Besides a sell-off in other sectors, which often leads to traders dumping non-essential assets like cryptocurrencies to meet margin calls elsewhere, traders should monitor the fallout from top Chinese property developer Evergrande, the world’s most indebted real estate developer. It vowed to meet its interest payment tomorrow but is likely to crumble, and some analysts point out that the real estate developer is already in technical default with banks. Many Chinese investors piled into cryptocurrencies over the past two years, aiding a massive rally to all-time highs in the sector. A ripple effect from an Evergrande contagion event may force selling in cryptocurrencies, with Ethereum vulnerable to plunge towards the 2,000 level.

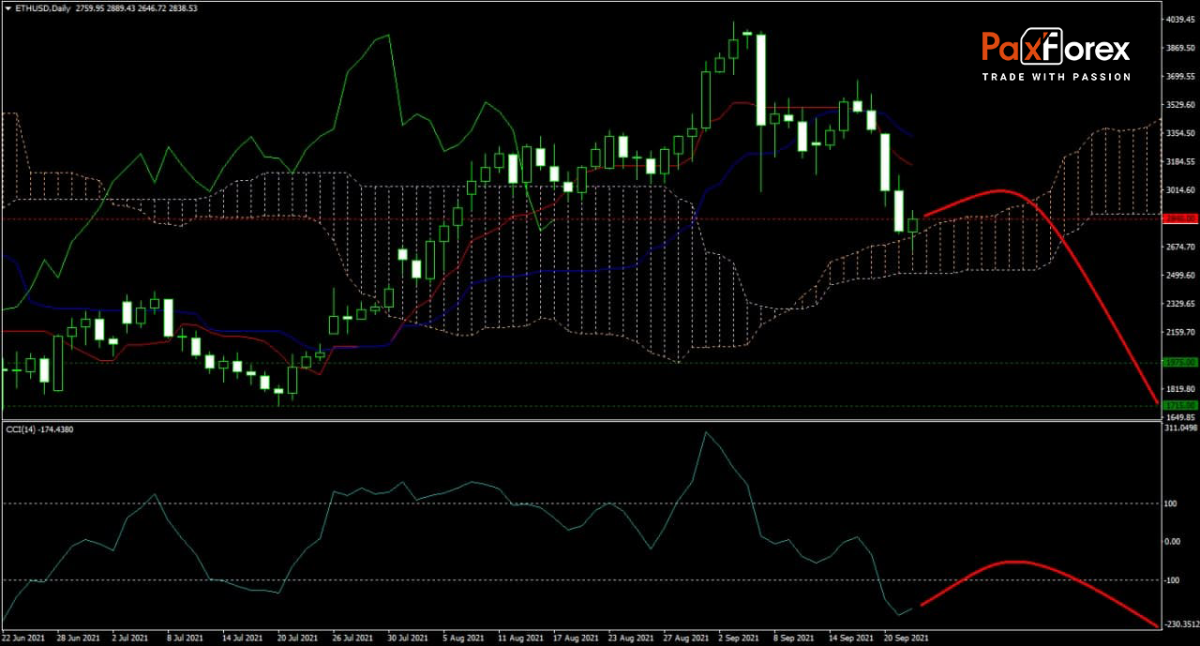

The forecast for the ETH/USD remains bearish despite its massive two-phase correction to date. After price action broke down below the ascending trendline of its head-and-shoulders chart pattern, selling pressures intensified. The Tenkan-sen and the Kijun-sen continue to descend, while the Ichimoku Kinko Hyo cloud, which forced a pause in the sell-off, trends higher. Traders should expect a rise in volatility and must remain patient, as this cryptocurrency pair is expected to attempt another breakdown. The CCI dropped into extreme oversold territory, and traders should wait for a breakout and reversal before selling the ETH/USD.

Should price action for the ETH/USD remain inside the or breakdown below the 2,750 to 2,915 zone, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 2,840

- Take Profit Zone: 1,715 – 1,975

- Stop Loss Level: 3,160

Should price action for the ETH/USD breakout above 2,915, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 3,160

- Take Profit Zone: 3,570 – 3,670

- Stop Loss Level: 2,915

NZD/USD | New Zealand Dollar to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Related articles

EUR/USD | Euro to US Dollar Trading Analysis