The yield on ten-year US Treasuries on Monday fell to 1.682% compared with 1.729% on Friday. That gave support to tech company securities, which have been winning in the COVID-19 pandemic but have been under pressure in recent days due to rising government bond yields. The Dow Jones Industrial Average index was up 103.23 points (0.32%) at 32731.2 by market close after declining for two straight sessions.

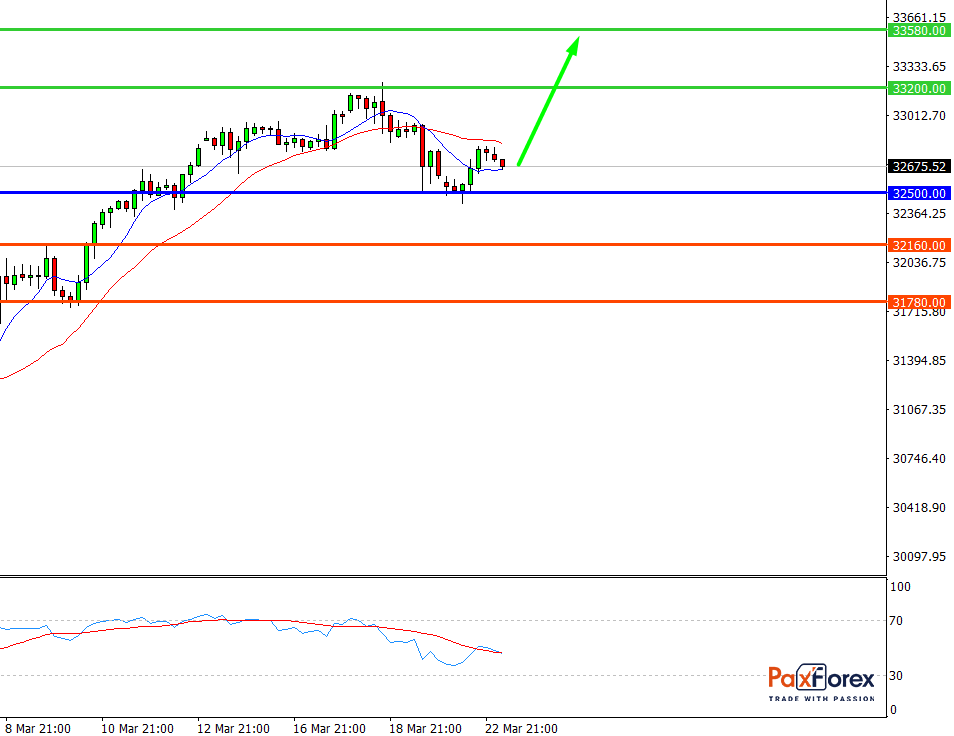

Dow Jones 30, H4

Pivot: 32746.00

Analysis:

Provided that the index is traded above 32500.00 , follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 32746.00

- Take Profit 1: 33200.00

- Take Profit 2: 33580.00

Alternative scenario:

In case of breakdown of the level 32500.00 , follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 32500.00

- Take Profit 1: 32160.00

- Take Profit 2: 31780.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

Resistance Support

34000.00 32500.00

33580.00 32160.00

33200.00 31780.00

Dow Jones 30, D1

Pivot: 32755.00

Analysis:

While the price is above 32000.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 32755.00

- Take Profit 1: 34100.00

- Take Profit 2: 34750.00

Alternative scenario:

If the level 32000.00 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 32000.00

- Take Profit 1: 30880.00

- Take Profit 2: 29850.00

Comment:

RSI is bullish and indicates a mid-term uptrend.

Key levels:

Resistance Support

37125.00 32000.00

34750.00 30880.00

34100.00 29850.00

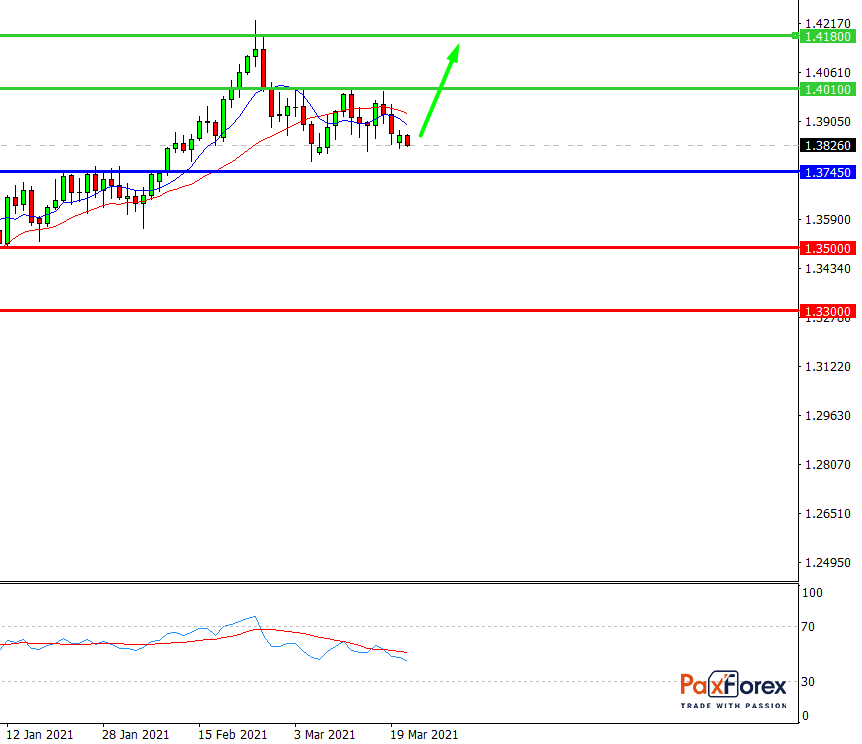

GBP/USD | British Pound to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis