General Electric has more than doubled from a low of 5.48 in May 2020, which came at a time when a pandemic wiped out the global airline and jet engine market.

On March 10, GE announced a $30 billion deal to merge its aircraft leasing division with AerCap. General Electric also reaffirmed its financial outlook for 2021 and announced a 1-for-8 reverse stock split.

Initially, GE stock fell slightly on the back of this news. But after Wall Street generally backed the aircraft leasing deal, the stock rose significantly.

GE remains a popular company with strong institutional support. As of December, 1,788 funds owned shares.

The jet engine business was once General Electric's biggest profit driver. But in 2020, GE Aviation, along with its jet engine leasing division, became GE's biggest revenue driver.

The Boeing 737 Max and the coronavirus crisis hit the business from a commercial perspective. However, its defense side was doing much better.

GE Aviation makes jet engines for aircraft manufacturers such as Boeing and Airbus. The company also runs a profitable aftermarket engine repair and maintenance business. Also, it leases aircraft to airlines.

GE's commercial aviation business experienced some downsides in 2020. Boeing halted production of the 737 Max for several months after two fatal flights, putting pressure on Leap engine sales. Besides, airlines parked planes and delayed or canceled orders because of the pandemic. Visits to engine shops slowed while leasing customers sought short-term deferrals. As a result, GE Aviation cut jobs by 25 percent and later warned of further layoffs.

Now airlines are getting the Boeing 737 Max back into the skies after the plane was approved to fly late last year. And airlines are starting to order planes again, especially the narrow-body, long-range planes.

Meanwhile, the steep drop in demand for larger, wide-body aircraft remains a problem for GE Aviation, which supplies such aircraft.

The leasing deal with Ireland's AerCap marks the biggest splash in GE CEO Larry Culp's renewal campaign.

Gains from the deal should accelerate that effort, allowing GE to reduce its debt by $30 billion and bring the total reduced from 2018 to $70 billion. General Electric is expected to eventually exit jet leasing altogether, although it currently holds a 46 percent stake in the combined company.

Culp's top priority is to improve General Electric's financial position. His new deal to sell jet financing business will allow him to focus on GE's industrial core as a manufacturer of jet engines, gas turbines, wind turbines, and hospital equipment.

In 2017. GE embarked on a massive and costly restructuring. Time-scarce acquisitions and some miscalculations in execution caused debt to swell to unbelievable proportions and GE's revenues and cash flow to shrink.

The pandemic hit GE Aviation - once the crown jewel - hardest, with revenues down 33%, profits down 82%, and orders down 41%. In 2020. GE showed a recovery in other business segments, with Q4 orders up 26% in electricity, 34% in renewable energy, and 1% in health care, minus the sale of its biopharmaceutical division.

Meanwhile, General Electric settled some SEC investigations while cutting billions of dollars in expenses and debt. These moves helped close legal and financial gaps, reducing the riskiness of GE stock.

On Jan. 26, General Electric took the big step of restoring financial guidance as the epidemiological situation improved. On March 10, GE backed its 2021 revenue growth targets in the low single digits and up to $4.5 billion in free cash flow. GE expects aviation to recover in the second half of the year.

"Much of GE's story now continues to rely on aviation, including a promising recovery from vaccine proliferation," Gordon Haskett's Inch said in January.

Other core businesses haven't been neglected either. GE Power, for example, is stabilizing after a terrible downturn in the market for coal and gas turbines for power generation. But demand continues to shift toward wind and solar power, where GE has a fledgling business.

Still, as GE's financial health improves, dividend hopes may follow. In December 2018, General Electric cut its quarterly dividend to a token penny per share. An earlier cut announced in November 2017, along with a broad restructuring, cut the dividend in half, to 12 cents.

The cuts shocked investors who valued GE stock for its long and reliable history of paying dividends. GE stock's current 4-cent annual payout offers a yield of 0.6 percent.

General Electric is making progress on its long, ambitious renewal. GE's earnings and cash flow are expected to continue to improve in 2021 when the Boeing 737 Max flies again and the overall economy is expected to recover.

Also, GE's financial position continues to improve as it reduces debt and expenses while building liquidity. The aircraft leasing deal with AerCap should help GE's balance sheet even more.

Many Wall Street analysts are optimistic about GE's current leadership and improving fundamentals. But others remain on the sidelines as General Electric belongs to a severely underperforming industry group.

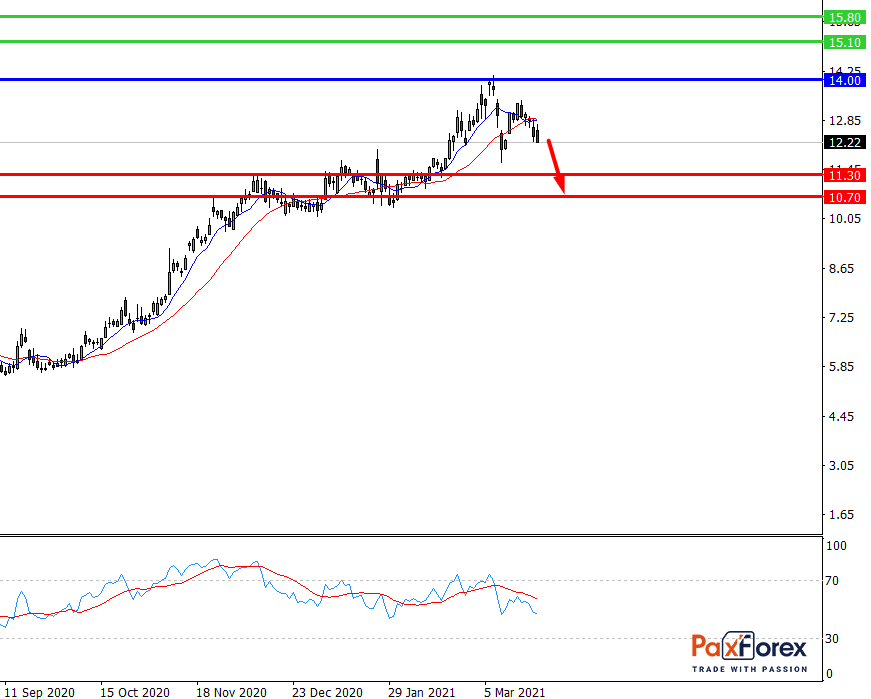

While the price is below 14.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 12.66

- Take Profit 1: 11.30

- Take Profit 2: 10.70

Alternative scenario:

In case of breakout of the level 14.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 14.00

- Take Profit 1: 15.10

- Take Profit 2: 15.80

XAU/USD | GOLD/USD | Gold to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis