The Unemployment Rate for July was reported at 4.6%. Economists predicted a reading of 5.0%. Forex traders can compare this to the Unemployment Rate for June, reported at 4.9%. 4.2K Full-Time Positions were lost, and 6.4K Part-Time Positions were created in July. Forex traders can compare this to the creation of 51.6K Full-Time Positions and the loss of 22.6K Part-Time Positions, reported in June. The Labor Force Participation Rate for July was reported at 66.0%. Economists predicted a reading of 66.0%. Forex traders can compare this to the Labor Force Participation Rate for June, reported at 66.2%.

The Swiss Trade Balance for July was reported at CHF4.100B. Forex traders can compare this to the Swiss Trade Balance for June, reported at CHF4.400B. Swiss Industrial Production for the second quarter increased 15.7% annualized. Forex traders can compare this to Swiss Industrial Production for the first quarter, which increased by 4.7% annualized.

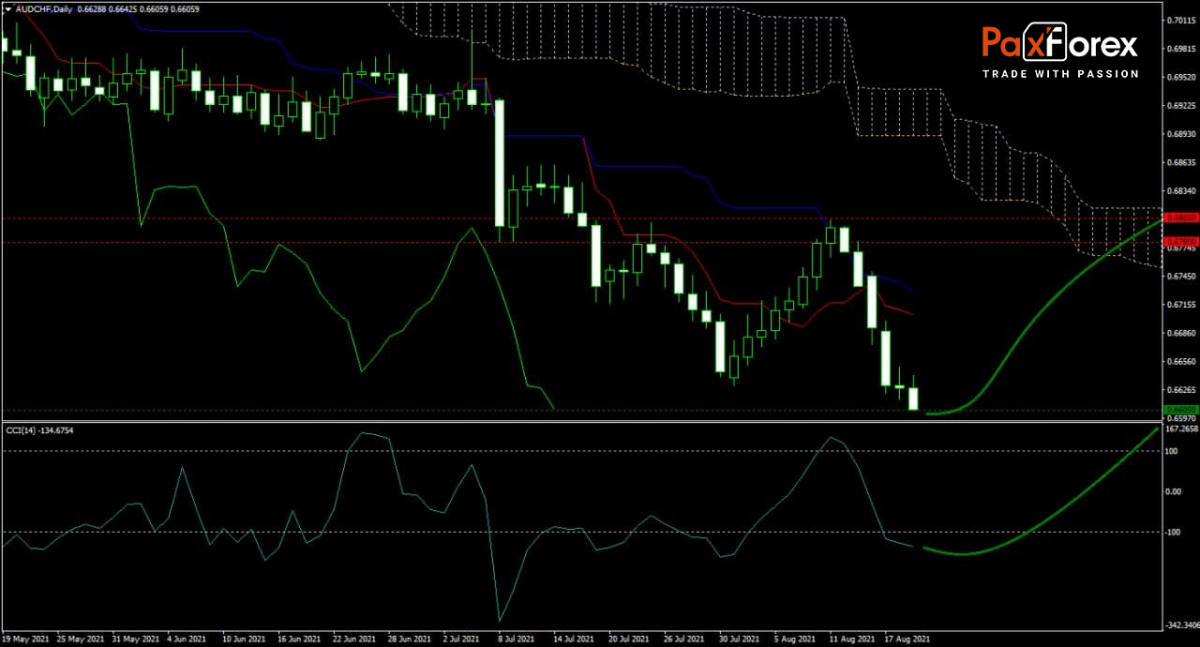

The forecast for the AUD/CHF is volatile, but price action is approaching the end of its sell-off. Traders should remain patient but can start seeking buy orders after the CCI moved into extreme oversold territory and a positive divergence formed. The Tenkan-sen and the Kijun-sen continue to move lower, and patience is warranted, but the Senkou Span A of the descending Ichimoku Kinko Hyo Cloud shows signs of flattening out, suggesting bearish pressures will soon fade.

Should price action for the AUD/CHF remain inside the or breakout above the 0.6580 to 0.6630 zone, recommended the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.6605

- Take Profit Zone: 0.6780 – 0.6805

- Stop Loss Level: 0.6540

Should price action for the AUD/CHF breakdown below 0.6580, recommended the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.6540

- Take Profit Zone: 0.6400 – 0.6465

- Stop Loss Level: 0.6580

How to find out which pair and time frame is the best to trade?

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis