But as the coronavirus vaccination has intensified and social distance rules in the U.S. have relaxed a bit, the factors reinforcing this trend are beginning to weaken or disappear. This return to normalcy could be a major setback for Home Depot, as people have more options on what they can spend their money on.

Given these factors, investors should pay close attention to the company's overall earnings growth when Home Depot reports its first-quarter earnings Tuesday.

Wall Street has high hopes for Home Depot's report. The home improvement retailer has benefited from several positive trends in the past year, including growing demand for do-it-yourself projects, rising prices for materials such as lumber, and a general boom in the housing market.

However, the industry leader has ceded market share to competitors, including Lowe's, in recent quarters, which means investors will be watching closely for signs of business strength.

With that big picture in mind, let's look at a few indicators to watch for when Home Depot announces its results tomorrow.

We can hardly expect more growth. After all, Home Depot grew sales by $6.5 billion, or 25 percent, in the previous quarter. And the housing market remained strong through early 2021.

That's why investors expect first-quarter growth to be about 25% again.

But those numbers could be skewed by rising prices for items such as lumber, so it's more useful to keep an eye on comparable Home Depot sales. The chain saw a 21% increase in the fiscal year 2020, compared with a 26% jump in Lowe's. Reports from both retailers released this week will show whether the industry's second-largest player will continue to close the operating gap between the two retailers in 2021.

Last year, Home Depot's profitability remained flat, with operating margins holding steady at about 14% compared to Lowe's at 11%. Upcoming reports may show a further tightening of the relationship between the two companies, but overall margins should increase thanks to higher prices in many home goods niches, especially lumber. It will be interesting to see how the chains handled these price hikes and whether they were able to provide savings to their customers.

Home Depot executives said in February that operating margins should remain at 14%, and Lowe's is projecting another small step toward its goal of 13% over time.

The biggest factor affecting the stock this week will be an updated outlook from company management. Three months ago, CEO Craig Menear and his team said sales could be flat after a record year in 2020 when Home Depot added $20 billion to its annual base. But executives gave no specifics other than a warning of volatility and great uncertainty about economic growth, consumer demand, and the path of the COVID-19 virus.

Ahead of the peak of the spring sales season, with several months of sales results already recorded, Home Depot may come out with more detailed guidance. Menear should comment on the strength of the housing market and key trends that support the company's business, including home prices, home turnover, and wages.

Each of these factors looks strong on the eve of the second quarter, so it should come as no surprise to investors if Home Depot hints at another year of growth in 2021, even after it added more sales to its base last year than in its first 20 years.

Analysts on Wall Street expect Home Depot to report revenue of $34.17 billion and earnings per share of $2.98, up 24.1% and 43.3%, respectively, from last year. Home Depot stock is up 19% since the beginning of the year, and investors believe the company can maintain this momentum for some time to come.

The stock is now trading at a price-to-earnings ratio of 26 for 12 months. That's nearly the highest ratio in a decade. In other words, the stock is not cheap compared to historical averages. Nevertheless, Home Depot is a well-run company that has performed well over time. Sometimes it's better to pay for quality than to look for bargains. Investors looking for a company that can grow their wealth over the long term can add Home Depot to their list of stocks to watch.

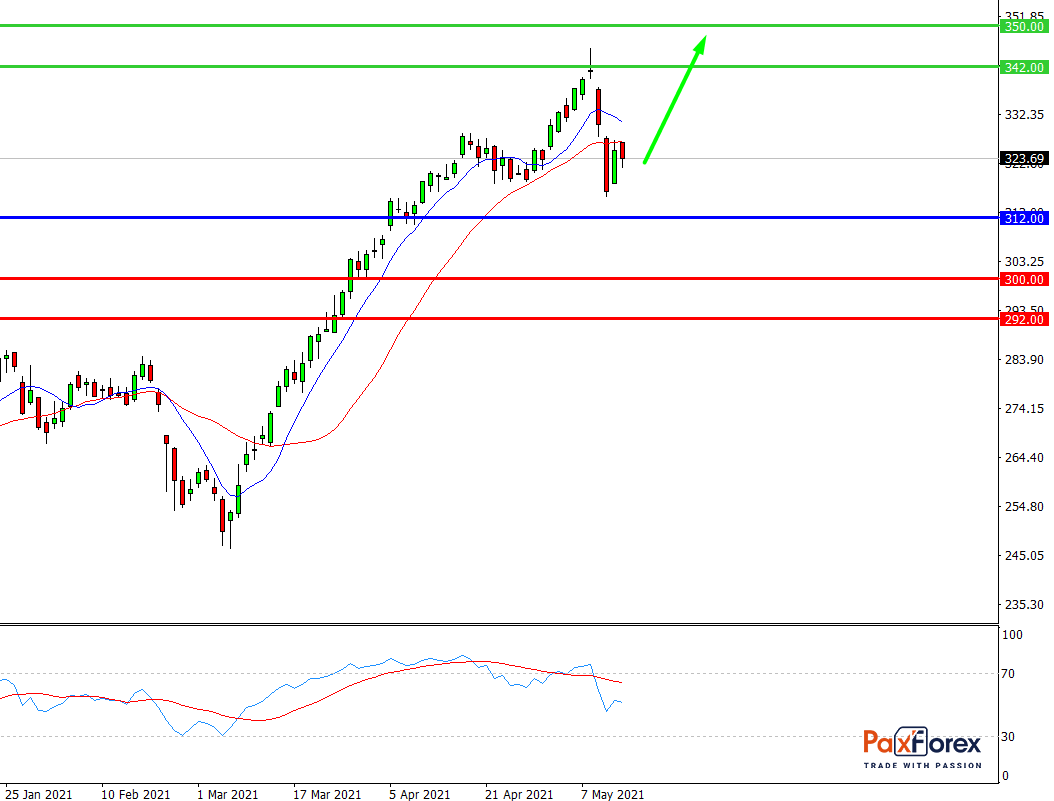

While the price is above 312.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 323.00

- Take Profit 1: 342.00

- Take Profit 2: 350.00

Alternative scenario:

If the level 312.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 312.00

- Take Profit 1: 300.00

- Take Profit 2: 292.00

SPX500 | Trading Analysis of S&P 500 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis