The price collapse was triggered by the hawkish monetary policy verdict of the Bank of Canada. The central bank decided to change the size of the QE program. Volumes of weekly purchases of government bonds were reduced from the current C$4 billion to C$3 billion.

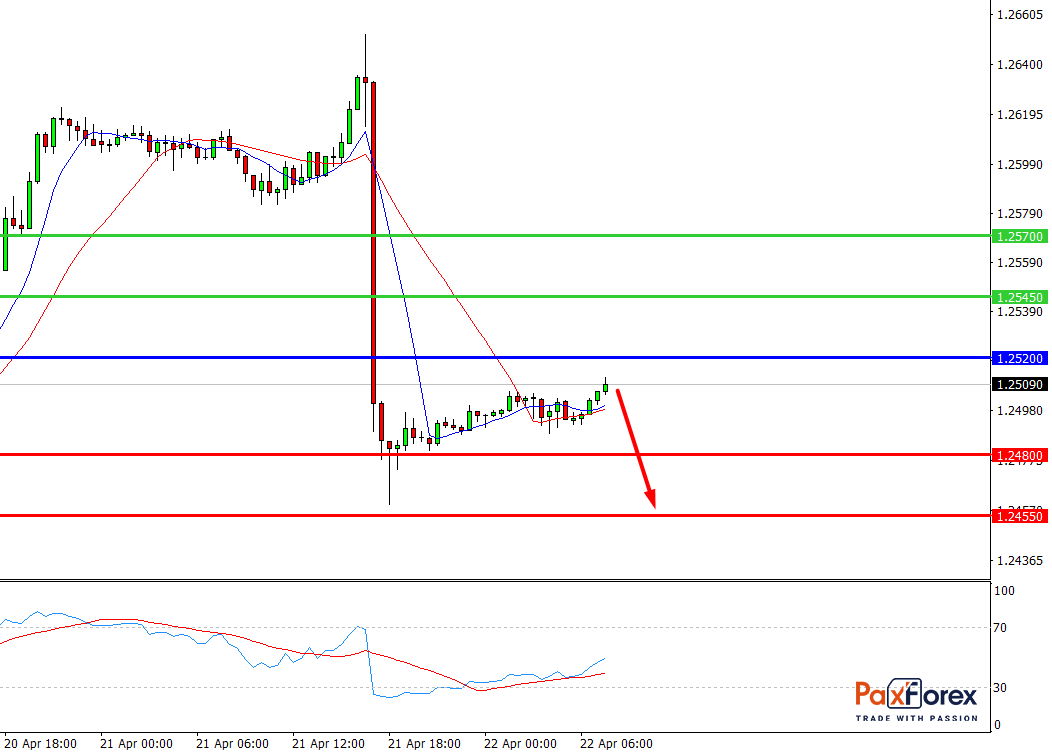

USD/CAD, 30 min

Pivot: 1.2500

Analysis:

Provided that the currency pair is traded below 1.2520, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 1.2500

- Take Profit 1: 1.2480

- Take Profit 2: 1.2455

Alternative scenario:

In case of breakout of the level 1.2520, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 1.2520

- Take Profit 1: 1.2545

- Take Profit 2: 1.2570

Comment:

RSI shows the possibility of a downtrend during the day.

Key levels:

Resistance -- Support

1.2570 ------- 1.2480

1.2545 ------- 1.2455

1.2520 ------- 1.2430

USD/CAD, D1

Pivot: 1.2600

Analysis:

While the price is below 1.2745, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 1.2600

- Take Profit 1: 1.2360

- Take Profit 2: 1.2220

Alternative scenario:

If the level 1.2745 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 1.2745

- Take Profit 1: 1.2855

- Take Profit 2: 1.2980

Comment:

RSI shows the possibility of the downtrend in the medium term.

Key levels:

Resistance -- Support

1.2980 ------- 1.2360

1.2855 ------- 1.2220

1.2745 ------- 1.2100

USD/CAD Forecast Fundamental Analysis | US Dollar / Canadian Dollar

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis