The measure, introduced as the pandemic began, allowed banks to exclude Treasuries and deposits with the Fed from the calculation of the leverage ratio. The Standard & Poor's 500 fell 2.36 points (0.06%) to 3,913.1 points.

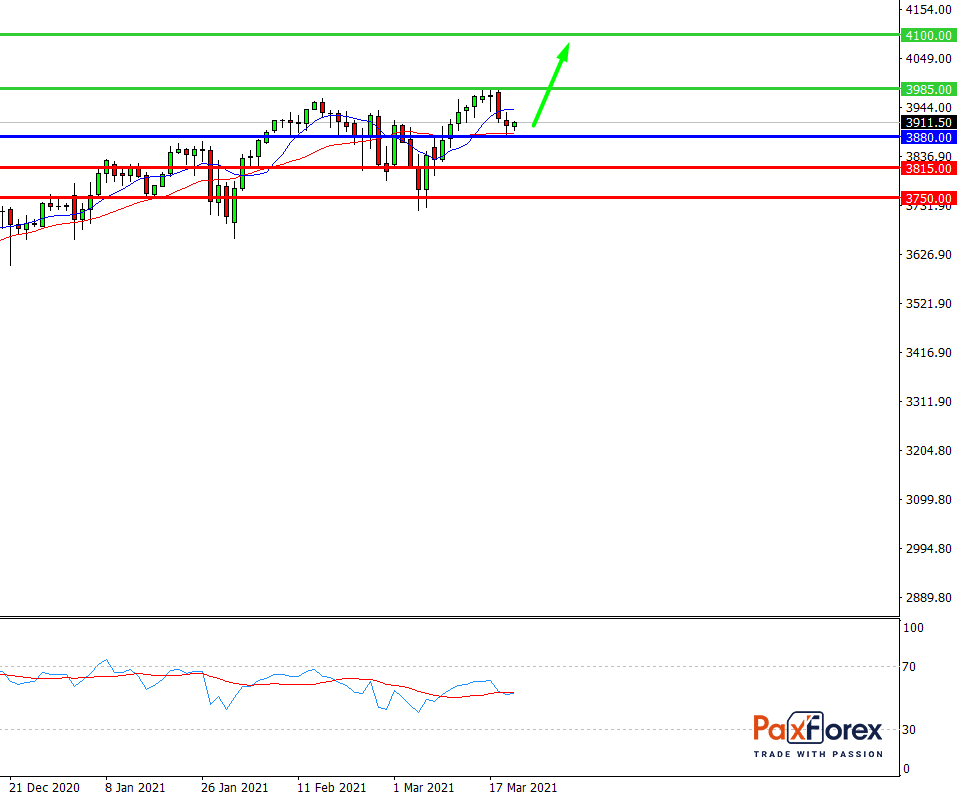

S&P 500, H4

Pivot: 3911.00

Analysis:

Provided that the index is traded above 3880.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 3911.00

- Take Profit 1: 3985.00

- Take Profit 2: 4100.00

Alternative scenario:

In case of breakdown of the level 3880.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 3880.00

- Take Profit 1: 38615.00

- Take Profit 2: 3750.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

Resistance Support

4150.00 3880.00

4100.00 3815.00

3985.00 3750.00

S&P 500, D1

Pivot: 3922.00

Analysis:

While the price is above 3820.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 3922.00

- Take Profit 1: 4040.00

- Take Profit 2: 4450.00

Alternative scenario:

If the level 3820.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 3820.00

- Take Profit 1: 3725.00

- Take Profit 2: 3580.00

Comment:

RSI is bullish and indicates further increase.

Key levels:

Resistance Support

4500.00 3820.00

4450.00 3725.00

4110.00 3580.00

EUR/USD | Euro to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis