The market is demonstrating on the back of the negative dynamics in the telecommunication, utilities and consumer goods sectors. The NASDAQ Composite Index rose 0.87%.

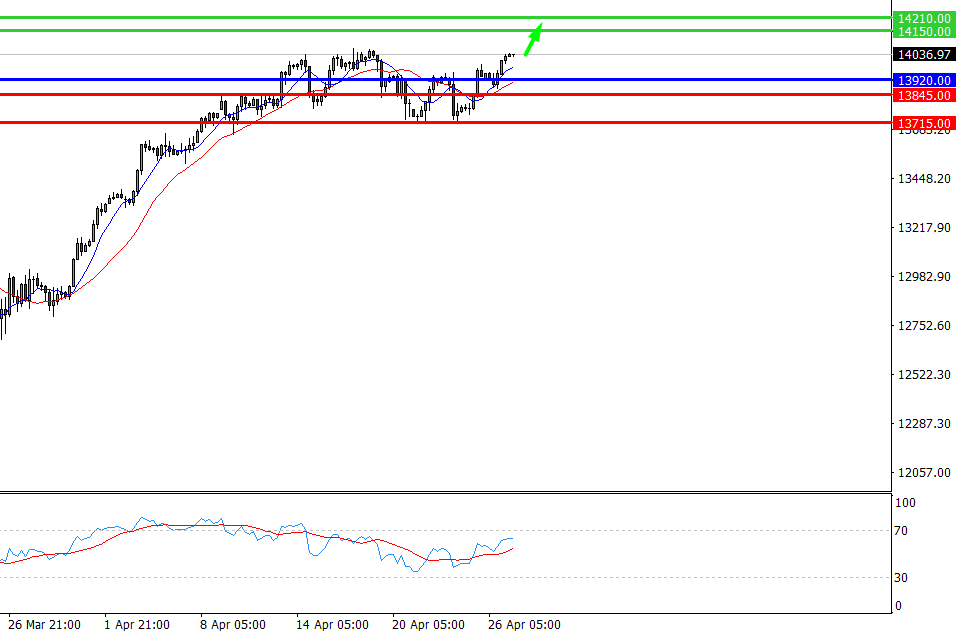

Nasdaq 100, H4

Pivot: 14035.00

Analysis:

Provided that the index is traded above 13920.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 14035.00

- Take Profit 1: 14150.00

- Take Profit 2: 14210.00

Alternative scenario:

In case of breakdown of the level 13920.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 13920.00

- Take Profit 1: 13845.00

- Take Profit 2: 13715.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

Resistance ---- Support

14350.00 ------ 13920.00

14210.00 ------ 13845.00

14150.00 ------ 13715.00

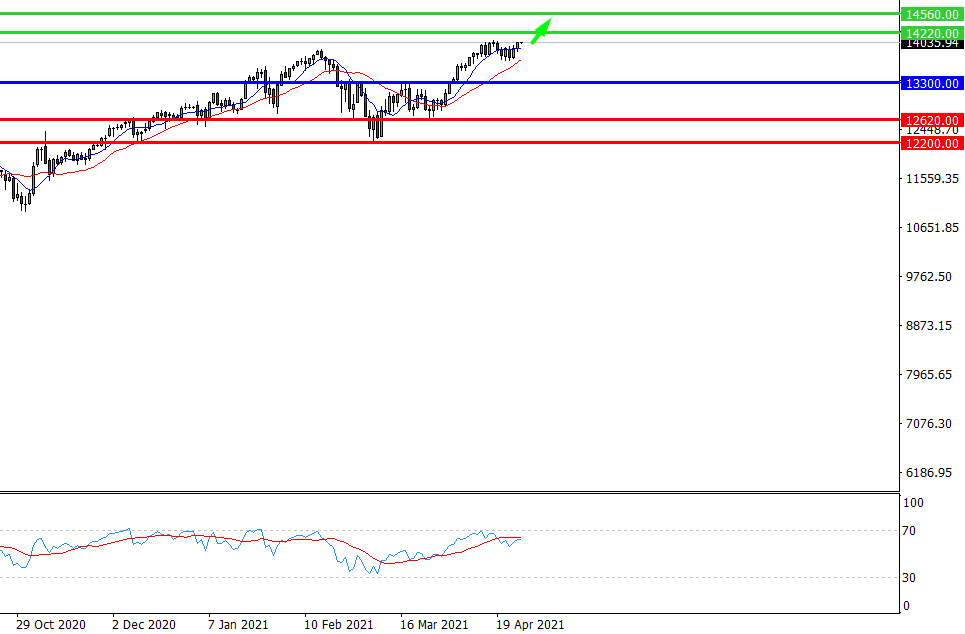

Nasdaq 100, D1

Pivot: 13930.00

Analysis:

Provided that the index is traded above 13300.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 13930.00

- Take Profit 1: 14220.00

- Take Profit 2: 14560.00

Alternative scenario:

In case of breakdown of the level 13300.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 13300.00

- Take Profit 1: 12620.00

- Take Profit 2: 12200.00

Comment:

RSI is bullish and indicates further increase.

Key levels:

Resistance ---- Support

14650.00 ------ 13300.00

14560.00 ------ 12620.00

14220.00 ------ 12200.00

USD/JPY | US Dollar to Japanese Yen Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis