GE has been lauded for improving free cash flow (FCF) generation over previous guidance and market expectations. This is something that could be further strengthened if market speculation is right and GE sells its aircraft leasing business, GECAS, to Aercap. The sale could bring in cash that could be used to reduce debt and thus pay interest in the future.

Going back to the industrials, GE Healthcare will be able to generate at least $2.6 billion in FCF for another year. However, in 2020. GE Power and GE Aviation were virtually break-even in terms of FCF, while GE Renewable Energy had $640 million in outflows. If GE is going to achieve its stated goals of $2.5 billion to $4.5 billion in FCF in 2021 (with growth thereafter), all three divisions will need to continue to improve.

Before the COVID-19 pandemic and its impact on air travel, GE Aviation generated about 74% of its revenue from commercial engines and services. The remaining 13% came from military engines and services, and the rest came from business and general aviation, avionics, and other aerospace businesses. Regardless of how you cut that figure, commercial aviation is important.

As noted earlier, the availability of capital must be open to airlines so that they can start flying again when the aviation markets open up. Given these conditions, GE Aviation looks well-prepared for the recovery.

For example, its joint venture with Safran, CFM International, provides a single-engine option (LEAP) for the Boeing 737 MAX. The LEAP engine is also one of two options on another narrow-body workhorse, the Airbus A320 NEO. So GE has every advantage when the new generation of narrow-body aircraft starts flying again and Boeing and Airbus start rolling out production.

On a less positive note, the old CFM56 engine, which powers the aging Boeing 737 and Airbus A320 aircraft, will lose much of the service revenue that investors had previously hoped for from shop visits. The cancellation of the first delivery date for the Boeing 777X wide-body aircraft is also not good news, as the GE9X is the only option for the aircraft.

Overall, GE Aviation is well-prepared for the recovery, but there's no denying that the consequences of the pandemic will be felt for years to come.

Both divisions are already in recovery mode, and both are making more progress than previously thought. To see this, let's go back to the 2020 and 2021 guidance that was given at the March 2020 investor outlook meeting.

This data can be a bit tricky to read, but the key point to keep in mind is that GE Power returned to positive FCF (only) in 2020 when capital outflows were expected. Meanwhile, GE Renewable Energy's FCF in 2020 was better, no lower than 2019, and is expected to generate FCF in 2021 compared to previous expectations, which were negative.

Clearly, both businesses are already in turnaround mode. For GE Renewable Energy, the company continues to operate on less profitable old shoreline wind farm contracts, and management says it saw "improved pricing and project execution" in its fourth-quarter earnings report.

Meanwhile, investors will hope that the giant Haliade-X offshore wind turbine, building on the initial success of its Dogger Bank orders, will add another growth lever for GE Renewable Energy.

The rise of renewable energy as a source of power generation has led to a slowdown in gas turbine orders, and the market is unlikely to change anytime soon. Nevertheless, GE continues to win orders with its heavy-duty HA turbine, and the company has an opportunity to improve order execution in the power services industry.

GE faces many challenges today, such as lost service revenue on CFM56, fierce competition in wind power, and continued weakness in gas turbine demand. However, it also has great potential to grow its CFM56 earnings/FCF through self-help initiatives such as improved execution in energy services as well as onshore wind power. GE can also provide growth through the success of key products such as the HA turbine and the Haliade-X offshore wind turbine.

Overall, the growth potential and recent history of exceeding expectations are probably enough to make the positive conclusion that GE is more than ready to take advantage of any improvements in its end markets.

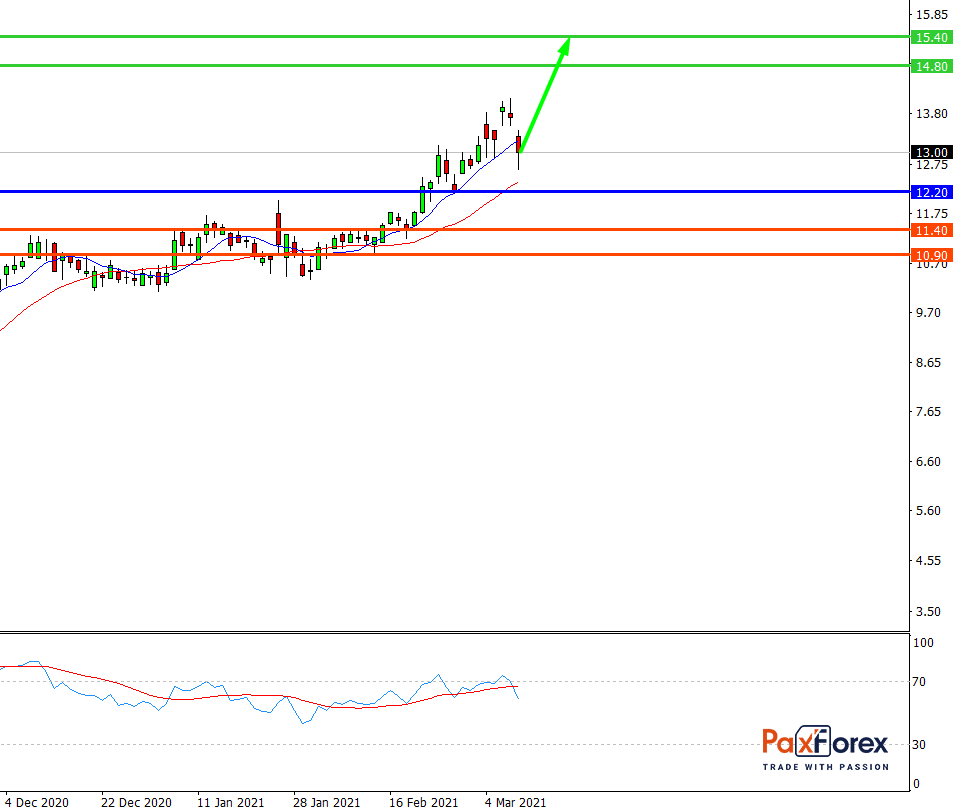

While the price is above 12.20, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 13.36

- Take Profit 1: 14.80

- Take Profit 2: 15.40

Alternative scenario:

If the level 12.20 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 12.20

- Take Profit 1: 11.40

- Take Profit 2: 10.90

Trading Analysis of Dow Jones 30 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis