The commercial aviation industry is attractive right now. Of course, cynics will concentrate on the basic risk of continued lock-downs and pandemic travel restrictions. Optimists, however, will note that the air traffic situation is improving. Also, management at several leading aerospace businesses, such as GE and Raytheon Technologies, predicts a multi-year recovery.

In this, the optimists are right. After all, the industry is unlikely to have a worse year than during the pandemic in 2020. With global vaccination programs in place and travel restrictions loosened, it's a matter of "when not if" for improvement.

To understand Boeing's role in this process and the company's profit potential, it's a good idea to figure out exactly how the aviation giant makes money. If you look at the company's revenue by segment, you can see how much it depended on Boeing Commercial Airplanes' profits. The company was doing well before two separate 737 MAX crashes in 2018 and 2019 provoked a worldwide backlash two years ago. Then came the pandemic in 2020.

Boeing's defense, space and security business may provide some decent support, but the outlook is bleak at best. For example, Boeing CEO Dave Calhoun, in his latest earnings report, said: "The scale of government spending to combat COVID-19 has the potential to increase pressure on global defense spending in the coming years."

Raytheon Technologies CEO Greg Hayes, meanwhile, believes his company can boost defense industry revenues. Nevertheless, it comes down to its international strength and its impact on "high-growth areas" such as defense systems, missiles, and intelligence, rather than the "flat budget environment" he predicts. Finally, Boeing Global Services will recover as passenger flights return, but it is unlikely to have the impact that Boeing Commercial Airplanes might.

The key to BCA's future earnings is revenue growth. It may seem obvious, but consider the fact that BCA's profitability depends mostly on production growth. As airline production grows, unit costs tend to go down, which means that each additional aircraft will be produced at a higher profit margin. Over time, as production and revenues increase, so do profit margins.

In the happy days of early 2019, former CEO Dennis Muilenburg believed that increased production on the 737 MAX would help BCA achieve a 15% profit margin in 2019 after BCA's 13.6% profit margin in 2018.

In turn, orders for the narrow-body 737 MAX are key to revenue growth. Boeing had previously hoped that the wide-body replacement cycle would begin earlier this decade, aided by orders for its wide-body 777X and 787 aircraft. However, domestic air travel will likely recover faster than international air travel. Therefore, it is likely that demand for narrow-body aircraft will recover first.

Simply put, Boeing needs orders for its flagship narrow-body aircraft, the 737 MAX. The good news is that orders are starting to come back. The unfortunate news is that it will take a long time before BA can regain its glory of yore. What's more, the commercial aviation market is very distinct from what it was several years ago. In a nutshell, it is now a buyer's market.

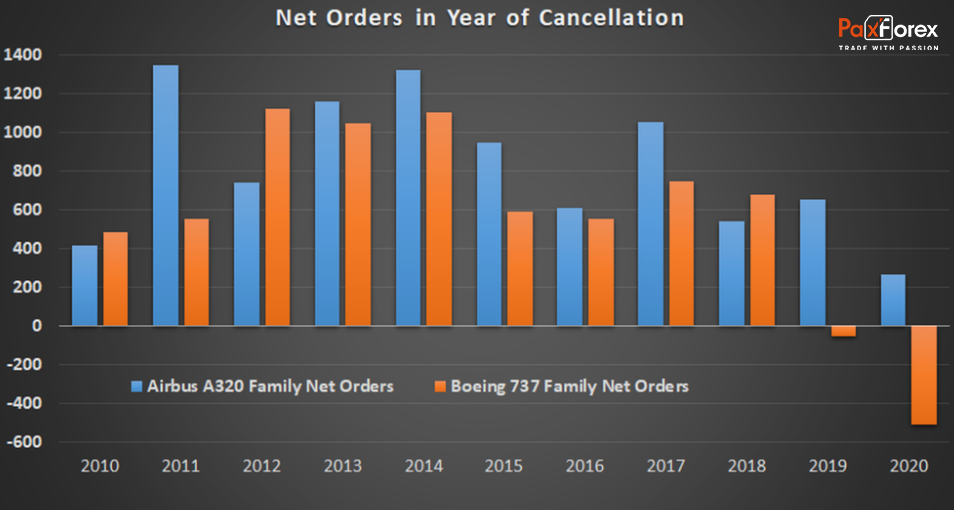

Before, Boeing and Airbus struggled to ramp up production to meet demand, but now it's about maintaining existing orders and fighting for every new order. The following chart shows net orders for the 737 and 737 MAX compared to the Airbus A320 family of aircraft. It's been a nightmare couple of years for Boeing and the 737 MAX in particular. In case you're wondering, the decline in net orders in 2019 and 2020 is due to cancellations.

Now the question is, what orders can Boeing win for the 737 MAX, and at what price? Aviation will likely recover and demand for narrow-body aircraft will eventually return. On the other hand, Airbus is a fierce competitor, and it is not guaranteed that the 737 MAX will always win orders against the Airbus A320 NEO. Furthermore, Boeing may end up making serious discounts to win orders for the 737 MAX.

Overall, Boeing will unquestionably be a more solid business in a few years, but the high level of indecision about orders and prices for the 737 MAX means that it is difficult to predict what BCA's margin profile will look like in the future. And that means it's hard to predict what Boeing's profit level will be in the future. As such, it's probably not the best way to play the commercial aviation recovery.

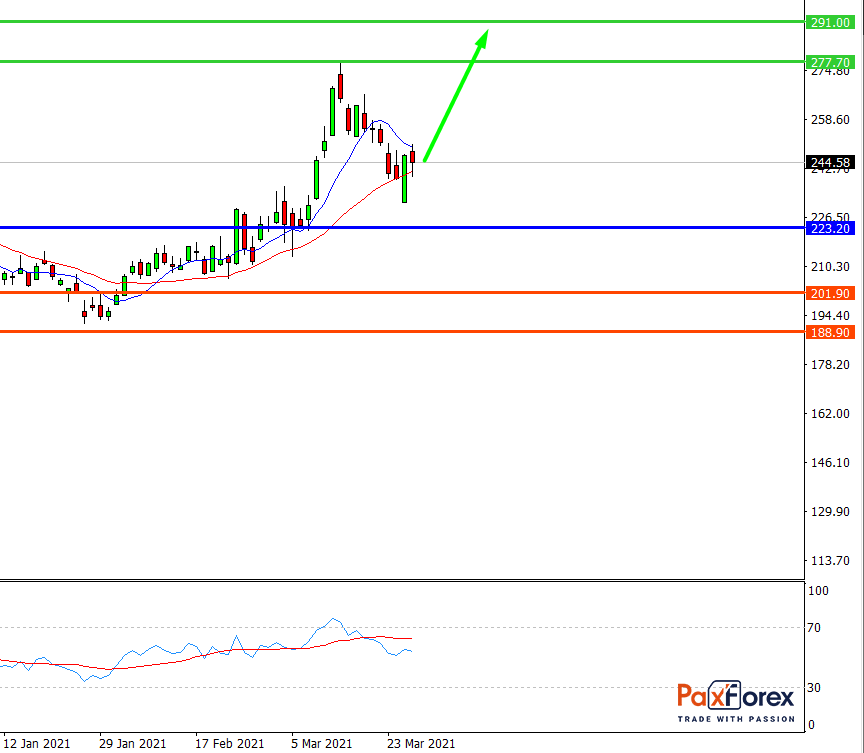

While the price is above 223.20, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 244.00

- Take Profit 1: 277.70

- Take Profit 2: 291.00

Alternative scenario:

If the level 223.20 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 223.20

- Take Profit 1: 201.90

- Take Profit 2: 188.90

US30 | Trading Analysis of Dow Jones 30 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis