But as recovery from the crisis gains momentum, Verizon expects its wireless services and other revenues to grow by at least 2 percent in 2021. Does that mean now is a perfect moment to buy stock?

A look at where Verizon is now, as well as the company's outlook, might help us answer that question.

Verizon's expected revenue growth in 2021 builds on the momentum the telecom carrier experienced last year. While overall fourth-quarter revenue fell from 2019, the company's wireless services revenue grew 2.2 percent year-over-year.

The wireless services segment represents the largest component of Verizon's business revenue. It generated $16.7 billion of the company's $34.7 billion in total revenue in the fourth quarter. Wireless service revenue alone is expected to increase by at least 3 percent in 2021, prompted by circumstances such as broader adoption of more expensive unlimited service plans.

The company sees its wireless service and other revenues, which do not include hardware sales, as a big revenue driver in the coming years. The introduction of Verizon's 5G wireless network is expected to drive that growth.

With its faster data rates, Verizon's 5G can offer more than just phone service. The technology adds home and business Internet access to the company's lineup. By the end of 2021, Verizon plans to provide 5G Internet service to 15 million homes nationwide.

At a March 10 investor event, Verizon executives discussed expected wireless and other revenue growth of 3 percent in 2022 and 2023 as the 5G network expands. Going forward, management expects 4% growth in 2024 and beyond.

To get there, the company spent $52.9 billion to buy the C-band spectrum in a U.S. government auction this year. This purchase more than doubles Verizon's mid-band spectrum ownership, allowing the company to expand its 5G network coverage to more locations.

Building this 5G network is capital-intensive, and Verizon is well-positioned financially to meet the challenge. Notwithstanding the impact of the pandemic on revenues, Verizon posted a 16.8 percent increase in operating cash flow in the fourth quarter compared to the fourth quarter of last year. It led to a 32.4% year-over-year increase in free cash flow (FCF) to $23.6 billion in 2020.

The company has consistently generated strong FCF over the years.

Its steady ability to produce FCF means that Verizon is able to fund its 5G construction and dividend, which at the time of this writing is up to 4.46%. Paying dividends is one of the reasons why Warren Buffett's Berkshire Hathaway recently acquired Verizon stock.

Although there were positive trends in the fourth quarter, Verizon keeps facing strong competition. The U.S. telecommunications market is saturated, and Verizon has to steer customers away from competitors to grow its customer base. In the fourth quarter, it was far from its best in this arena.

Postpaid phone subscribers are the most valuable in the telecommunications industry. When it came to the growth of postpaid phone additions, Verizon lagged far behind its top telecom competitors, AT&T and T-Mobile US.

Furthermore, for Verizon customers to use the faster 5G network, they had to buy 5G-enabled devices. This reality has yet to translate into revenue growth for Verizon. The company's fourth-quarter wireless revenue fell from $6.8 billion in 2019 to $6.4 billion in 2020.

But as 5G adoption expands, Verizon's hardware sales will eventually accelerate. At the end of last year, only about 9 percent of its consumer base of postpaid phones used 5G-enabled devices, so the company has significant room for growth in this area.

Verizon's competitors are also investing heavily in 5G networks. As a result, Verizon may not be the biggest player in this 5G war.

But it has many attributes that make it an excellent choice for investing in 5G stock. Its wireless revenues are growing and are expected to do so for years to come.

Management took swift action in response to the pandemic, building cash reserves to survive the emergency. Verizon successfully increased its cash and cash equivalents by 2020 to $22.2 billion by the end of the year, up from $2.6 billion in 2019. This demonstrates the company's ability to adapt quickly even to extreme circumstances.

Efficiency in financial management also means reliable dividends, and the company increased its payout for the 14th consecutive year in 2020.

Even in a highly competitive and pandemic environment, Verizon can deliver solid financial results and reward shareholders with dividends. These factors make this stock a worthwhile investment.

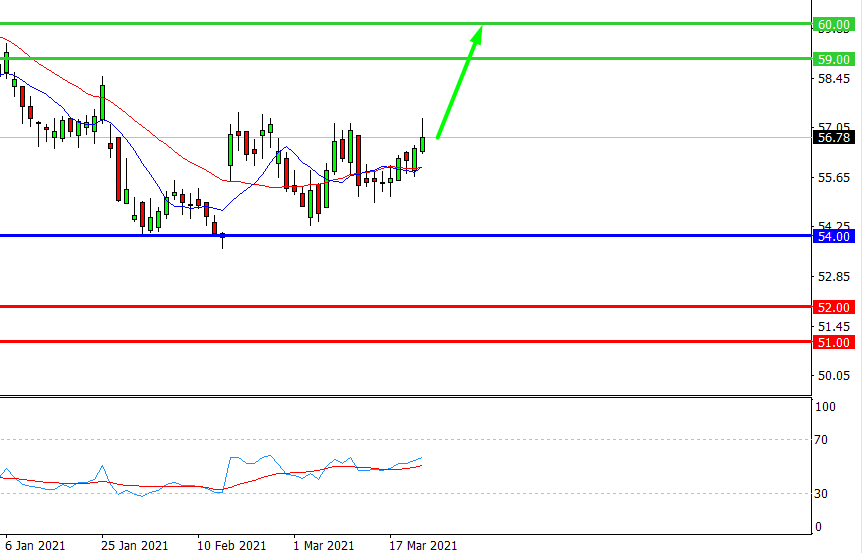

Provided that the company is traded above 54.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 57.00

- Take Profit 1: 59.00

- Take Profit 2: 60.00

Alternative scenario:

In case of breakdown of the level 54.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 54.00

- Take Profit 1: 52.00

- Take Profit 2: 51.00

USD/CAD | US Dollar to Canadian Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis