Amazon has undoubtedly become one of the favorites of investors. More and more consumers continue to take advantage of Prime's membership, which now has more than 150 million members. This growing customer base is helping Amazon strengthen its leadership position by attracting a large number of third-party sellers. In the fourth quarter, third-party merchant sales accounted for 55% of Amazon's total billable units in its retail business, the highest level in the company's history.

Amazon continues to invest in more fulfillment centers, technology, and content and expanding its delivery network to meet growing demand. The company has enough resources to do this, with a free cash flow of $31 billion last year. Part of that investment also supports the growth of Amazon Web Services, which continues to lead the cloud services market.

Amazon has grown into a big business with $386 billion in annual revenue, but it's still capable of delivering the level of growth needed to generate huge revenue. Considering that Amazon grew revenues 44 percent in the fourth quarter compared to the fourth quarter of last year. Behind this biggest growth rate in the stock is the tremendous pace of business development that allows the company to generate such revenue.

Understandably, people are shopping more on Amazon since it's convenient, but even more importantly, they've been doing so lately because it provides some security in a time of the raging pandemic.

So far, more than 150 million people in the U.S. have received at least one dose of the coronavirus vaccine. So it makes sense that shareholders are questioning what will occur to buying habits as more and more people get vaccinated. In that context, here are a few aspects to look out for when the earnings report comes out.

The first thing investors will want to look at is net sales. The company is targeting a 36% year-over-year increase in midyear, which would be another quarter of its more than $100 billion in revenue. People seem to be maintaining the buying habits they developed during the lockdown. And even though vaccinations are gaining momentum worldwide, the end of the pandemic is unfortunately still not in sight. It could mean a steady increase in spending at Amazon.

Second, those interested in Amazon stock will want to know how much operating income the company earned this quarter. The online retailer spends about $2 billion each quarter on COVID-related expenses, which affects profits even though sales are up. There is hope that if Amazon continues to serve customers well during the pandemic, COVID-related spending will decline after the pandemic, while many of its newly acquired customers will remain. But even with the billions in additional spending, Amazon's operating income is up in 2020, up 57% from the previous year.

And third, we should look at what management will say about changing consumer behavior as people in the U.S. increasingly leave their homes. Amazon has proven to be a reliable and safe provider of basic necessities for people during the most acute phases of the pandemic. Now that more than 135 million people in the U.S. have begun to get vaccinated and feel more comfortable away from home, this could hurt sales on Amazon.com.

Wall Street analysts expect Amazon to report revenue of $104.36 billion and earnings per share of $9.45, an increase of 38.3% and 88.6%, respectively, year over year. Earnings estimates are slightly higher than the midpoint in management's guidance.

Rising revenues and new customers are contributing to Amazon's profits reaching record levels at an extraordinary rate. For example, operating income in 2020 was $22.9 billion, more than 10 times what it was in 2015 at $2.2 billion. But to date, Amazon's stock is up only 1 percent. In part, that may be due to investor fears about falling sales after the pandemic as consumers return to their old habits. Still, if you're focused on the long term, Amazon's trajectory remains positive.

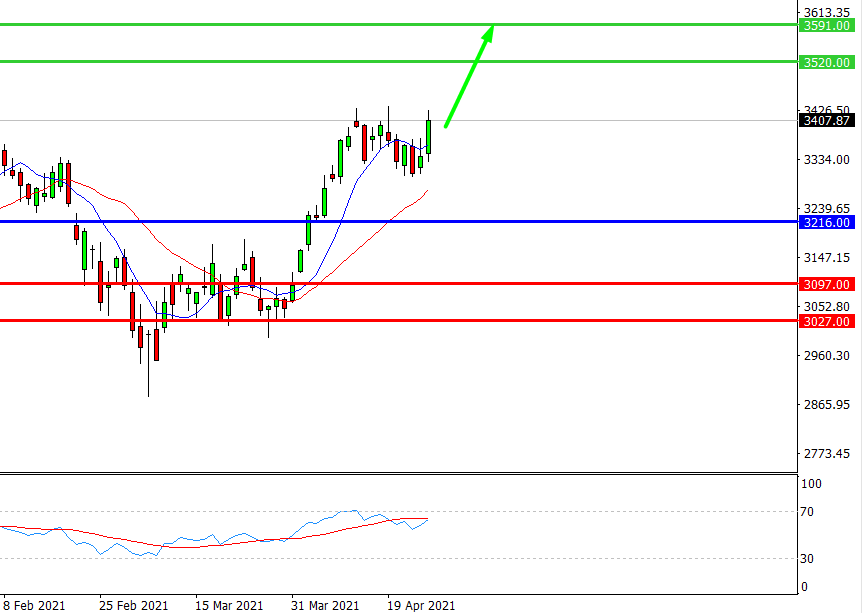

Provided that the company is traded above 3216.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 3340.00

- Take Profit 1: 3520.00

- Take Profit 2: 3591.00

Alternative scenario:

In case of breakdown of the level 3216.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 3216.00

- Take Profit 1: 3097.00

- Take Profit 2: 3027.00

Nas100 | Trading Analysis of Nasdaq 100 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis