But detractors of the tech giant declare that there is nothing left for Apple to achieve, and investors would be better off putting their money elsewhere. Nevertheless, even as the world's most expensive company, investors still have plenty of reasons to buy Apple stock and never sell it.

The first reason is Warren Buffett's endorsement.

It is far more useful for investors to follow the example of legendary manager Warren Buffett. Since he took over Berkshire Hathaway in 1965, he has led investors to dizzying returns, delivering compound annual growth of more than 20 percent. By the end of 2020, his total stock returns had risen an incredible 2,810,526% since he took over the company.

Buffett makes no secret of his love for Apple, saying, "It's probably the best business I know." He went even further, noting:

"We bought about 5 percent of the company. I would love to buy 100 percent of its stock. ... We really like the economics of their operations. We really like their management and their way of thinking."

It's nothing less than an endorsement from one of the most successful investors in the world.

Secondly, it's the rebirth of the iPhone, so to speak.

Not so long ago, some claimed the death of the iPhone, but the release of the latest line of devices showed that this is not the case. Apple released four new iPhone models in 2020 - more than it ever did in a single year. The iPhone 12, 12 Mini, 12 Pro, and 12 Pro Max have a wide range of retail prices and features, and they do offer something for everyone.

During the holiday quarter of 2020, Apple reported record revenue of $111 billion, up 21% year over year, with 59% of that revenue coming from iPhone sales. And that may just be the beginning. At the beginning of 2021, CEO Tim Cook said Apple had an installed base of 1.65 billion devices, including more than 1 billion active iPhones. Wedbush analyst Daniel Ives estimates that about 40 percent of iPhone users have not updated their devices in the past 3.5 years. It could be the beginning of a long-awaited "supercycle" that could eventually drive Apple's market value to $3 trillion within the next year.

Third, Apple is what's in vogue.

Investors should not depreciate the increasing influence of Apple's wearable device business. In the fiscal year 2020 (ended Sept. 26, 2020), the company's wearable devices, home goods, and accessories segment grew 25 percent over 2019, earning a record $30 billion and accounting for more than 11 percent of Apple's total revenue. Not only that, the segment ended the year on a high note, with each product category - wearable devices, home goods, and accessories - posting record sales. At the time, Apple noted that its "wearable device business is now the size of a Fortune 130 company."

Growth in this segment has accelerated over the past six months. Revenue from wearable devices, home goods, and accessories is up nearly 28% year over year, driven by strong demand for the AirPods, AirPods Pro, and Apple Watch.

Fourth, it's all about services.

In early 2017, Cook announced that Apple intends to double its services revenue by the end of 2020. In July 2020, he reported that Apple reached that lofty goal as much as six months ahead of schedule.

Business is booming in 2021. In the second quarter of fiscal 2021 (ended March 27, 2021), Apple's services segment posted record revenue of $16.9 billion, up nearly 27% year over year and posting its fastest growth rate in more than two years.

The growth was driven by 660 million paid subscribers in Apple's services segment, which includes Apple TV+, Apple Music, App Store, and iCloud, among others. Luca Maestri, the company's CFO, said the video, music, games, and advertising segments had a record-breaking quarter. This segment accounts for about 19 percent of Apple's total revenue -- even with the recent spike in iPhone sales.

Next, one of the most important things is the dividend.

Apple resumed paying a dividend in 2012 after a 17-year hiatus. The quarterly payout resumed at $0.095 on a split-adjusted basis, up 132% in just nine years.

Apple announced this week that it would increase its quarterly payout to $0.22 per share, a 7% increase over 2021. Just as importantly, the company uses just 22% of its earnings to fund dividends, giving Apple ample room for future raises.

Another aspect of Apple's capital return policy is its aggressive stock buyback plan. The company has been buying back stock for years. Each quarter, Apple shareholders own an increasing share of Apple's pie. Over the past decade, Apple's stock has declined by nearly 36%.

Over the past four quarters, the company has bought back an average of about 1% of its stock and plans to continue this beneficial practice for shareholders. Just this week, Apple announced that it is adding another $90 billion to its existing share buyback program.

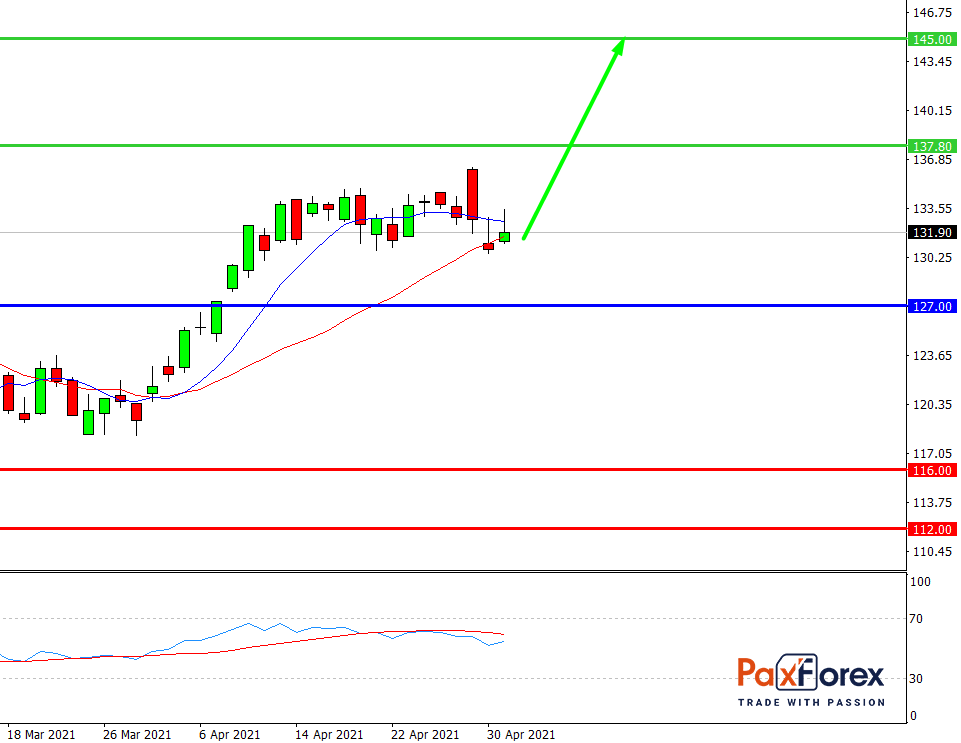

While the price is above 127.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 132.88

- Take Profit 1: 137.80

- Take Profit 2: 145.00

Alternative scenario:

In case of breakdown of the level 127.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 127.00

- Take Profit 1: 116.00

- Take Profit 2: 112.00

XAU/USD | GOLD/USD | Gold to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis