Jason Kilar, CEO of AT&T WarnerMedia, explained further, "According to publicly available information and analyst estimates, we believe we are already the 2nd largest source of revenue offline subscription video-on-demand service in the United States." Presumably, Netflix's Canadian and U.S. customers, who pay an average of $13.51 a month, qualify it as the domestic market leader.

Kilar's formulation, however, could undoubtedly be misunderstood, drawing a much quicker picture for AT&T's streaming capability than it deserves.

The deadlock is the shortage of precision about what Kilar intended to say by "revenue-generating standalone subscription video-on-demand." His portion of AT&T's March 12 analyst day event focused mostly on HBO Max, so one could easily assume that his award was for HBO Max itself. But that math doesn't add up.

We do not know precisely how many people pay for a subscription to HBO Max. What we do know, however, is that as of late last year, there were a total of 41.5 million customers between the regular HBO service and the new HBO Max streaming platform.

And here's the catch: The majority of customers who access HBO through their cable provider (or even outside the regular cable service) are eligible for free access to HBO Max, as are users of several AT&T Unlimited wireless plans.

We also know that as of the end of 2020, only 17.1 million people have activated their HBO Max option, notwithstanding it is a free perk for many. Of course, even more, users could have been attracted at that time. However, given the relatively slow start amid a pandemic when consumers are starving for entertainment, it is unlikely that the growth of HBO Max paying customers has suddenly accelerated.

But if you combine HBO with HBO Max, does it qualify as a "stand-alone video-on-demand subscription"?

That's too much. HBO delivered on TV is not "on-demand"-at least not in the sense that we recognize Disney+ or Netflix. And if HBO Max customers are mostly generated by relationships with AT&T Wireless or HBO, it's not "on-demand" either (again, at least not in the sense that we understand Disney+ or Netflix).

Even under the best-case scenario, 41.5 million consumers paying the full retail price for any relationship with the HBO brand only generates $7.5 billion a year in revenue for AT&T. In that regard, AT&T said in its presentation that all of HBO's revenue-generating brand platforms combined brought in only $6.8 billion last year.

Not only can this figure not compete with domestic top leader Netflix, but also with Amazon, most likely the prime business in the U.S. Consumer Intelligence Research Partners assesses that 126 million U.S. households pay at least $9 a month, the price of the video version of Prime alone. That amounts to a minimum of $13.6 billion a year.

AT&T's presentation figures also omit the significance of how much of HBO's current business is generated by U.S. customers. It apparently is, but assuredly, some of it is not. Kilar didn't say.

Next, there's an even more important question: So what? HBO may be the second-largest streaming brand in the U.S., but is it the second most profitable? Can it stay that way? Bear in mind, AT&T now runs two different video platforms. Some content overlaps. The other content does not. Both platforms require ongoing support and maintenance.

Neither is designed to support AT&T or Kilar. There is no doubt that HBO Max is a success, and Kilar helped make it one.

If details meant to attract investors are disclosed, they are subject to audit. It just doesn't hold up well, raising questions about why it was proposed in the first place; especially missing the relevance mark. It would be much more useful to know that many HBO Max subscribers, regardless of their location, are actually paying for the service and how much they pay per month. Netflix and Walt Disney have already released such figures.

Nevertheless, there is one positive thing about all of these statements from WarnerMedia, and the situation as a whole. That is, the company believes that HBO as a whole will more than double its top 2020 line of $6.8 billion by 2025 when it is anticipated to break even on $15 billion in revenue. Of course, this also implies that the division is losing money now, and will likely lose money over the next four years.

In any case, HBO's suddenly offered a questionable share of the U.S. streaming market doesn't matter much.

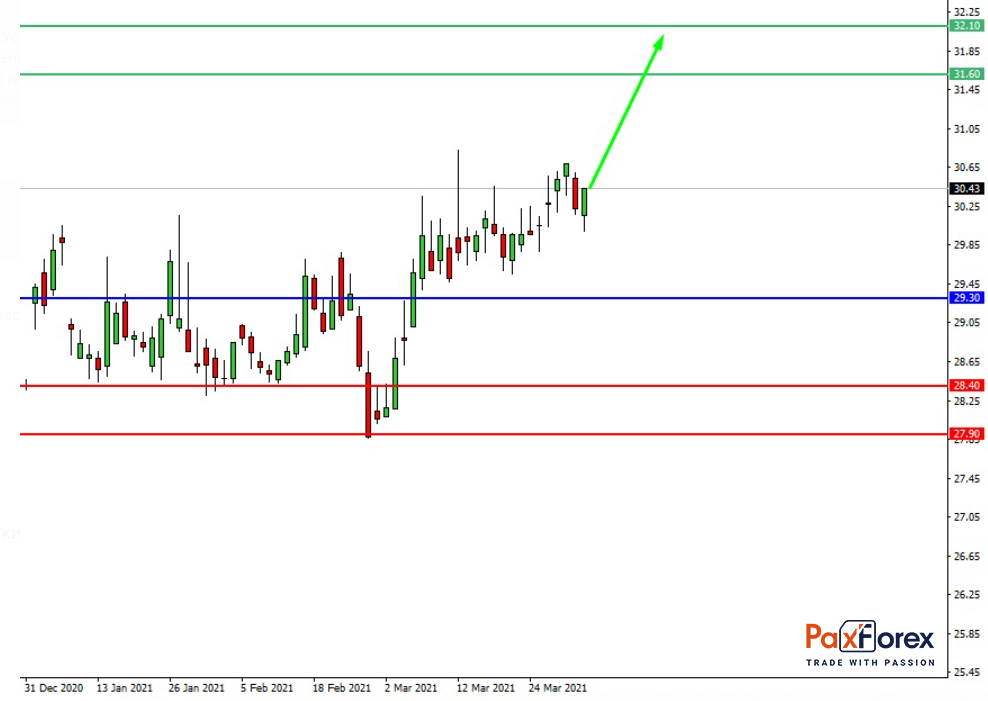

Provided that the company is traded above 29.30, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 30.40

- Take Profit 1: 31.60

- Take Profit 2: 32.10

Alternative scenario:

In case of breakdown of the level 29.30, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 29.30

- Take Profit 1: 28.40

- Take Profit 2: 27.90

Nas100 | Trading Analysis of Nasdaq 100 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis