South African Manufacturing Production for July is predicted to decrease 3.0% monthly and increase 3.6% annualized. Forex traders can compare this to South African Manufacturing Production for June, which decreased 0.7% monthly and increased 12.5% annualized.

US Initial Jobless Claims for the week of September 4th are predicted at 335K, and US Continuing Claims for the week of August 28th are predicted at 2,744K. Forex traders can compare this to US Initial Jobless Claims for the week of August 28th, reported at 340K, and to US Continuing Claims for the week of August 21st, reported at 2,748K.

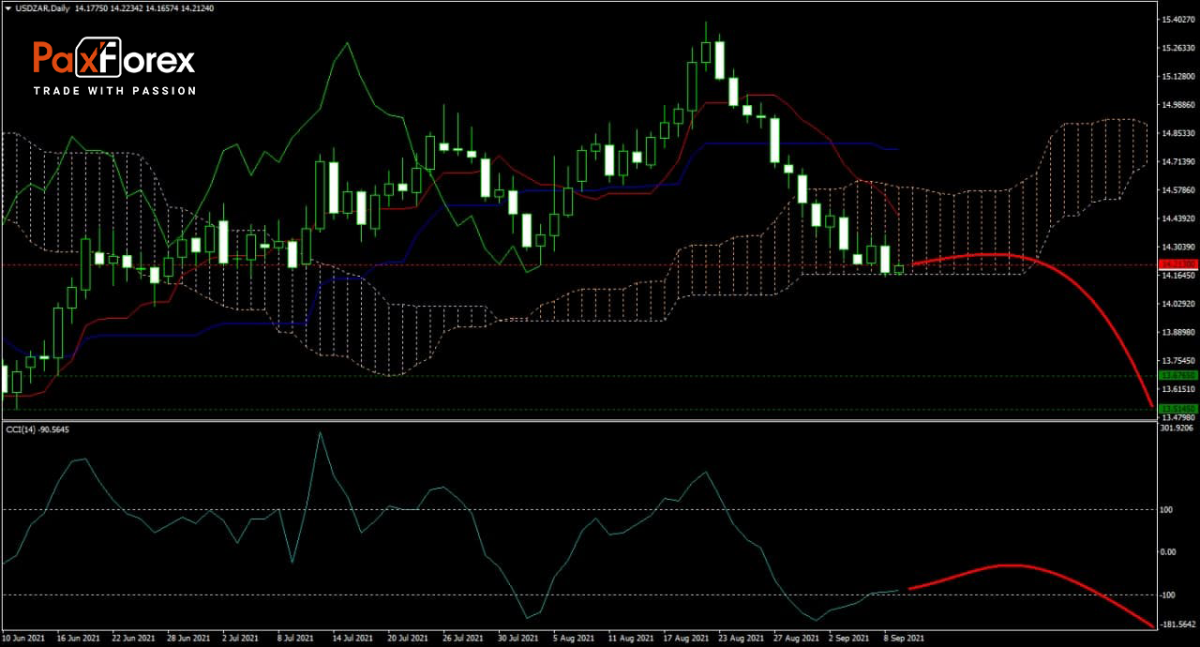

The forecast for the USD/ZAR remains bearish despite its recent sell-off. Price action now challenges the Senkou Span B of its Ichimoku Kinko Hyo Cloud. Traders should expect a rise in volatility as bulls and bears battle for control over the next move. The descending Tenkan-sen crossed below the Kijun-sen, which shows a mild bearish bias, suggesting selling pressure prevails. After the CCI dropped into extreme oversold territory and reversed, traders should wait for another breakdown before placing new short positions.

Should price action for the USD/ZAR remain inside the or breakdown below the 14.1260 to 14.3490 zone, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 14.2130

- Take Profit Zone: 13.5145 – 13.6765

- Stop Loss Level: 14.4300

Should price action for the USD/ZAR breakout above 14.3490, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 14.4300

- Take Profit Zone: 14.6300 – 14.7715

- Stop Loss Level: 14.3490

EUR/JPY | Euro to Japanese Yen Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Related articles

EUR/USD | Euro to US Dollar Trading Analysis