Cisco posted adjusted earnings and revenue for the third fiscal quarter of 2021 that beat analysts' estimates.

Oppenheimer analyst believes the company is seeing improved demand as customers resume deferred projects and reschedule planned projects.

Ordering trends have gained in all regions and customer segments, reflecting the easing of negative factors associated with Covid-19. However, supply chain pressures keep impacting margins, and these factors are expected to persist through the end of the year.

Because of the COVID-19, corporate spending on data networks has stalled amid rising office vacancy rates. One view is that enterprise networks will become less important if remote working takes root.

As a result, Cisco stock should increase its investment in next-generation enterprise networks. Cisco strives to assist enterprise customers build hybrid network architectures that use on-premises data centers and cloud computing infrastructure.

At its Cisco Live virtual conference at the end of March, the company said that "hybridization is at the core of its product strategy," Morgan Stanley analyst Meta Marshall said in a statement to clients.

One of the big questions is whether Cisco will be able to gain share in cloud data centers, where its main competitor is Arista Networks.

In addition, the company is looking to increase recurring revenue from software and subscription services and move away from its core business of selling network switches and routers.

The majority of bulls trading CSCO stock believe a major, transformative acquisition is needed.

Cisco has appointed a new CFO, Scott Herren of Autodesk.

Cisco stock remains one of the top U.S. technology companies in terms of cash on the balance sheet. With a 4% dividend yield, CSCO stock continues to find support among institutional investors. Although Cisco stock offers an engaging dividend, its share buyback program has slowed.

From its initial public offering in 1990 through early 2000, Cisco flourished as a major provider of Internet networking equipment to both telecommunications companies and large companies outside the sector. During that period, Cisco stock rose more than 100,000% before the dot.com bubble burst.

From the first quarter of 2016 through the end of 2017, Cisco's revenues stayed flat or fell. Since the beginning of 2018, revenues have started to rise again, albeit in small single digits.

This reversal put Cisco stock into rally mode.

The growth in Cisco's revenue in 2018 was largely driven by the Trump administration's tax changes.

Moreover, much of Cisco's revenue growth came from acquisitions.

In addition to acquisitions, the new accounting rules were beneficial for earnings credit. The rules, known as ASC 606, require prior recognition of multi-year software licenses.

In 2019, Cisco agreed to buy Acacia Communications, a 400G device maker, for $2.6 billion in cash. The Chinese government deferred approval of the deal. In January, Cisco increased its offer for Acacia to $4.5 billion, and the deal finally closed.

Arista beat Cisco in the cloud data center market by getting Microsoft, Facebook, and Amazon.com as customers. But Cisco reportedly got business from Microsoft.

In addition, according to analysts, Cisco is also well positioned as enterprise customers move into a networking technology called software-defined wide-area networking, or SD-WAN.

This technology often uses the bandwidth of the public Internet.

With SD-WAN, companies need less of the expensive private data networks leased from telecommunications companies. Cisco competes in the SDN market with VMware, startup Aryaka, Fortinet, and CloudGenix. Palo Alto Networks recently bought CloudGenix.

Against the backdrop of the market's late-2020 rotation toward "value" stocks, Cisco stock has started to rise again.

In March, Cisco stock formed a flat base with an entry point of 49.44. The stock surged thanks to new products unveiled at the Cisco Live virtual conference in late March. Initially, CSCO stock sold off on fiscal third-quarter results and forecasts. But the stock has bounced back.

As of early June, Cisco stock was trading just above its 5% buy zone.

Still, some of Cisco's technical's could have been better. Deutsche Bank analyst Matthew Nikham gave the stock a "hold" rating on April 20.

"Cisco is attractive from several perspectives, including a recovery in IT spending that is driving positive earnings changes, an underlying shift toward software/services, and healthy profitability/financials generation," he said in a report. "Still, we don't see an increase in consensus valuations that would justify a more positive view, while valuations are now at a premium both individually and relative to the market."

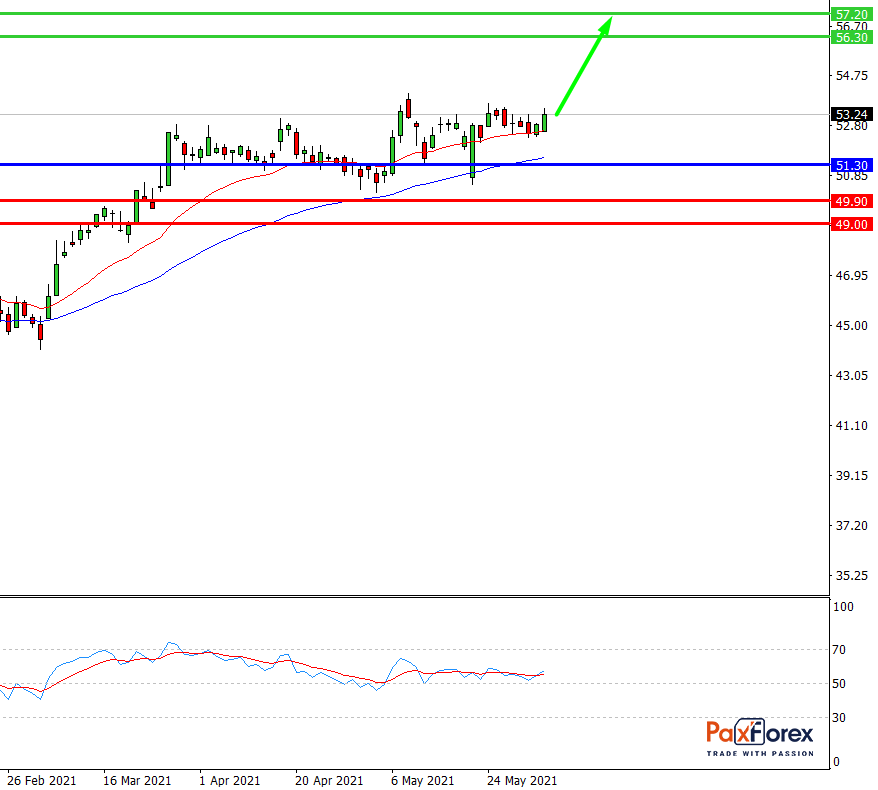

While the price is above 51.30, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 52.80

- Take Profit 1: 56.30

- Take Profit 2: 57.20

Alternative scenario:

If the level 51.30 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 51.30

- Take Profit 1: 49.90

- Take Profit 2: 49.00

GBP/USD | British Pound to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis