The market was supported earlier this week by a decline in U.S. Treasuries, as well as optimism over the approval of a coronavirus vaccine made by Johnson & Johnson (NYSE: JNJ) and the prospects of a new aid package for the U.S. economy. The yield on 10-year U.S. government bonds fell below 1.45% this week after jumping to a high for the year of 1.6% a week earlier. The Standard & Poor's 500 fell 31.53 points (0.81%) to 3,870.29 points.

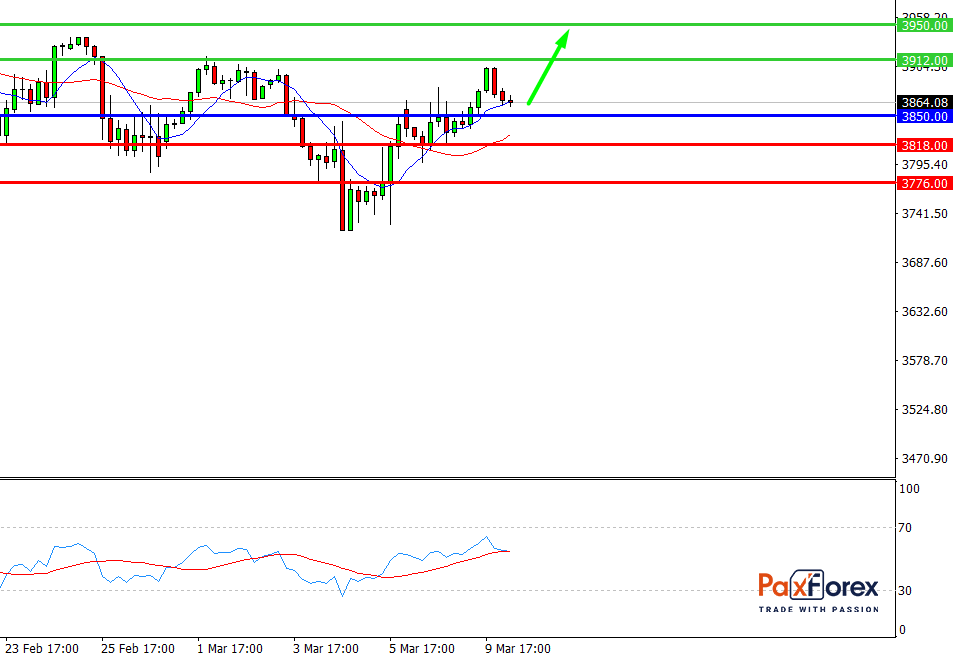

S&P 500, H4

Pivot: 3885.00

Analysis:

Provided that the index is traded above 3850.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 3885.00

- Take Profit 1: 3912.00

- Take Profit 2: 3950.00

Alternative scenario:

In case of breakdown of the level 3850.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 3850.00

- Take Profit 1: 3818.00

- Take Profit 2: 3776.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

Resistance Support

3975.00 3850.00

3950.00 3818.00

3912.00 3776.00

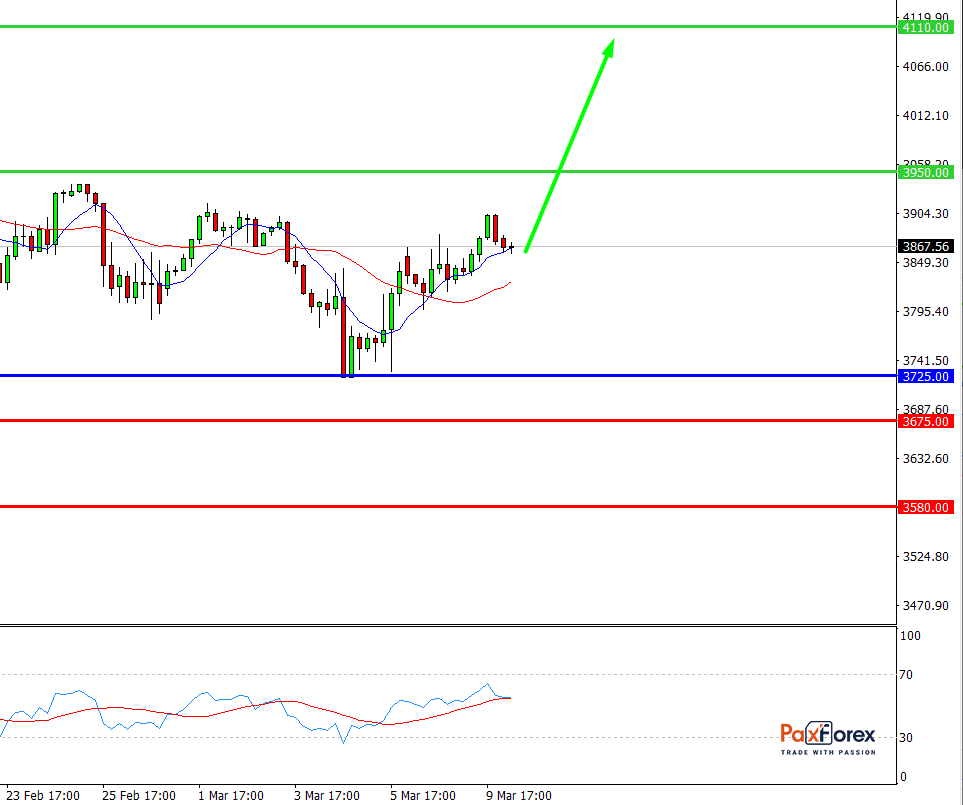

S&P 500, D1

Pivot: 3902.00

Analysis:

While the price is above 3725.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 3902.00

- Take Profit 1: 3950.00

- Take Profit 2: 4110.00

Alternative scenario:

If the level 3725.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 3725.00

- Take Profit 1: 3675.00

- Take Profit 2: 3580.00

Comment:

RSI is bullish and indicates further increase.

Key levels:

Resistance Support

4260.00 3725.00

4110.00 3675.00

3950.00 3580.00

USD/CHF | US Dollar to Swiss Franc Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis