Forex traders can compare this to the New Zealand GDP for the third quarter, which increased by 13.9% quarterly and by 0.2% annualized. The New Zealand GDP Annual Average for the fourth quarter decreased by 2.9% quarterly, and GDP Expenditure decreased by 1.5% quarterly. Economists predicted a decrease of 2.6% and 0.2%. Forex traders can compare this to the New Zealand GDP Annual Average for the third quarter, which decreased by 2.3% quarterly, and to GDP Expenditure, which increased by 14.3% quarterly.

The Australian Employment Change for February was reported at 88.7K. Economists predicted a figure of 30.0K. Forex traders can compare this to the Australian Employment Change for January, reported at 29.5K. The Unemployment Rate for February was reported at 5.8%. Economists predicted a reading of 6.3%. Forex traders can compare this to the Unemployment Rate for January, reported at 6.%. 89.1K Full-Time Positions were created, and 0.5K Part-Time Positions were lost, in February. Forex traders can compare this to the creation of 58.7K Full-Time Positions and the loss of 29.3K Part-Time Positions, reported in January. The Labor Force Participation Rate for February was reported at 66.1%. Economists predicted a reading of 66.2%. Forex traders can compare this to the Labor Force Participation Rate for January, reported at 66.1%.

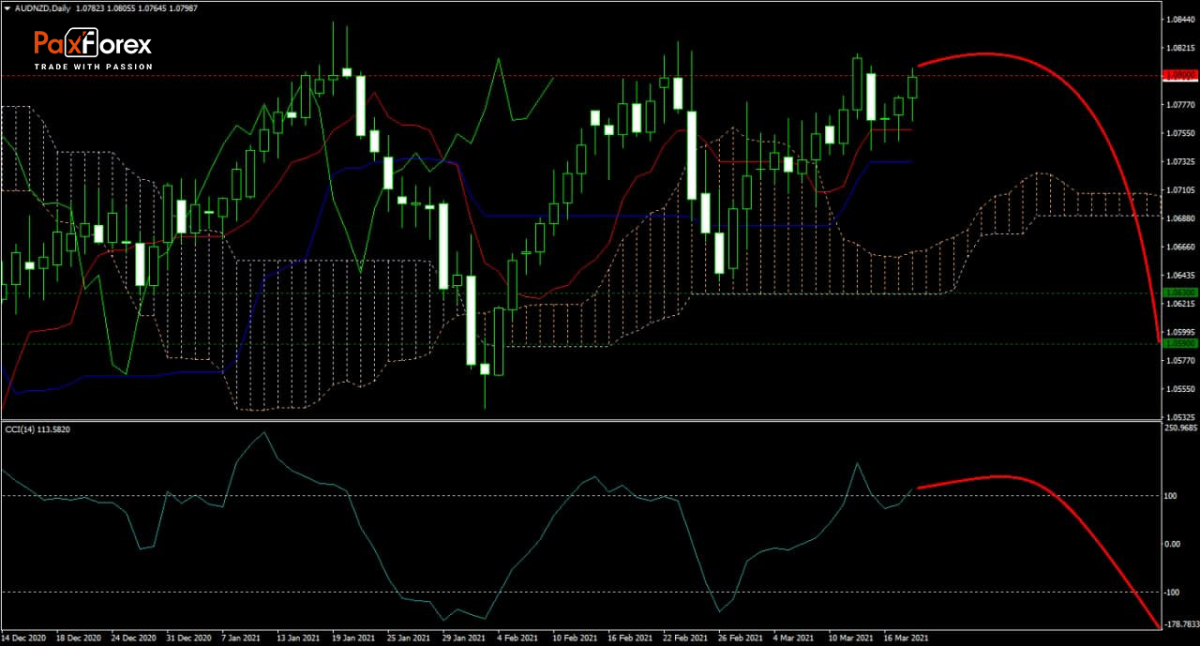

The forecast for the AUD/NZD turned bearish after the Kijun-sen and Tenkan-sen flatlined as price action approached a strong resistance area. Uncertainty over the Australian relationship with China weighs on price action, which could pressure this currency pair into its sideways trending Ichimoku Kinko Hyo Cloud. The CCI moved back into extreme overbought territory but could record a lower high before correcting.

Should price action for the AUD/NZD remain inside the or breakdown below the 1.0785 to 1.0815 zone, the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.0800

- Take Profit Zone: 1.0590 – 1.0630

- Stop Loss Level: 1.0860

Should price action for the AUD/NZD breakout above 1.0815, the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.0860

- Take Profit Zone: 1.0935 – 1.0960

- Stop Loss Level: 1.0815

ExxonMobil | Fundamental Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis