G smartphone shipments are expected to more than double from 280 million units last year to 600 million units in 2021, as per DigiTimes. Apple is expected to hold 35% of the global 5G smartphone market in 2021, according to third-party estimates, thanks to its huge user base waiting for the upgrade. All of this indicates that this year's iPhone lineup could surpass sales of the iPhone 12.

Moreover, noted Apple analyst Ming-Chi Kuo predicts that the company could release a 5G iPhone SE smartphone in the first half of next year. The iPhone SE is Apple's initial device, and a 5G-compatible version could help the company boost sales in price-sensitive markets such as India, where the transition to 5G networks is expected to begin at the beginning of next year.

Also, it is worth noting that the distribution of 5G smartphones is expected to increase to 37% of the total market in 2021. Thus, next-generation wireless devices will still have plenty of room for growth after this year, which could pave the way for Apple's multi-year supply growth. JPMorgan analysts predict that the company's shipments will grow by 13% in 2021, but they could reach higher numbers in 2022, as supply chain gossip shows.

Last year, Apple's services revenue totaled nearly $54 billion, more than double that in 2016.

It's important to note that most of Apple's services have much higher gross margins than hardware sales. Last year, services accounted for less than one-fifth of revenue, but more than one-third of gross profit. And if service revenue growth continues to outpace hardware sales growth, that segment could easily account for half of the gross profits by the middle of the decade.

Looking at the bigger picture, there are even more reasons for investors to be optimistic about Apple's growth potential. The technology company's most profitable segment, services, is growing faster than the consolidated top line. Fiscal services revenue for the first quarter was $15.8 billion, up 24% year over year. This segment boasts a profitable gross margin of 64% - well ahead of the 35% profit that Apple's product segment had over the same period (first quarter of fiscal 2021). As Apple's second-largest segment after the iPhone, its service segment looks important to serve as a significant catalyst for the tech giant's business for years to come.

The current downturn in Apple's stock price has made it cheaper than it was last year. It trades at just under 33 times earnings, compared to an average price-to-earnings (P/E) multiple of more than 40 in 2020. The current price-to-earnings ratio of 7.1 is also lower than last year's average of nearly 8.5.

Still, Apple is expected to significantly improve its financial performance in 2021. Analysts expect more than 21% revenue growth from Apple this fiscal year, along with a 35% increase in earnings per share. The company's earnings were up just 5.5% in fiscal year 2020. So investors can buy Apple at a pretty low price compared to last year and see the company achieve a much improved financial performance. That's why now is a good time to buy this stock, as the company will undoubtedly grow and evolve.

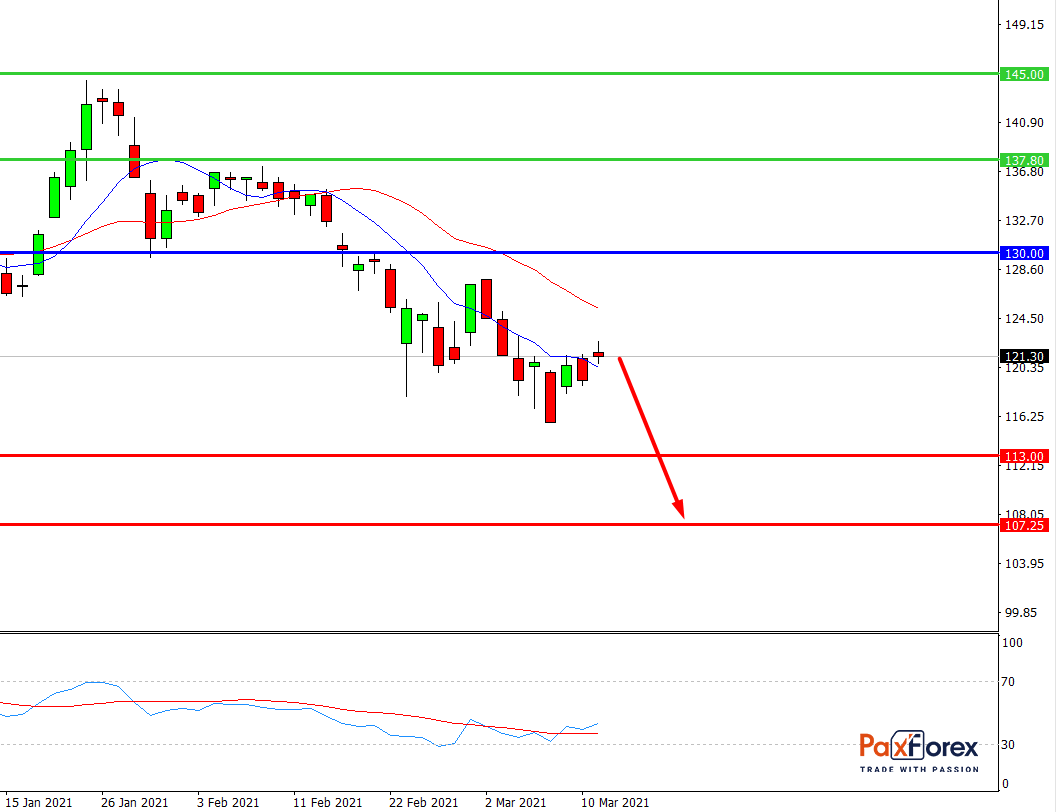

Provided that the company is traded below 130.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 121.00

- Take Profit 1: 113.00

- Take Profit 2: 107.25

Alternative scenario:

In case of breakout of the level 130.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 130.00

- Take Profit 1: 137.80

- Take Profit 2: 145.00

Trading Analysis of Nasdaq 100 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis