Despite a 19% increase in revenue and a 44% increase in net income in the third quarter of fiscal 2021, the company's stock has tumbled about 5% since the earnings report was released in late April. Estimating the company's prospects, this short-term decline shouldn't prevent you from adding Microsoft to your watchlist.

Two years ago, Microsoft gained a contract with the U.S. Department of Defense to render services to the Pentagon through its Azure cloud computing business. Microsoft beat out Amazon's AWS in the $10 billion deal, indicating that Azure is reclaiming market leadership from AWS.

AWS still has a large share of the cloud computing market, but Azure's revenues are increasing faster year over year, by 50%, compared to AWS's 32%. Azure's growth is due to a strong competitive advantage over AWS on price, as well as integration with Microsoft 365 with special cost reductions. More than 95 percent of Fortune 500 companies now use Azure, a dominant and growing position that Microsoft undoubtedly owes to decades of trust from large U.S. corporations counting on Windows servers and operating systems.

The extension of the Azure segment is great news for Microsoft's profitability since the company's sales of cloud solutions are high margin as opposed to its overall business. Although Microsoft said in its Q3 report that its commercial cloud gross margin is 70% (up 3% year-over-year), the business does not report its margins specifically for Azure. Nevertheless, it does stipulate that Azure margins are steadily improving as the segment grows.

The successful launch of the Xbox Series X and Xbox Series S at the end of 2020 helped Microsoft bring the company's gaming hardware revenue to 9% of total revenue. However, hardware sales alone don't capture the whole picture.

Microsoft's Xbox Game Pass is like Netflix for Xbox, enabling gamers to download unlimited games from an extensive digital library of popular games for a monthly fee. The service has brought more than 23 million subscribers, up 5 million since January of this year. Sony does not offer a service for its PlayStation console that matches Game Pass from Xbox in terms of access to a wide selection of new, exclusive games.

This competitive advantage is significant since Microsoft's growth in the gaming industry is likely to be mostly digital and subscription-based. In the third quarter, Xbox content and services revenue was up 34% from a year ago, as Game Pass became an industry favorite. This focus on digital growth will undoubtedly increase margins -- both Microsoft and Sony sell their physical consoles at a loss, and the long-term strategy is to secure loyal customers and recurring revenue through digital offerings.

The better Microsoft's digital game offerings are, the less likely it is that loyal Xbox users will switch to another platform and pay for valuable recurring subscriptions on PlayStation or elsewhere. The network effects in the gaming space are powerful - friends are more likely to play games together if they all use a service like Game Pass, and the social aspect of modern gaming cannot be overstated.

The Microsoft 365 software subscription package enjoys a de facto monopoly in the office software space, holding nearly 90% of the market. Microsoft 365 includes traditional Office products such as Word, Excel, and Outlook, as well as popular new products such as Teams, a free business communication platform. In the third quarter, the number of daily active Teams users doubled from a year ago to 145 million.

The key point in the office products segment is the large gap from competitors. Transition costs, which include such factors as lost time in retraining staff on the new software, give Microsoft a significant competitive advantage. In addition, while Teams is a free product, it contributes to Microsoft's competitive environment by introducing users to the Microsoft 365 software suite, which accounts for about 22 percent of the company's total revenue by a higher margin than traditional software sales, and by encouraging paid upgrades for additional storage, security and collaboration among other Microsoft applications. These factors combine to help Microsoft attract and retain new paying and long-term customers through Teams.

It should be noted that Amazon has sued to overturn the Defense Department's choice of Microsoft's proposal over its own, claiming that AWS lost the contract because of political interference. If Amazon wins this lawsuit, it could ruin Azure's relationship with the Department of Defense for a long time. That being said, Microsoft recently landed a $22 billion government contract to supply augmented reality headsets to the Army, and losing $10 billion in revenue from the Defense Department won't have much impact on Microsoft's top line, accounting for only about 6 percent of the company's 12-month revenue.

Nevertheless, investors considering investing in Microsoft should keep an eye on how Azure continues to evolve in the cloud computing space, especially compared to AWS.

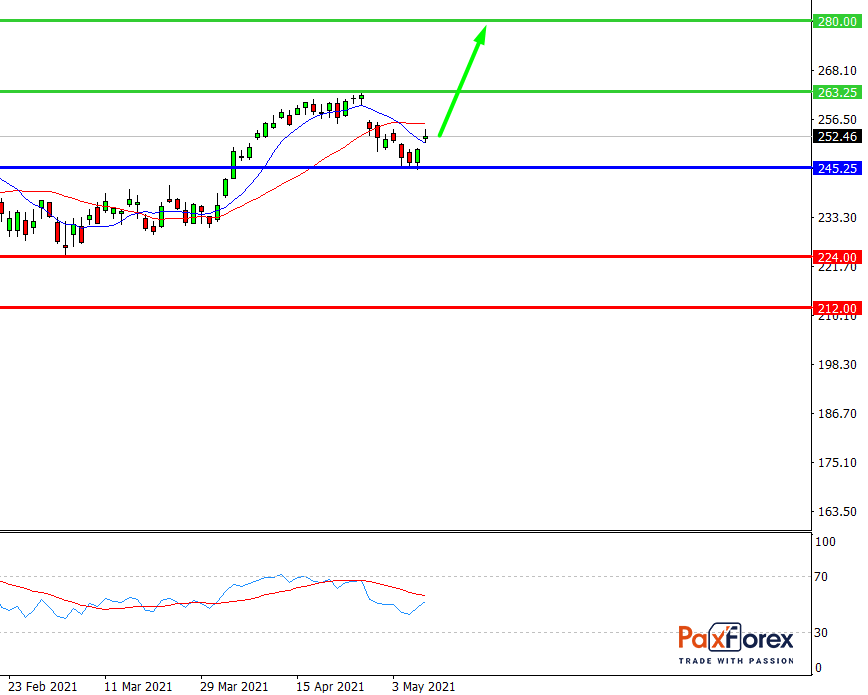

While the price is above 245.25, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 252.59

- Take Profit 1: 263.25

- Take Profit 2: 280.00

Alternative scenario:

If the level 245.25 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 245.25

- Take Profit 1: 224.00

- Take Profit 2: 212.00

XAU/USD | GOLD/USD | Gold to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis