UK Mortgage Approvals for July are predicted at 78.60K. Forex traders can compare this to UK Mortgage Approvals for June, reported at 81.34K. UK Net Consumer Credit for July is predicted at £0.441B, and Net Mortgage Lending is predicted at £3.100B. Forex traders can compare this to UK Net Consumer Credit for June, reported at £0.308B, and Net Mortgage Lending reported at £17.870B.

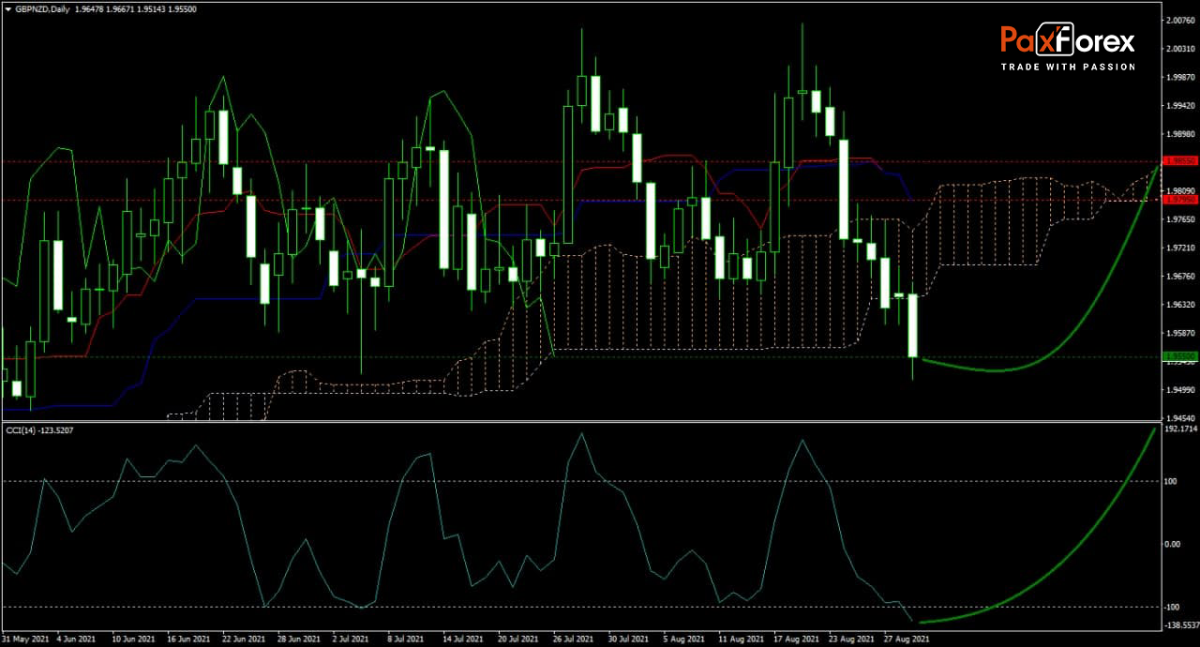

The forecast for the GBP/NZD started to turn bullish after price action corrected into support and bounced higher. While the Tenkan-sen and the Kijun-sen point lower, suggesting more short-term selling pressure and increased volatility ahead, the Ichimoku Kinko Hyo Cloud maintains its bullish trend. The CCI reached extreme oversold territory, but traders should wait for a breakout before committing to larger buy orders.

Should price action for the GBP/NZD remain inside the or breakout above the 1.9515 to 1.9600 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.9550

- Take Profit Zone: 1.9795 – 1.9855

- Stop Loss Level: 1.9465

Should price action for the GBP/NZD breakdown below 1.9515 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.9465

- Take Profit Zone: 1.9175 – 1.9255

- Stop Loss Level: 1.9515

USD/CAD | US Dollar to Canadian Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Related articles

NZD/USD | New Zealand Dollar to US Dollar Trading Analysis