Stocks of companies that depend on the easing of restrictions related to the coronavirus pandemic, including airline carriers and cruise operators, showed strong gains.

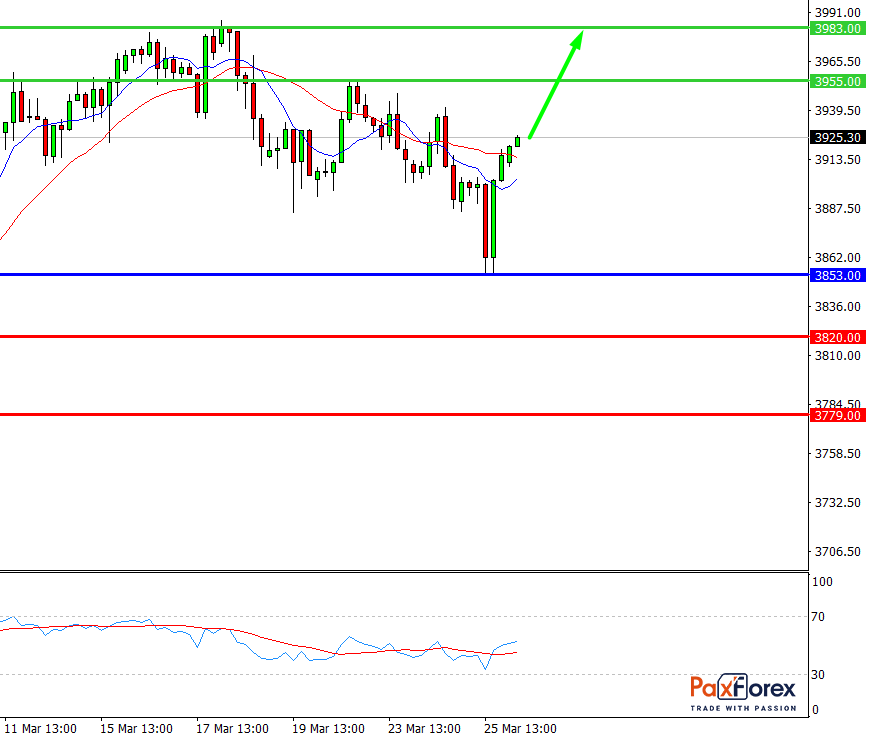

S&P 500, H4

Pivot: 3909.00

Analysis:

Provided that the index is traded above 3853.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 3909.00

- Take Profit 1: 3955.00

- Take Profit 2: 3983.00

Alternative scenario:

In case of breakdown of the level 3853.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 3853.00

- Take Profit 1: 3820.00

- Take Profit 2: 3779.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

Resistance Support

4015.00 3853.00

3983.00 3820.00

3955.00 3779.00

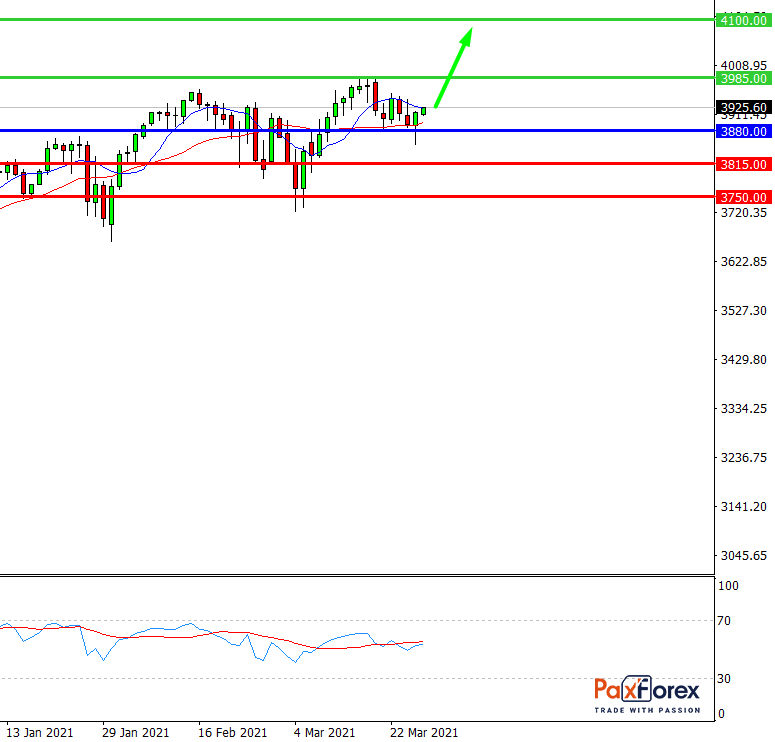

S&P 500, D1

Pivot: 3930.00

Analysis:

While the price is above 3880.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 3930.00

- Take Profit 1: 3985.00

- Take Profit 2: 4100.00

Alternative scenario:

If the level 3880.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 3880.00

- Take Profit 1: 3815.00

- Take Profit 2: 3750.00

Comment:

RSI is bullish and indicates further increase.

Key levels:

Resistance Support

4450.00 3880.00

4100.00 3815.00

3985.00 3750.00

AUD/USD | Australian Dollar to US Dollar Trading Analysis

Prev article

EUR/JPY | Euro to Japanese Yen Trading Analysis

Next article

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis

ECB head Lagarde: so far we see no signs that inflationary pressures are becoming widespread.

GBP/JPY | British Pound to Japanese Yen Trading Analysis

GBP/JPY is declining from 2-week highs, approaching 151.50.