Japanese Bank Lending for February increased by 6.2% annualized. Forex traders can compare this to Japanese Bank Lending for January, which increased by 6.1% annualized. The Preliminary Japanese Current Account Balance for January was reported at ¥647.0B. Forex traders can compare this to the Japanese Current Account Balance for December, reported at ¥1,166.0B. The Preliminary Japanese Adjusted Current Account Balance for January was reported at ¥1,500.0B. Forex traders can compare this to the Japanese Adjusted Current Account Balance for December, reported at ¥2,080.0B. The Preliminary Japanese Leading Index for January was reported at 99.1, and the Preliminary Japanese Coincident Index was reported at 91.7. Forex traders can compare this to the Japanese Leading Index for December, reported at 97.7, and to the Japanese Coincident Index, reported at 88.2.

German Industrial Production for January is predicted to increase by 0.2% monthly. Forex traders can compare this to German Industrial Production for December, which was reported flat at 0.0% monthly. Spanish Industrial Production for January is predicted to decrease by 0.7% annualized. Forex traders can compare this to Spanish Industrial Production for December, which decreased by 0.6% annualized. Eurozone Sentix Investor Confidence for March is predicted at 1.9. Forex traders can compare this to Eurozone Sentix Investor Confidence for February, reported at -0.2.

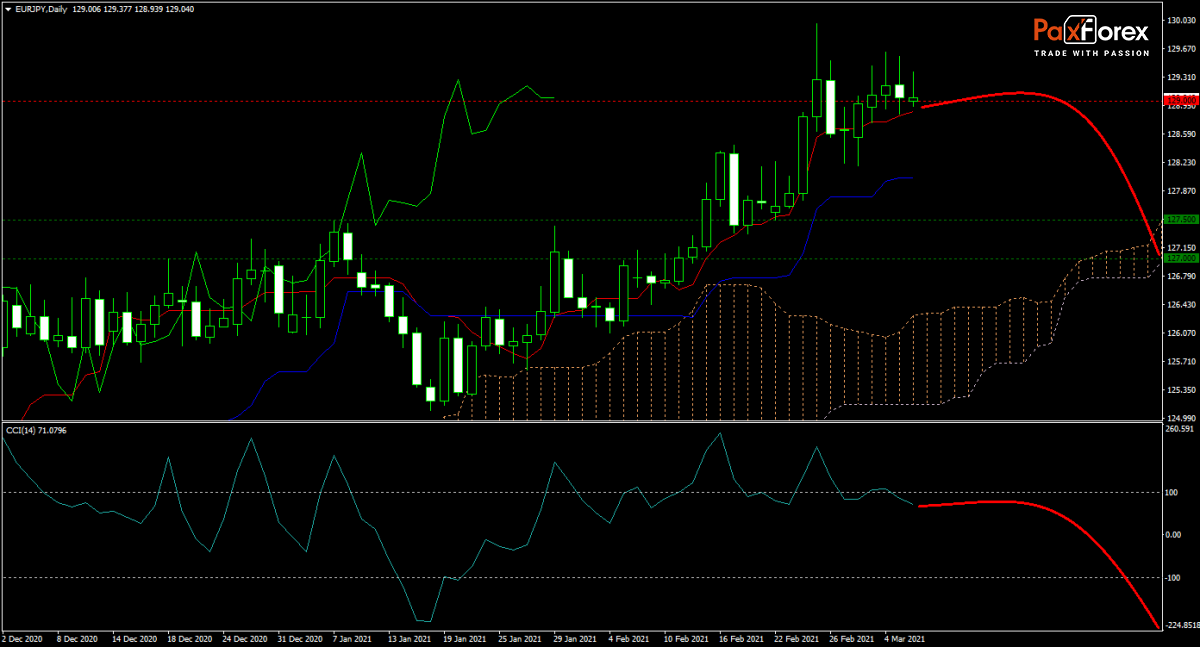

The forecast for the EUR/JPY turned bearish following the most recent run-up. While economic activity remains depressed, temporary inflationary pressures start to worry markets. While the Tenkan-sen maintains in an uptrend, the Kijun-sen flatlined, suggesting fading bullish momentum. The CCI corrected out of extreme overbought territory with plenty of downside potential, pointing the price action into a sell-off into its ascending Ichimoku Kinko Hyo Cloud.

Should price action for the EURJPY remain inside the or breakdown below the 128.850 to 129.350 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 128.500

- Take Profit Zone: 127.000 – 127.500

- Stop Loss Level: 129.650

Should price action for the EURJPY breakout above 129.350 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 129.650

- Take Profit Zone: 130.000 – 130.150

- Stop Loss Level: 129.350

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis