The real story, however, is CEO Albert Burla's vision for a more streamlined, innovation-oriented company. He outlined his strategy when he took office in 2019, and Komirnati is just an early sign that the transformation is working.

Despite Pfizer's plans to deliver 2 billion doses of vaccine in 2021, the company's stock is valued at near its lowest projected sales and earnings multiples since the first reports of the SARS-CoV-2 virus surfaced. It could make Pfizer stock one of the best bargains in the stock market right now.

As Burla relates, every action the company has taken over the past few years has been to turn Pfizer into a dynamic scientific center. To that end, last November the company separated its generic drug division and merged it with generic drug maker Mylan, creating Viatris. The decline in sales in that segment reduced it from 26% of Pfizer's revenue in 2017 to just 20% in 2019. Similarly, the company merged its consumer health segment with GlaxoSmithKline, allowing the British drugmaker to control a $90 billion venture. By getting rid of these businesses, the company plans to use previous acquisitions to drive growth through the development and commercialization of new, innovative drugs.

To do so, the company will build on acquisitions that were made after Burla held control of the company's health care business. In particular, the company will continue to rely on assets acquired through a $14 billion buyout of cancer-fighting company Medivation and a $5 billion acquisition of inflammatory disease drug maker Anacor. Burla stated unequivocally that in the future he is more likely to go for many smaller deals than one big one. It suggests that he likes the company's position and will only allocate capital in such a way as to generate additional sales and profits over the next few years.

To that end, the company emphasizes a combination of science and patience. While the COVID vaccine will generate financial flow, management is thinking not only about the drug but also about the RNA messenger platform (mRNA) on which it relies. Pfizer is already working on a combination COVID influenza vaccine and says that while mRNA technology has been validated, it's too early to say what other diseases the company might use it against. Pfizer has talked about launching up to 25 new drugs by 2025, and annual sales of nine drugs could exceed $1 billion. Wall Street is in no hurry to give the company credit for this potential.

No one knows exactly how the pandemic will evolve in the months and years ahead. Will we need vaccinations every year, or will public immunity take hold and eliminate the threat?

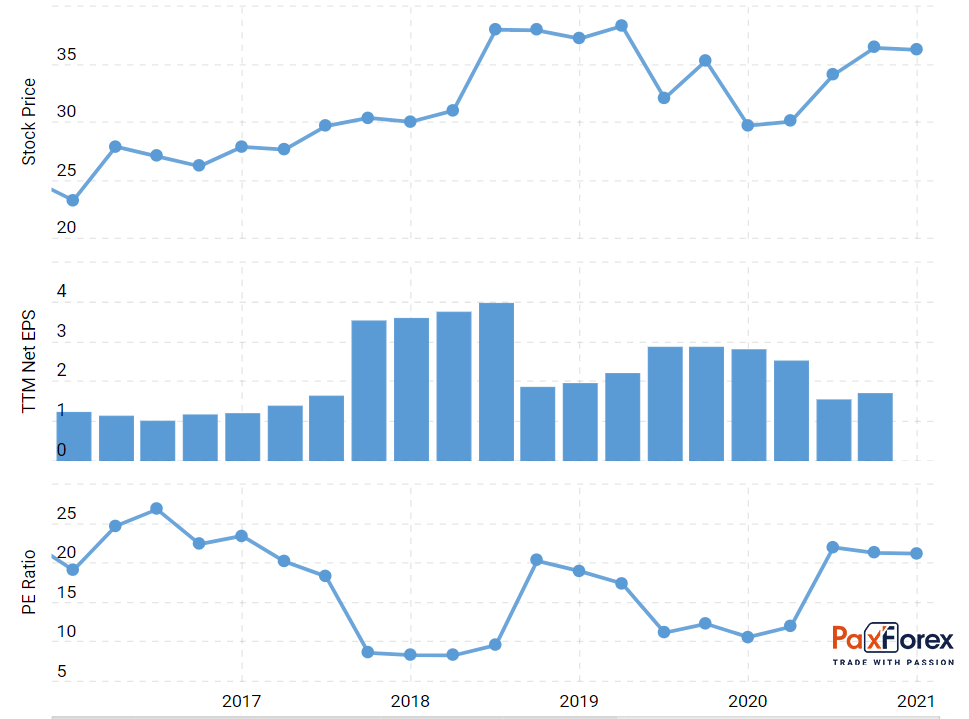

Many experts and industry leaders are leaning toward the vaccine becoming endemic, constantly circulating in the population. It means that people are likely to need some kind of booster vaccine or another full-blown vaccine from time to time. For Pfizer, it indicates that the impressive sales and profits it projects for 2021 may be more sustainable than ever anticipated. It also means that the stock is trading cheap, assuming sales of $60 billion and an earnings per share (EPS) calculation of $3.15. They haven't been this cheap in a long time:

According to Burla, even by eliminating the impact of COVID from 2021, Pfizer is increasing sales by 6% and earnings per share by 11%. Moreover, he agrees, there is an increasing likelihood that annual revaccination will be required. Despite a potentially higher base level of business, the company has no plans to make any changes in how it spends its money. In the latest analyst update, the CFO responded to a question about using extra cash for a big deal or a special one-time dividend by breaking down earnings growth and explicitly ruling out any changes to its current capital allocation strategy.

Pfizer has transformed over the past five years, culminating in its role in helping to develop a vaccine to slow the global pandemic. It now appears that the vaccine can continue to generate sales and profits for years to come. Despite that, the company is trading at a historically cheap price for many of the indicators listed. Investors seeking access to stock in a large, stable company that pays dividends and has a proven plan for continued growth would be hard-pressed to find a better candidate than Pfizer.

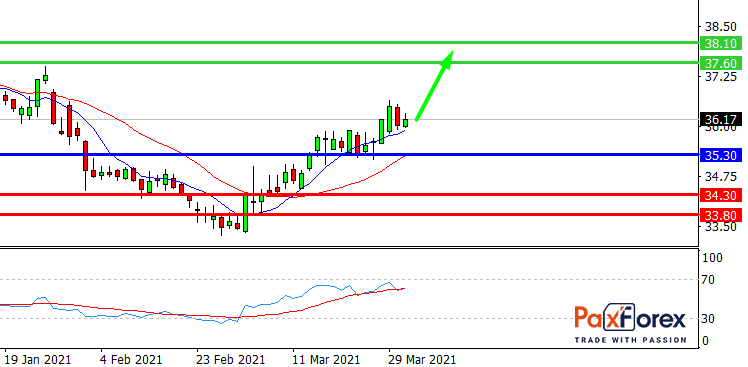

Provided that the company is traded above 35.30, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 36.23

- Take Profit 1: 37.60

- Take Profit 2: 38.10

Alternative scenario:

In case of breakdown of the level 35.30, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 35.30

- Take Profit 1: 34.30

- Take Profit 2: 33.80

SPX500 | Trading Analysis of S&P 500 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis