The Twitter stock recently hit a record high after the company introduced audacious three-year growth targets. It now intends to increase its mDAUs (monetizable daily active users) from 192 million at the end of 2020 to "at least" 315 million by the end of 2023.

The social media business plans to double the number of features per employee that "directly drive" its mDAUs or revenue growth, and estimates that this effort will more than double its annual revenue from $3.7 billion in 2020 to "over $7.5 billion in 2023." That confidence has definitely stunned the bulls, but many aren't sure that Twitter is able to reach those exalted goals for a few simple reasons.

About ten years ago, Twitter said it would reach 400 million monthly active users (MAUs) by 2013. But the company closed 2013 with just 241 million MAUs, and by the first quarter of 2019, that number had grown to 330 million MAUs.

Twitter consequently ceased summarizing MAUs and displaced the industry-standard metric with "mDAU," which seemingly eliminated spam, bots, and inactive accounts. Of course, we shouldn't evaluate Twitter solely on its past decisions, but its experience of changing targets makes many view its new projections with a certain amount of skepticism.

The company's MDAU grew 21% to 152 million in 2019 and then grew another 27% to 192 million in 2020. To reach 315 million mDAUs by 2023, its mDAUs have to increase at an average of 18.5% per year over the next three years.

Many would agree that this goal is too high due to several obvious reasons. First off, Twitter associated its increasing mDAU growth in 2020 with "global discussion of current events," including the U.S. election, civil unrest, and the pandemic. But with the end of the election and the likely end of the pandemic later this year, people could spend much less time on Twitter.

Secondly, Twitter has persistently banned dubious users, including the former president, from spreading misinformation or inciting violence. These bans may drive some Twitter users to competing platforms, including the Parler app, resulting in lower mDAU growth.

Finally, Twitter faces stiff competition from fast-growing social platforms such as Snapchat, Pinterest, and TikTok. All of these platforms could lead to people spending less time on Twitter over the next three years.

Even if Twitter reaches 315 million mDAUs by the end of 2023, that would only mean 64% growth from 2020-so it would have to significantly increase its average revenue per user to double its annual revenue.

Twitter believes it can achieve this by selling more ads to small- and medium-sized businesses (SMBs), launching carousel ads and other advertising features, and testing subscription models for popular accounts.

Twitter claims that branded campaigns from large enterprises now account for about 85% of ad revenue. The other 15% comes from "performance" advertising, which is mostly used by small and medium-sized businesses to redirect clicks toward site visits or app installs.

Revenue product lead Bruce Falck says he can change that mix to 50/50 by "just aligning our existing high-performance products with other dealer offerings in the marketplace."

In other words, he intends to launch new advertising products for small businesses to increase ad revenue per user. But it can still struggle to catch up with Facebook, its subsidiary Instagram and Pinterest, which seem better equipped to handle ads, carousels, or e-commerce than Twitter's chaotic news feed.

Twitter thinks it can monetize certain accounts by encouraging followers to pay to subscribe to exclusive tweets, videos, and other content. This could be an attractive idea for some independent content creators, but they could also simply post links back to Patreon or other platforms instead of accepting direct payments from Twitter.

Twitter is also planning to expand its mobile advertising network, MoPub, to boost its revenue. But MoPub faces stiff competition from similar platforms such as Facebook and Audience Network, and Apple's upcoming iOS 14 update, which will allow users to opt-out of data-tracked ads, could hurt all of these companies.

When Snap recently said its annual revenue would grow by more than 50 percent for "several years," analysts believed it because the company showed how it could juice more revenue out of its users with its enhancing ecosystem of AR lenses, short videos, and in-app games.

We should be doubtful of Twitter's heightened objects because the company seems to be downplaying some serious shortcomings. There are doubts that it is on the right track, at least until it can consistently grow its mDAUs at an average rate of about 20 percent over the next few quarters while its average revenue per user grows.

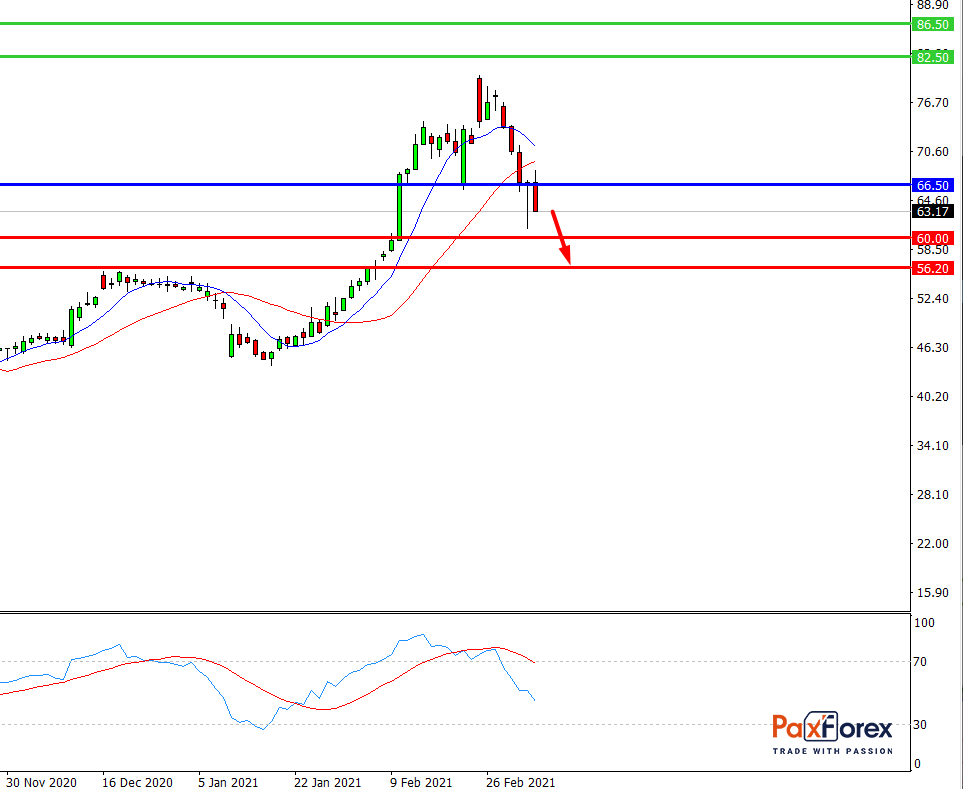

While the price is below 66.50, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 63.00

- Take Profit 1: 60.00

- Take Profit 2: 56.20

Alternative scenario:

If the level 66.50 is broken-out, follow the recommendations below.

- Time frame: D1

- Recommendation: long position

- Entry point: 66.50

- Take Profit 1: 82.50

- Take Profit 2: 86.50

GOLD/USD | Gold to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis