The company declared plans to reduce its carbon emissions by developing solutions such as "carbon capture and low-carbon hydrogen" since the demand for clean energy grows.

The event took place perfectly in the time since shareholders were becoming more concerned about the company's intentions to combat climate change as other global oil giants launched green energy plans.

But executives did reiterate earlier announcements about creating a new ExxonMobil low-carbon solutions business that will focus on carbon dioxide capture and sequestration projects.

Exxon also expects total oil production to be 3.7 million barrels per day by 2025, about the same as last year, as an investment in new projects declines.

On Feb. 2, Exxon posted a 92.7% drop in fourth-quarter profit to 3 cents per share, beating forecasts by one cent, as revenue fell 30.7% to $46.54 billion.

Total production fell 8% to 3.7 million barrels. Production in the Permian Basin increased 42% year over year to 418,000 barrels of oil equivalent per day in 2020. Exxon's current production will be about 700,000 barrels per day by 2025, down from 1 million barrels per day by 2024.

CEO Darren Wood assured experts that the company could keep its dividend if the Brent price holds steady at $45 a barrel, and $50 would enable the business to concentrate on decreasing debt or returning capital to investors.

However, to shield its payout, Exxon is decreasing costs and jobs. Exxon's capital program for 2021 is $16 billion to $19 billion, down from $21.4 billion in 2020. Exxon has already cut investments in 2020 by $10 billion from 2019 levels.

A few months ago, Exxon cut its five-year spending plan. The company now intends to spend $19 billion or less this year and $20 billion to $25 billion a year during the next 3 years. That's less than the previous projection of $30 billion in annual investments over the same period.

Exxon's revenues have stuck at 0% over the past three years. From the revenue perspective, Exxon's three-year growth rate is down 9%.

Indeed, Exxon stock provides a strong dividend yield of 5.6%. But it is rising in part because the stock has been trending downward for the past five years. Still, a high dividend cannot compensate for the constantly dropping price of shares.

Meantime, uncertainties are rising on Wall Street that Exxon can maintain its current dividend, even with the latest spending cuts. On Dec. 1, JPMorgan analysts said a dividend cut is still possible in early 2021, interpreting Exxon's promise to "maintain a robust dividend" as a failure to keep its current level.

As demand declines, independent U.S. shale companies are cutting costs to stay within their balance sheets, leaving the door open for the big oil companies.

Exxon became a bigger shale player when it struck a $5.6 billion deal in 2017 to double its oil and gas holdings in the Permian Basin.

But the company has since revised its plans downward due to the pandemic. Exxon plans to operate 7 to 10 rigs in the Permian Basin this year, down from 10 to 12 rigs at the end of 2020 and down from 50 to 60 rigs before the pandemic.

Exxon is in the middle of a $25 billion divestment process by 2025, across Europe, Africa, and Asia, as it hopes to free up more capital to invest in the Permian Basin and massive projects like the Guyana oil field.

Competitors are moving to expand shale holdings. In July, Chevron announced the purchase of oil and gas producer Noble Energy in a $5 billion all-stock deal. Noble owns 92,000 acres in the Delaware Basin of the oil-rich Permian province.

And in October, ConocoPhillips agreed to buy Concho Resources in a $9.7 billion all-stock deal, creating the largest independent U.S. oil company.

But a potential merger is still possible. Exxon and Chevron executives were in preliminary merger talks in the early days of the pandemic, sources told the Wall Street Journal. No talks are currently underway, but sources told the Journal that they could be revisited in the future.

Woods said during the fourth-quarter earnings call that he would not speculate on press reports, but that the company "continues to actively seek value growth opportunities."

Shale companies are also merging. Pioneer Natural Resources struck a deal in October to buy Parsley Energy for $4.5 billion.

Meanwhile, competing big oil companies such as BP and Royal Dutch Shell are making big cuts and moving away from fossil fuels.

Exxon's earnings are volatile and should remain under pressure as the pandemic affects demand. XOM stock also fluctuates based on crude oil prices. It could mean not only quick short-term gains but also sharp sell-offs, as was the case after the March 2020 OPEC meeting.

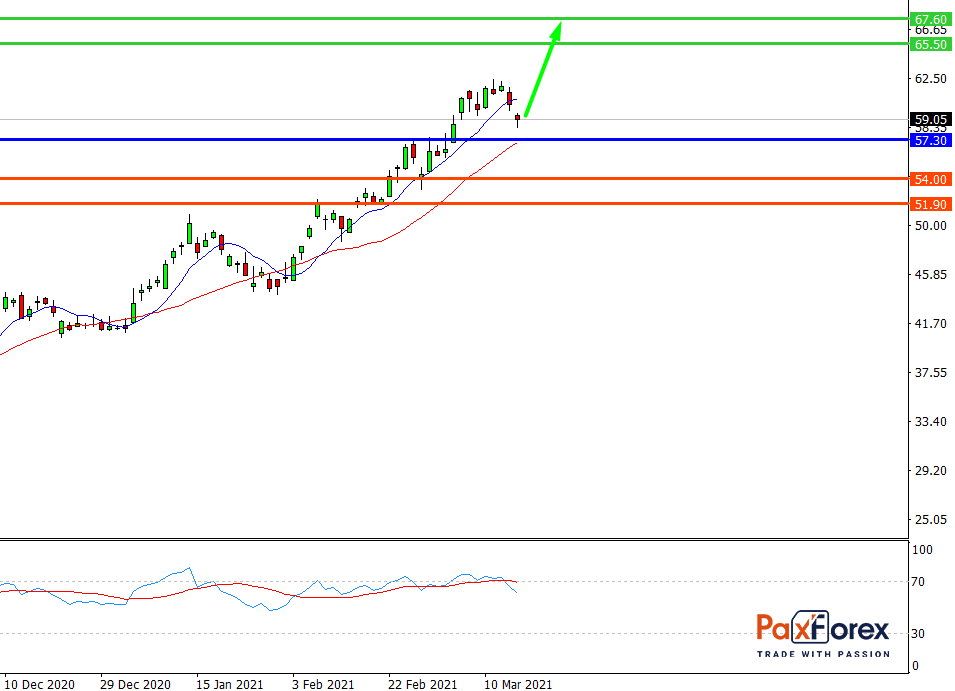

While the price is above 57.30, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 61.28

- Take Profit 1: 65.50

- Take Profit 2: 67.60

Alternative scenario:

If the level 57.30 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 57.30

- Take Profit 1: 54.00

- Take Profit 2: 51.90

US30 | Trading Analysis of Dow Jones 30 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis