- The U.S. economy still needs support, it still has a long way to go before it reaches target levels;

- Expects the economy to bounce back strongly in the fall and then slow down;

- Refuses to answer when she expects rate hikes to begin; "we will need a lot of patience."

- Doesn't note much pressure on wages at all;

- We're not going to roll back stimulus in advance;

- We will wait until inflation reaches target levels on a sustainable basis;

- Inflation may be too low rather than too high in the next 10 years.

NZD/USD, 30 min

Pivot: 0.6981

Analysis:

Provided that the currency pair is traded above 0.6950, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.6981

- Take Profit 1: 0.7020

- Take Profit 2: 0.7039

Alternative scenario:

In case of breakout of the level 0.6950, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.6950

- Take Profit 1: 0.6918

- Take Profit 2: 0.6899

Comment:

RSI shows the possibility of an uptrend during the day.

Key levels:

Resistance Support

0.7058 0.6950

0.7039 0.6918

0.7020 0.6899

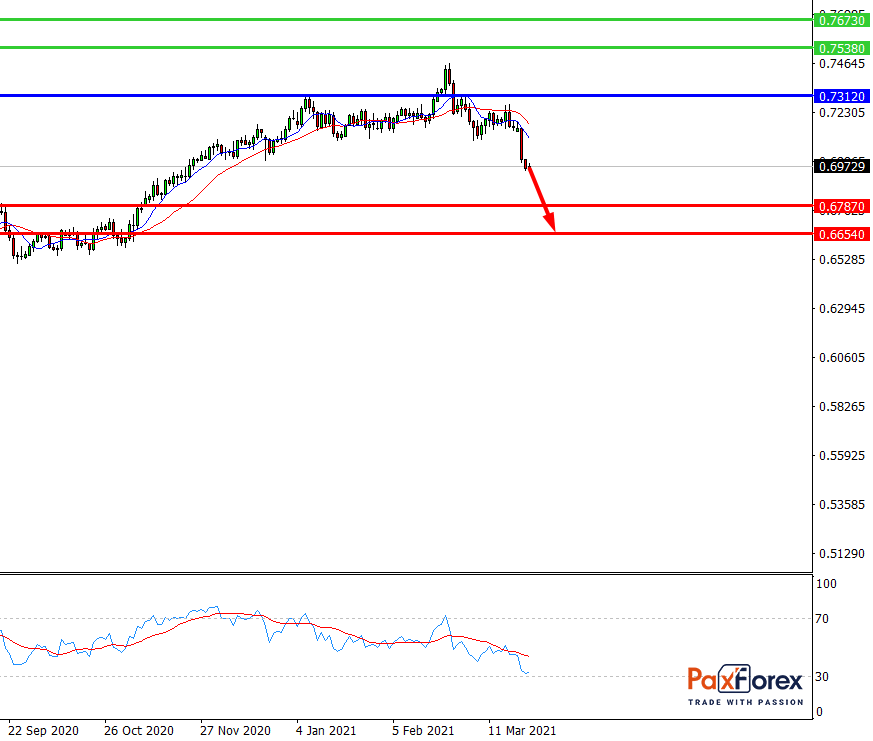

NZD/USD, D1

Pivot: 0.7066

Analysis:

While the price is below 0.7312, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 0.7066

- Take Profit 1:0.6787

- Take Profit 2:0.6654

Alternative scenario:

In case of breakout of the level 0.7312, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 0.7312

- Take Profit 1: 0.7538

- Take Profit 2: 0.7673

Comment:

RSI shows a downtrend in the medium term.

Key levels:

Resistance Support

0.7673 0.6787

0.7538 0.6654

0.7312 0.6520

USD/JPY Forecast Fundamental Analysis | US Dollar / Japanese Yen

Prev article

EUR/JPY | Euro to Japanese Yen Trading Analysis

Next article

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis

ECB head Lagarde: so far we see no signs that inflationary pressures are becoming widespread.

GBP/JPY | British Pound to Japanese Yen Trading Analysis

GBP/JPY is declining from 2-week highs, approaching 151.50.