- Key interest rate was left at -0.75%;

- The franc remains heavily overvalued;

- The SNB will remain active in the foreign exchange market if necessary;

- The pandemic continues to have a severe adverse effect on the economy;

- Inflation forecast for 2021 0.2% (pre. 0.0%);

- For 2022 0.4% (pre. 0.2%);

- For 2023 0.5%;

- GDP forecast for 2021 2.5% - 3.0%;

- Economic activity should return to pre-crisis levels in the 2nd half of 2021;

- Economic and inflation forecasts still carry a high level of uncertainty.

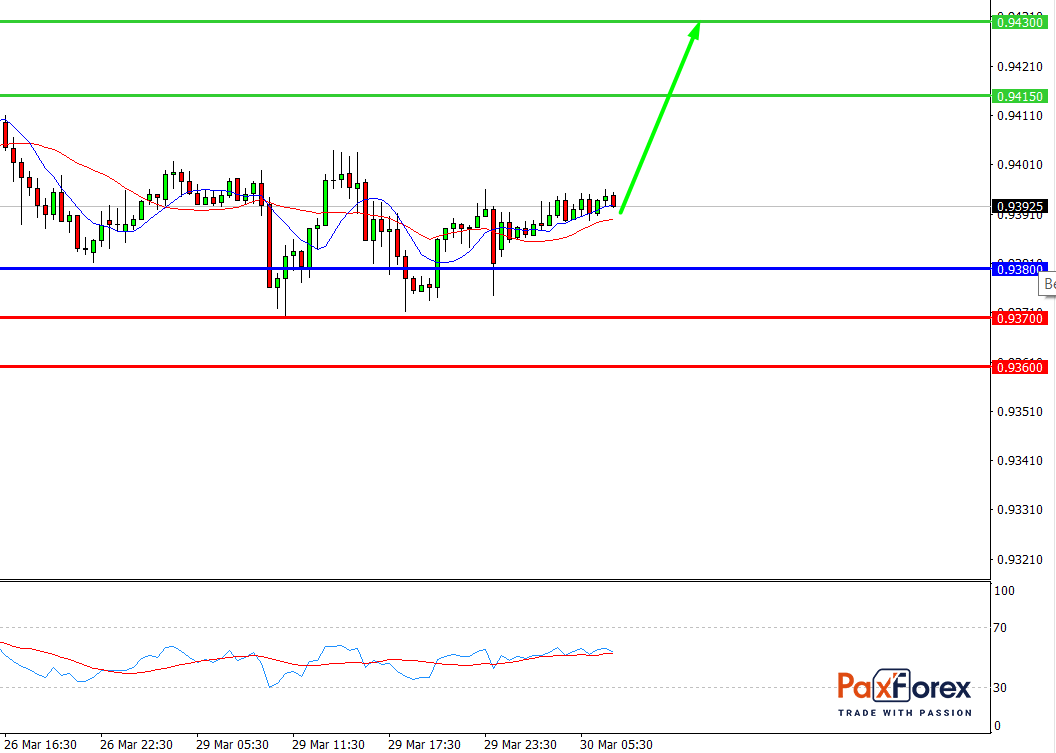

USD/CHF, 30 min

Pivot: 0.9392

Analysis:

Provided that the currency pair is traded above 0.9380, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.9392

- Take Profit 1: 0.9405

- Take Profit 2: 0.9415

Alternative scenario:

In case of breakdown of the level 0.9380, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.9380

- Take Profit 1: 0.9370

- Take Profit 2: 0.9360

Comment:

RSI shows the possibility of ascending momentum.

Key levels:

Resistance --- Support

0.9450 -------- 0.9380

0.9430 -------- 0.9370

0.9415 -------- 0.9360

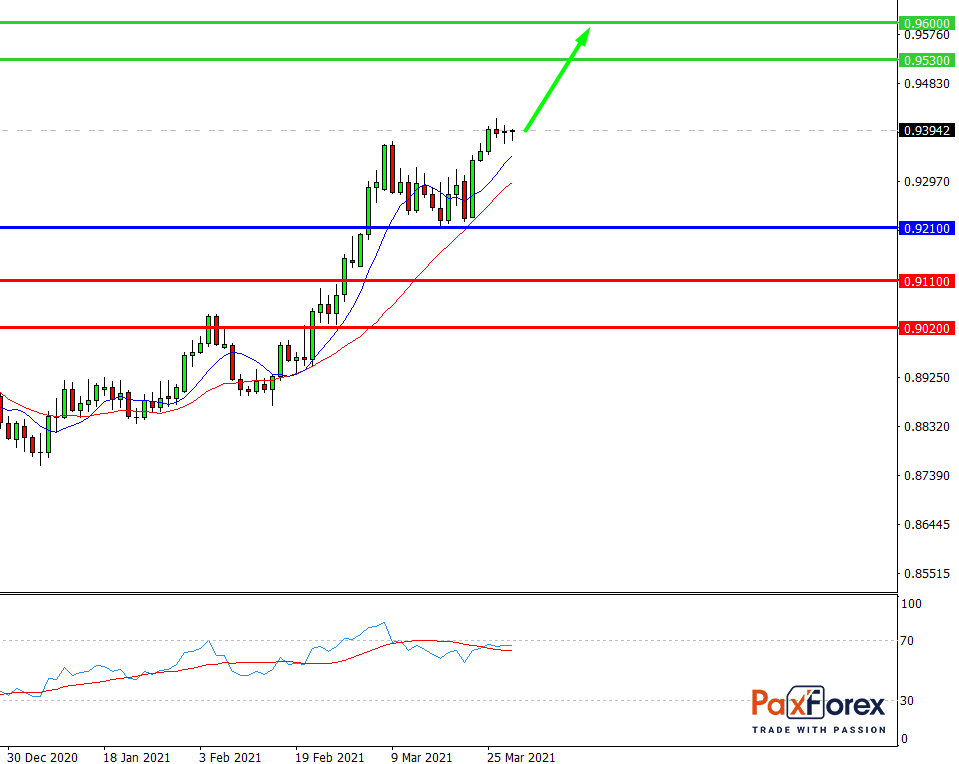

USD/CHF, D1

Pivot: 0.9392

Analysis:

While the price is above 0.9210, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 0.9392

- Take Profit 1: 0.9530

- Take Profit 2: 0.9600

Alternative scenario:

If the level 0.9210 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 0.9075

- Take Profit 1: 0.9110

- Take Profit 2: 0.9020

Comment:

RSI shows the development of an uptrend in the medium-term.

Key levels:

Resistance -- Support

0.9700 -------- 0.9210

0.9600 -------- 0.9110

0.9530 -------- 0.9020

XAU/USD | GOLD/USD | Gold to US Dollar Trading Analysis

Prev article

EUR/JPY | Euro to Japanese Yen Trading Analysis

Next article

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis

ECB head Lagarde: so far we see no signs that inflationary pressures are becoming widespread.

GBP/JPY | British Pound to Japanese Yen Trading Analysis

GBP/JPY is declining from 2-week highs, approaching 151.50.