The IPO of Coinbase added to a wave of selling, pushing Bitcoin down by over 25%, dragging many cryptocurrencies down with it. Litecoin is among the first that recovered from the bearish trade and is now poised to correct the previous sell-off.

One bullish factor adding to the upside to the LTC/USD is the launch of a Litecoin ETP earlier this month by asset manager CoinShares on the Swiss SIX Exchange. Each unit of the ETP, trading under ticker LITE, is backed by 0.20 LTC. The potential of Litecoin continues to increase, and it presents better value compared to Bitcoin. Following the pivot of Litecoin towards privacy, it has added appeal to true cryptocurrency enthusiasts, adding to other benefits, including scalability, transaction fees, and speed.

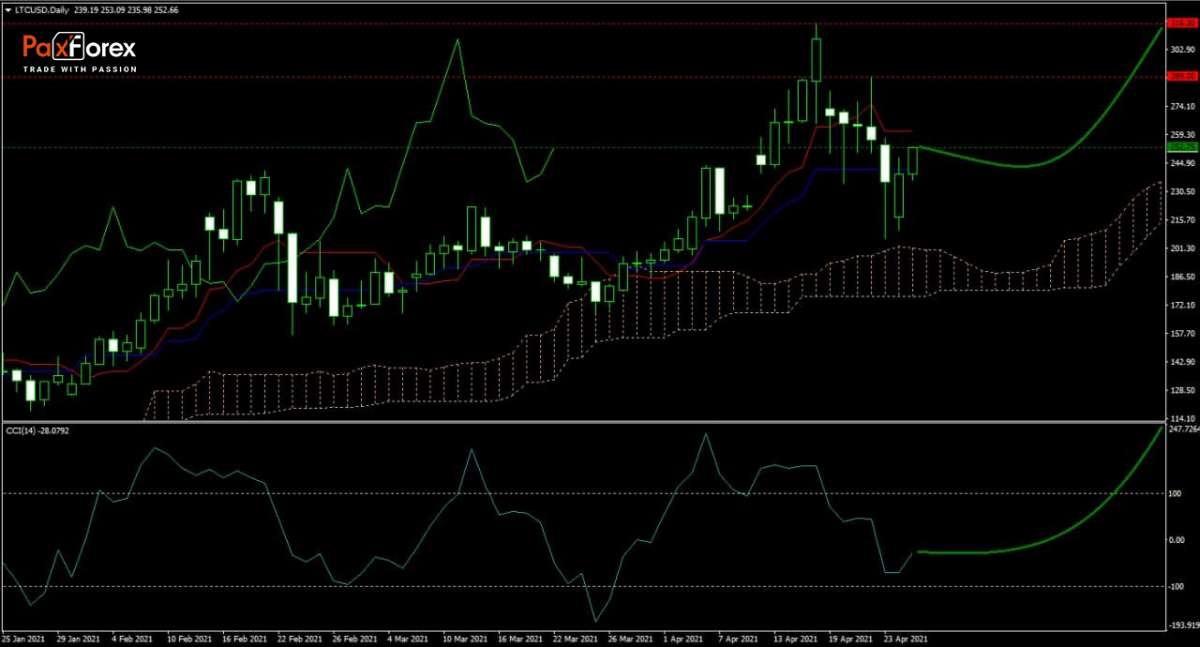

The forecast for the LTC/USD turned bullish after price action managed to push through resistance. Traders may face more volatility, as witnessed over the past few trading sessions with 10%+ gains and losses. The Kijun-sen and the Tenkan-sen remain flat, but the Ichimoku Kinko Hyo Cloud turned higher, adding bullish pressures to this cryptocurrency pair. After the CCI ended its move lower, it has plenty of upside potential ahead.

Should price action for the LTC/USD remain inside the or breakout above the 241.70 to 261.30 zone, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 252.75

- Take Profit Zone: 289.00 – 316.30

- Stop Loss Level: 220.00

Should price action for the LTC/USD breakdown below 241.70, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 220.00

- Take Profit Zone: 167.10 – 183.20

- Stop Loss Level: 241.70

US30 | Trading Analysis of Dow Jones 30 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis