For the first quarter, the company reported revenues of $14.6 billion, a 42% increase over last year. That result easily beat analysts' average forecast of $13.6 billion.

The company announced a first-quarter net income of $4.9 billion, or $0.86 per share. In the previous year, Pfizer's earnings were $3.4 billion, or $0.60 per share.

Pfizer's adjusted net income for the first quarter was $5.3 billion, or $0.93 per share. It was significantly better than adjusted earnings of $3.5 billion, or $0.63 per share, recorded in the prior year. It also far exceeded Wall Street's consensus forecast of $0.78 per share.

Undoubtedly, the COVID-19 BNT162b2 vaccine was the biggest star of Pfizer's first quarter. Sales of the vaccine totaled $3.46 billion, of which just over $2 billion came from the U.S.

However, even excluding the COVID-19 vaccine, Pfizer's revenue was up 8% year-over-year. That improvement even includes the 5% negative impact of pricing.

The company's cancer drug sales rose 18% year over year to $2.86 billion. Prostate cancer drug Xtandi and kidney cancer drug Inlyta led sales, offsetting a 1% decline in sales of breast cancer drug Ibrance.

Internal medicine brought in $2.59 billion for Pfizer, up 11% year-over-year. The blood-thinning drug Eliquis stood out, with sales up 26% to $1.64 billion.

Hospital drug sales were $2.34 billion, up 12%. Although sales of several drugs that Pfizer includes in the hospital category declined, the company's global contract manufacturing and development organization (CDMO), Pfizer CentreOne, more than offset the decline with strong revenue growth.

In the first quarter, sales of inflammation and immunology drugs rose 9% year over year to nearly $1.07 billion. The top drug was Xeljanz, with sales up 19% year-over-year.

Pfizer also recorded revenue of $824 million for its line of rare disease drugs, up 29%. Almost all of this growth came from the drug Vyndaqel, whose sales nearly doubled over the year.

While Pfizer showed impressive growth in the first quarter, there is a definite caveat to its results. In the first quarter of 2021, the company had three additional days of sales in the U.S. and four additional days of sales in international markets compared to the previous year.

No one can doubt that this will be an outstanding year for Pfizer. The company has raised its forecast for all of 2021. It now expects sales of between $70.5 billion and $72.5 billion. Pfizer expects adjusted earnings per share to be between $3.55 and $3.65.

The main reason for the improved forecast, unsurprisingly, is BNT162b2. Pfizer now predicts that the COVID-19 vaccine will generate $26 billion in revenue this year, up from $15 billion in the previous quarterly update.

But Pfizer isn't stopping there. The company is now poised to win another major market for the coronavirus. This move could give it the right to own the entire COVID-19 space... and that dominance may be just around the corner.

More and more people are getting vaccinated. And so far, vaccines are doing their job. But for people who already have COVID-19, the options are limited. The FDA has fully approved Gilead Sciences' Veklury (Remdesivir) for hospitalized patients. In addition, the FDA has approved the antibody to treat mild to moderate disease in high-risk people.

What's missing from this list is a simple drug that everyone can use at the first sign of infection. And that's what Pfizer has to offer. Pfizer CEO Albert Burla told CNBC the other day that an investigational pill to treat COVID-19 could be ready for commercialization by the end of the year.

It means that Pfizer could potentially make a profit from sales of this drug by that time. Thus, Pfizer will likely dominate not only the vaccine market but also the treatment market.

Next year also looks quite favorable for BNT162b2 sales. Pfizer has already signed contracts with Canada and Israel beyond 2021. The company stated that "it is currently negotiating similar potential contracts with several other countries. These include the European Union, which appears to be close to a deal with Pfizer and BioNTech to supply up to 1.8 billion doses by 2023.

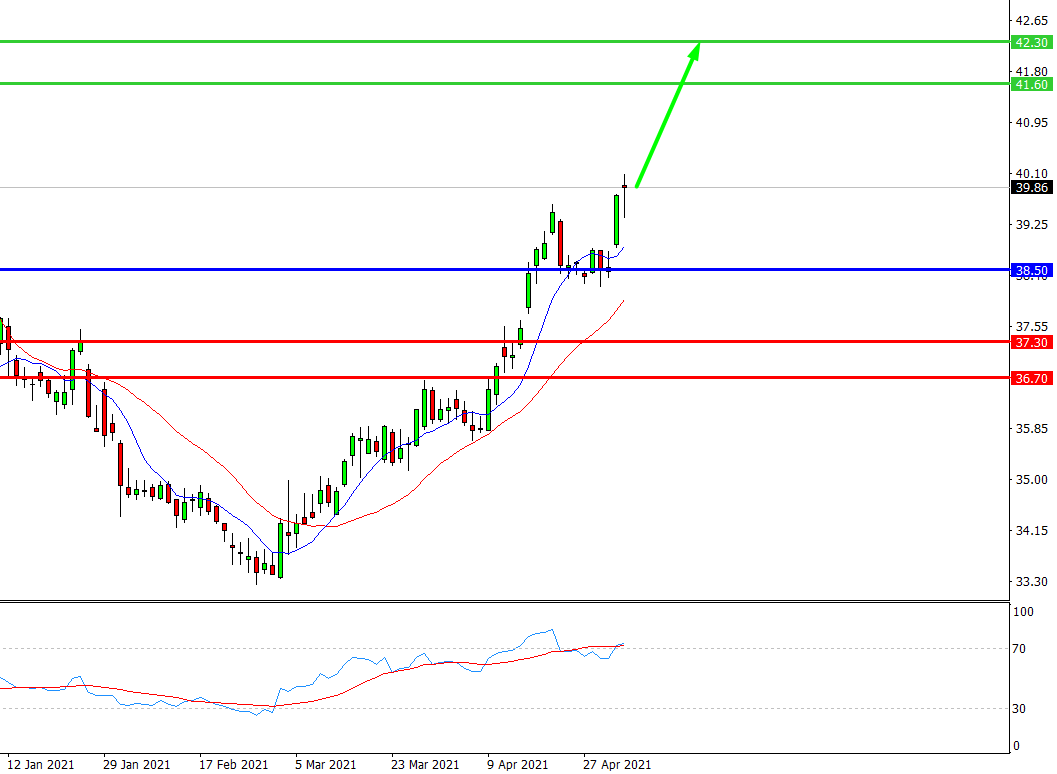

While the price is above 38.50, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 39.95

- Take Profit 1: 41.60

- Take Profit 2: 42.30

Alternative scenario:

If the level 38.50 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 38.50

- Take Profit 1: 37.30

- Take Profit 2: 36.70

SPX500 | Trading Analysis of S&P 500 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis