But after four quarters of falling sales, revenues turned positive in the first quarter of 2021 (ended April 2). Lockdowns are mostly behind us, and people are slowly leaving their homes again. The pandemic has exposed some gaps in the company's model, and it has restructured accordingly. So, will Coca-Cola be able to maintain its successes and continue where it started?

It's worth noting that Coca-Cola was showing positive momentum even before the coronavirus outbreak: sales were up 16% in the fourth quarter of 2019, after several years of slowing growth. But after a 28% drop in sales in the second quarter of 2020 and difficulties throughout the pandemic, the company ended the year with an 11% improvement for the full fiscal year. The company maintained a strong balance sheet throughout the downturn while continuing to pay dividends.

Earnings for the first quarter of 2021 were up 5%, helped by a return to the takeout segment, which was also up 5%. Earnings per share were down 19%, but both beat expectations. The recovery was so strong in the first quarter that March 2021 sales matched March 2019 sales.

However, with other parts of the world still under severe quarantine, it is unclear whether the recovery will continue on an upward trajectory. Despite the earnings growth, the company maintained its 2021 forecast of single-digit organic revenue growth.

The company has made some significant changes in managing its new operating environment. It reorganized its divisions into a more centralized system to eliminate inefficiencies, cut costs and develop a more focused marketing strategy and laid off thousands of employees. Also, it reduced its assortment from 400 to 200 brands, pushing out mostly locally focused brands with low volume products. At the same time, several new brands were launched that are more scalable to fit the new strategy.

These moves have strengthened the company as a whole and allowed it to maximize its business during quarantine, while restaurants and other out-of-home locations have been closed, but its sales concentration remains a big part of its overall business. Rival PepsiCo, whose beverage segment is not as large as Coca-Cola's, has weathered the pandemic better with a more diverse product line that includes the Quaker and the Frito-Lay brands. Both of these products were popular during the lockdown, hedging the overall sales decline.

In the first quarter, even without these segments, the company came close to a 6.8% increase in PepsiCo revenue. It means that Coca-Cola is in pretty good shape at this point, even with some quarantine constraints. It also shows that under unexpected and difficult circumstances, the company can change its business to operate under uncertain conditions.

Coca-Cola's near-term prospects seem to be tied to global vaccine introductions. But in the long term, the company is well-positioned to expand margins and increase sales.

Coca-Cola is highly valued for its dividend, which yields 3.1% at the current price. The company has raised its dividend for 57 consecutive years, making it one of the Dividend Kings. It has committed to pay dividends and continues to do so, as well as increasing them during a pandemic. The company's stock has not been that valuable in the last five years, gaining only 16%.

Coke is a great company with strong management and an unrivaled brand. The fight against the pandemic may not be completely over, but investors can expect a solid recovery when it happens.

It is undoubtedly too early to say now that the pandemic no longer threatens the company's business. But management is more confident in its broader outlook, which calls for organic sales growth this year in the high single digits compared to a 9% decline in 2020. Revenues should grow at a faster pace, executives affirmed. "We remain confident in our guidance for the full year," Quincey said.

That 8% growth this year compares well with the 5% growth PepsiCo expects in 2021, but the big question is whether the company can quickly start setting new sales records once the threat of the virus recedes. PepsiCo's broader portfolio allowed it to gain market share in both the beverage and food segments last year. The good news is that while Coca-Cola has lost ground in its core niche, it is poised for a sharp rebound in major markets such as the U.S. and Europe.

And with profitability on the rise, investors have every reason to expect higher profits - and cash returns - in 2021.

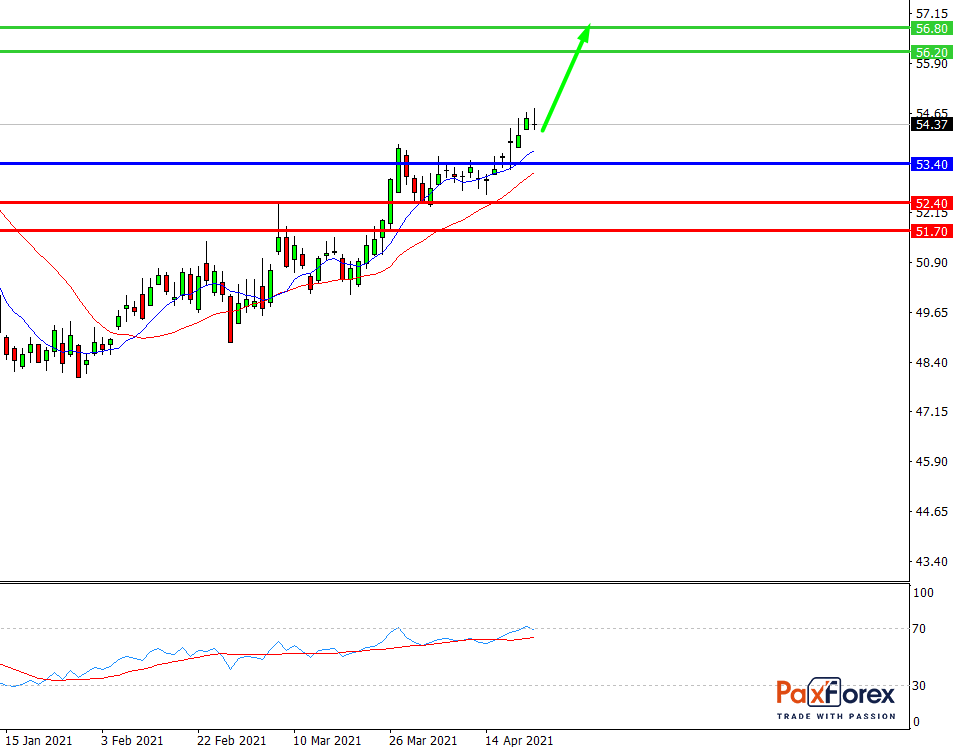

While the price is above 53.40, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 54.00

- Take Profit 1: 56.20

- Take Profit 2: 56.80

Alternative scenario:

In case of breakdown of the level 53.40, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 53.40

- Take Profit 1: 52.40

- Take Profit 2: 51.70

NZD/USD | New Zealand Dollar to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis