After Walmart added $40 billion to its annual sales base in 2020, no one can argue that the retail giant failed to seize the opportunities offered by the pandemic. Nonetheless, the stock has underperformed over the past year, lagging more than 40 percentage points behind the S&P 500's percentage gain. Walmart's earnings look even worse compared to comparable industry benchmarks, which have been pulling away from the market during the same one-year period.

Still, let's face facts: Walmart isn't just the leader in brick-and-mortar retail - it dominates the space. Last year, the company had $560 billion in global revenue, and its $370 billion share of U.S. manufacturing puts it in first place among its closest competitors.

By comparison, Costco earned $178 billion worldwide in the past 12 months; Target, $93 billion. Walmart even remains more than twice as big as online retailer Amazon, which sold $216 billion in physical goods in 2020.

The company is also on the right strategic path, transforming itself from a mere retailer to a full-fledged lifestyle company. Subscription delivery, medical clinics, premium alcohol brands, and beta-testing service teams to install tech products at home are just some of the previously unlikely ways in which Walmart is now expanding its network.

But a creative, dominant name in the industry doesn't mean that this stock is a buy for all investors at all times. If you're not ready to make a 10-year investment in Walmart, maybe now is not the best time to join the other shareholders.

Several significant points are underlying this argument.

One factor that will be discussed has to do with stock valuation.

The price-to-earnings ratio (P/E) is not necessarily the way to measure a stock's value. A lot of stocks with low P/E are struggling, while other high-priced stocks are thriving despite the high price.

But P/E can help investors determine the extent to which individual stocks are valued relative to the valuation that the market has historically supported. In this regard, Walmart's rolling 12-month P/E of 24.4 and forward P/E of 24.8 are slightly above long-term norms.

You could pay more for a stake in the company, and some investors have certainly been and continue to be rewarded despite the price at which they bought the stock. However, from a risk-management perspective, history suggests that we should wait a little longer.

Underscoring this call for patience is another prospective stumbling block that could derail Walmart stock for the foreseeable future: big spending plans for this year.

While the company is making what could end up being a reasonable investment in and of itself, the retailer has already warned us that the fiscal year 2022 (mostly calendar year 2021) will be somewhat expensive. Overall, Walmart is projecting $14 billion in capital spending in 2021, up about $10 billion a year. And it comes at the same time Walmart is planning wage increases for hourly workers and expects sales and revenues to calm down from the pandemic-induced shopping frenzy of 2020.

All of this spending should begin to pay off in 2022 in sales and revenue. Analysts are projecting a 3.3 percent increase in earnings for this year, combined with an expected increase in earnings per share from $5.40 to $5.87.

But a year is a long time to make investors wait for confirmation of progress. In the meantime, that perception could work against Walmart's stock price.

Maybe it doesn't matter. If you're really willing to make a 10-year commitment to the company, the turbulent and lackluster first year doesn't matter. You will already be positioned for its growth when it starts to form.

But if you're the kind of investor who tries to hold everything for years - or you flinch every time one of your assets moves down - wait. There are plenty of other great options with better prospects in 2021.

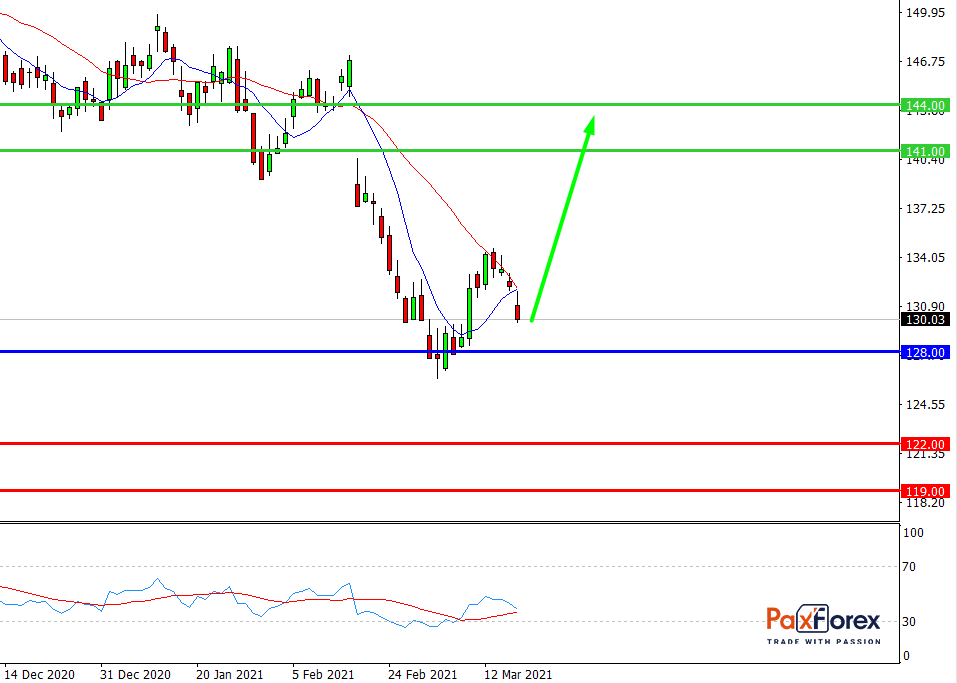

While the price is above 128.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 131.00

- Take Profit 1: 141.00

- Take Profit 2: 144.00

Alternative scenario:

If the level 128.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 128.00

- Take Profit 1: 122.00

- Take Profit 2: 119.00

XAU/USD | Gold to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis