Exports for March decreased by 2.0% monthly, and Imports increased by 4.0%. Forex traders can compare this to Exports for February, which decreased by 1.3%, and to Imports, which increased by 4.7%.

Australian Home Loans for March increased 3.3% monthly, and Investment Lending for Homes increased 12.7% monthly. Forex traders can compare this to Australian Home Loans for February, which decreased 1.8% monthly, and to Investment Lending for Homes, which increased 4.5% monthly. The Australian RBA left interest rates unchanged at 0.10%. Economists predicted no change in interest rates.

Forex traders can compare this to the previous Australian RBA Interest Rate Decision, where interest rates were left unchanged at 0.10%.

UK Mortgage Approvals for March are predicted at 92.30K. Forex traders can compare this to UK Mortgage Approvals for February, reported at 87.70K. UK Net Consumer Credit for March is predicted at -£0.500B, and Net Mortgage Lending is predicted at £5.800B.

Forex traders can compare this to UK Net Consumer Credit for February, reported at -£1.246B, and to Net Mortgage Lending, reported at £6.200B. The final UK Market/CIPS Manufacturing PMI for April is predicted at 60.7. Forex traders can compare this to the UK Market/CIPS Manufacturing PMI for March, reported at 58.9.

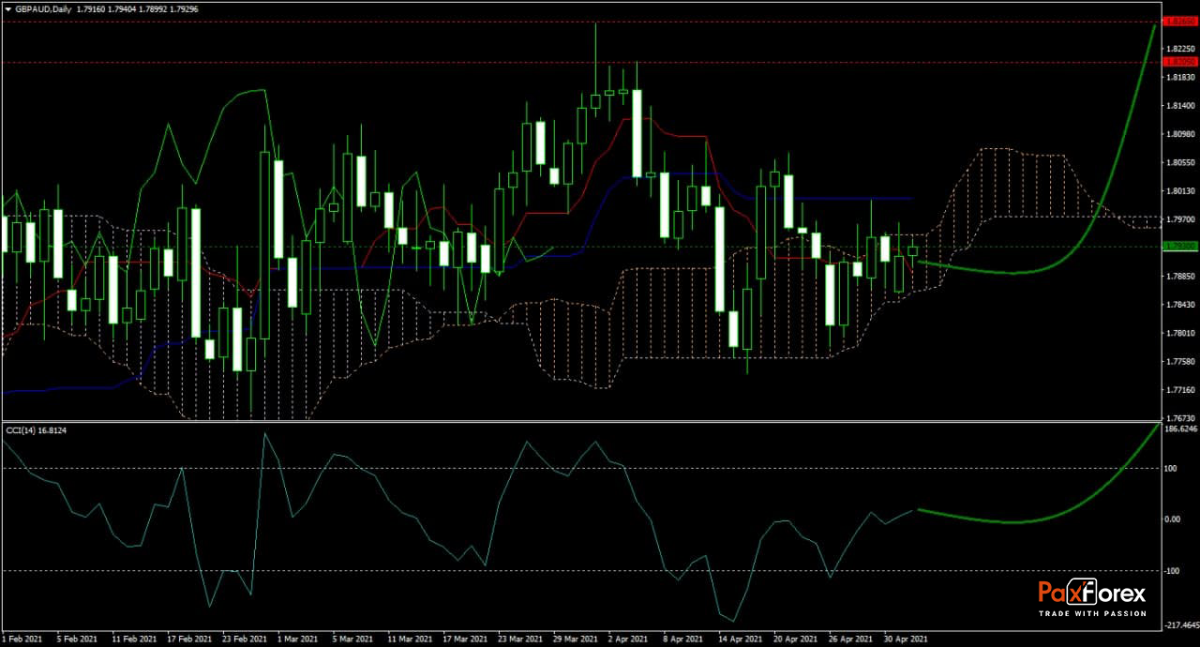

The forecast for the GBP/AUD remains bullish after this currency pair stabilized from its correction inside of its ascending Ichimoku Kinko Hyo Cloud. Traders should prepare for an increase in volatility as the Tenkan-sen continues to descend with the Kijun-sen flat. Adding to the bullish picture is the ascending CCI, which recovered from a contraction into extreme oversold territory with a higher low.

Should price action for the GBP/AUD remain inside the or breakout above the 1.7900 to 1.7975 zone, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.7930

- Take Profit Zone: 1.8205 – 1.8265

- Stop Loss Level: 1.7845

Should price action for the GBP/AUD breakdown below 1.7900, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.7845

- Take Profit Zone: 1.7720 – 1.7780

- Stop Loss Level: 1.7900

Intel | Fundamental Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis