It has certainly been a challenging year for ExxonMobil. The company incurred its first annual loss in at least two decades. Higher oil prices have boosted the stock this year, but is the worst for the oil giant over?

Let's take a closer look at the company's operations and plans to see what investors should expect in the long run.

ExxonMobil took a hit on all fronts last year. Lower oil and gas prices and reduced production affected the company's upstream operations. At the same time, lower refining margins and demand had a negative impact on the downstream business. Also, based on an assessment of changed market conditions, the company decided not to develop a significant portion of its dry gas assets, resulting in a significant impairment loss of nearly $17 billion in the fourth quarter. The decision also addressed the need to cut capital spending to focus only on its most profitable assets.

Last year, ExxonMobil received $14.7 billion in cash from operations, which did not allow it to cover its huge capital spending and dividend payments for the year, forcing it to borrow money for those same purposes. The company paid out $14.9 billion in dividends and spent about $19.5 billion on capital expenditures, with proceeds from asset sales totaling $1 billion.

In addition to difficult market conditions, ExxonMobil's woes can be attributed in part to lapses in management. It is reflected in Exxon's plummeting return on invested capital, which for years was a leader among similar companies. Heeding investors' calls for change, the company has already added three new directors to its board this year.

All oil and gas companies faced a crisis last year, and ExxonMobil was no exception. However, it faced an additional challenge. When oil demand fell because of the pandemic, ExxonMobil was in the middle of a massive capital investment program. The company's capital and exploration spending in 2019 was $31 billion, and it planned to spend $33 billion in 2020. But unfortunately, COVID-19 derailed those plans.

ExxonMobil, however, did not quickly change its capital plans, hoping that oil markets would eventually recover. But the markets remained problematic, putting pressure on the company's balance sheet and share price. As a result, the company, much later than others, decided to cut its spending plans. ExxonMobil's 2020 capital and exploration spending was $21 billion, $12 billion less than originally planned.

In 2021, the company plans to spend much less -- $16 billion to $19 billion -- on capital and exploration projects. It is a shift in response to market conditions. ExxonMobil expects to generate enough cash to pay its dividend when it invests $16 billion in capital projects in 2021 if the benchmark price of Brent crude stays at $50 a barrel for a year.

Going forward, ExxonMobil intends to balance its three main priorities: balance sheet strength, capital and exploration spending, and dividend payments. Given the uncertainty, the company has now become much more flexible in its capital plans. It can adjust its spending plans, depending on market conditions, to create maximum value for its shareholders.

ExxonMobil is also focused on cutting costs. In 2020, the company cut its cash operating expenses by $3 billion. It expects to save another $3 billion in costs by 2023.

Flexible capital spending plans, cost reductions, and improved markets should help ExxonMobil maintain its dividend in the coming years, one of the company's key priorities. Notably, if oil prices fall and stay lower this year, preserving the dividend could stretch the balance sheet even further. Paying dividends on borrowed funds is not an ideal situation for shareholders in the long term.

Besides, the company continues to invest in some of its cheapest projects, including those in Guyana and Brazil. It should position it well for growth in a variety of price environments.

ExxonMobil's stock price is highly correlated with oil prices, which makes the stock quite volatile. However, for investors with long-term dividends, the stock currently offers an attractive yield of about 6.2%. Even though it is trading near its 52-week high, it is still trading at much lower levels than its 3 or 5-year highs.

The good news is that the company is moving in the right direction. Patient investors are likely to be well rewarded. Indeed, investors who held their positions on ExxonMobil because of last year's steep price decline surely have reason to rejoice right now.

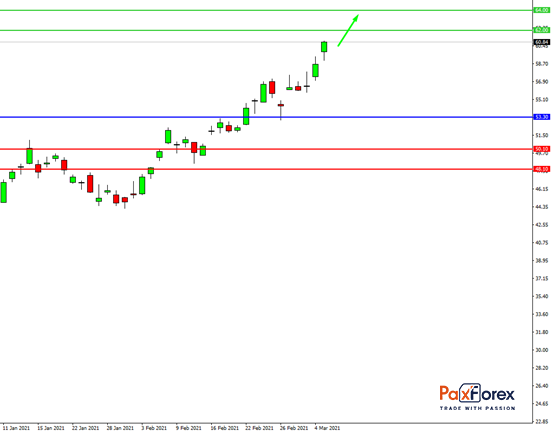

While the price is above 53.30, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 57.19

- Take Profit 1: 62.00

- Take Profit 2: 64.00

Alternative scenario:

If the level 53.30 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 53.30

- Take Profit 1: 50.10

- Take Profit 2: 48.10

GOLD/USD | Gold to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis