Alphabet`s stock bulls are out there trumpeting the recovery of digital advertising since the coronavirus vaccine spreads, boosting the global economy as industries normalize.

Advertising on Internet search engines and YouTube exceeded expectations in December, according to analysts, sparking a rebound in GOOGL stock.

Under the leadership of Alphabet's new CEO Sundar Pichai, Google has increased its transparency. In its Q4 earnings report, the company said its rapidly developing cloud computing unit is not profitable amid high investments.

Nevertheless, cloud computing's operating margins are foreseen to develop. BoA expert Justin Post shared an optimistic view with clients in a recent report.

"We believe the new cloud computing admission implies confidence about the margin trajectory, and we see a potential $10 billion increase in earnings over the next five years using Amazon margins as a target," Post said.

Meanwhile, the ongoing share buyback program has supported earnings for GOOGL stock. Google bought $7.9 billion of its own stock in the fourth quarter. It also bought $7.9 billion in September and $6.9 billion in June.

Google continues to dominate digital advertising, along with Facebook. While Google has developed into cloud computing and consumer hardware, digital advertising still accounts for the lion's share of the revenue.

The company announced in early March that it would stop using Web browser tracking technology to sell ads. Earlier, management said the company would phase out the use of third-party cookies.

With Amazon gaining traction in digital advertising, Google lately made significant adjustments to how it manages e-commerce ads.

Google's profits are still a problem because of high investments in data centers for cloud computing, artificial intelligence, YouTube, and consumer products.

Meantime, Google has strived to achieve a share in cloud computing compared to Amazon and Microsoft.

Bank of America predicts that YouTube subscription revenue will reach $18 billion by 2025, up from $5 billion in 2020. YouTube is also capitalizing on this as big brands shift advertising budgets from linear TV to digital channels.

YouTube has more than 30 million subscribers to premium music and pay channels, and YouTube TV has more than 3 million subscribers, Google said in its September earnings report.

Undoubtedly, the key question for investors is how much Waymo's self-driving car and other projects like Verily Life Sciences should cost.

Two years ago, some experts predicted a long-term valuation for Waymo in the range of $75 billion to $125 billion. Recently, however, expectations for self-driving cars have been lowered.

In early March, Waymo managed to raise $2.25 billion from outside investors, including private equity firm Silver Lake, the Canada Pension Plan Investment Board, and an Abu Dhabi-based investment unit Mubadala.

While Google doesn't disclose Waymo's value during the financing phase, reports say it's only $30 billion.

In October, Waymo CEO John Krafcik announced that Waymo would open up the Phoenix suburbs to the public for driverless ridesharing. In the past, the company has used human supervisors.

Another issue is the performance of Google's hardware business. It struggles with Apple in smartphones and Amazon in smart home devices.

In September, Google released new Pixel smartphones with support for 5G wireless services. Apple released the iPhone 5G on Oct. 13.

With Android's built-in operating system for mobile devices sold around the world, revenue growth from the Play Store continues to be a very positive sign. Nevertheless, the app service fees charged by Apple and Google are subject to more regulatory scrutiny.

Some claim that Google stock is long past those glory days when the company rose nearly 800% in just over three years after its IPO. In recent years, Alphabet stock has generally kept pace with the S&P 500, interrupted by abrupt periods of outperformance.

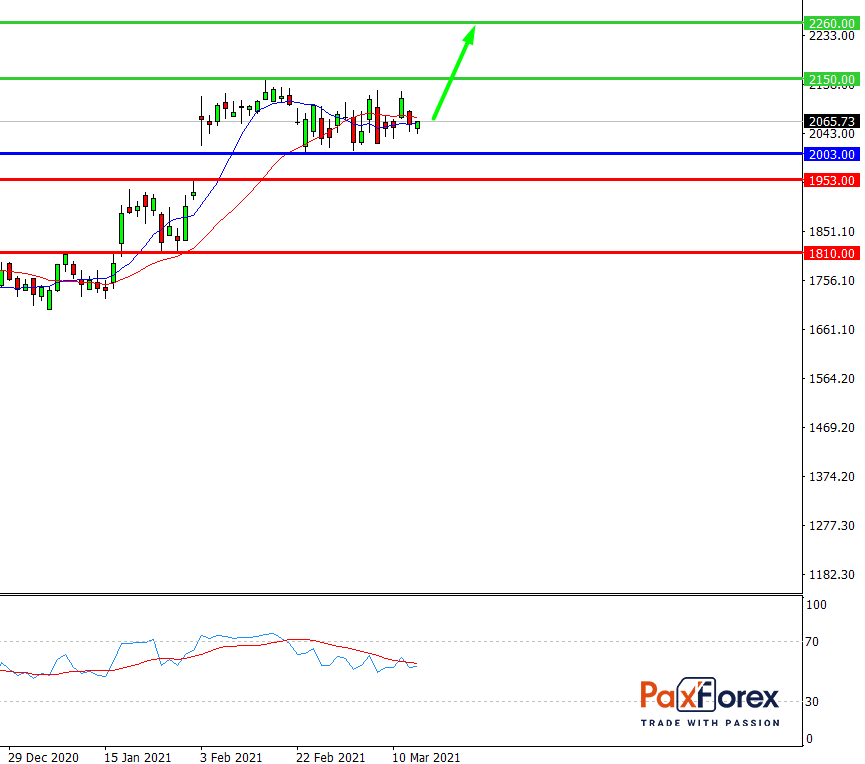

While the price is above 2003.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 2057.00

- Take Profit 1: 2150.00

- Take Profit 2: 2260.00

Alternative scenario:

If the level 2003.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 2003.00

- Take Profit 1: 1953.00

- Take Profit 2: 1810.00

SPX500 | Trading Analysis of S&P 500 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis