Global recovery/reflation trade is helping to improve Australia's trading conditions as commodity prices continue to rise. The price of iron ore has recently risen sharply and is now approaching its highest level in nearly a decade. If the external environment is still favorable to the Aussie dollar, as we expect it to be, it will force the RBA to keep its soft policy.

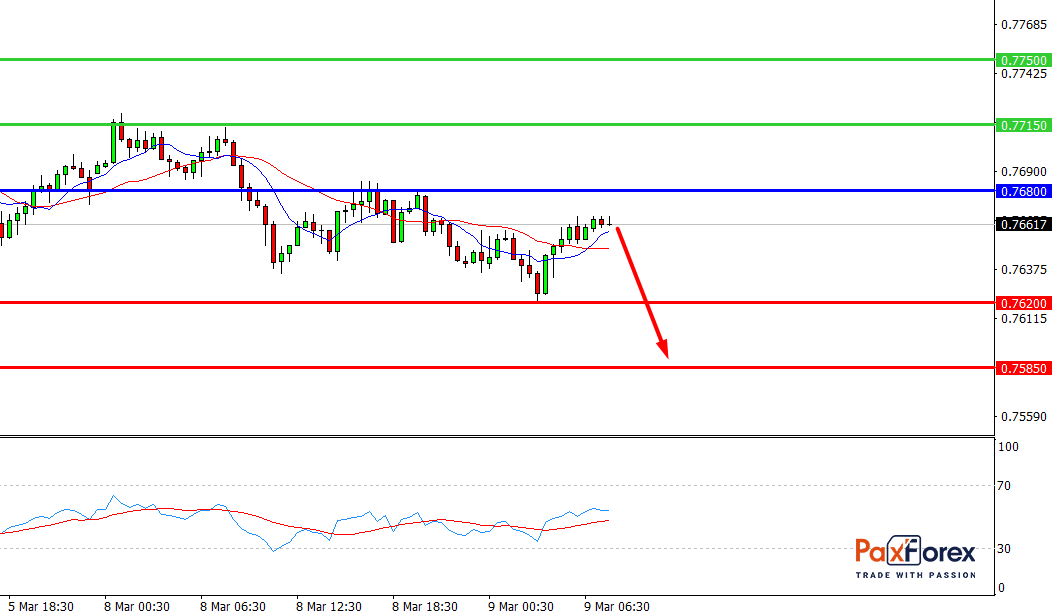

AUD/USD, 30 min

Pivot: 0.7654

Analysis:

Provided that the currency pair is traded below 0.7680, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.7654

- Take Profit 1: 0.7620

- Take Profit 2: 0.7585

Alternative scenario:

In case of breakout of the level 0.7680, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.7680

- Take Profit 1: 0.7715

- Take Profit 2: 0.7750

Comment:

RSI shows the possibility of descending momentum during the day.

Key levels:

Resistance Support

0.7750 0.7620

0.7715 0.7585

0.7680 0.7560

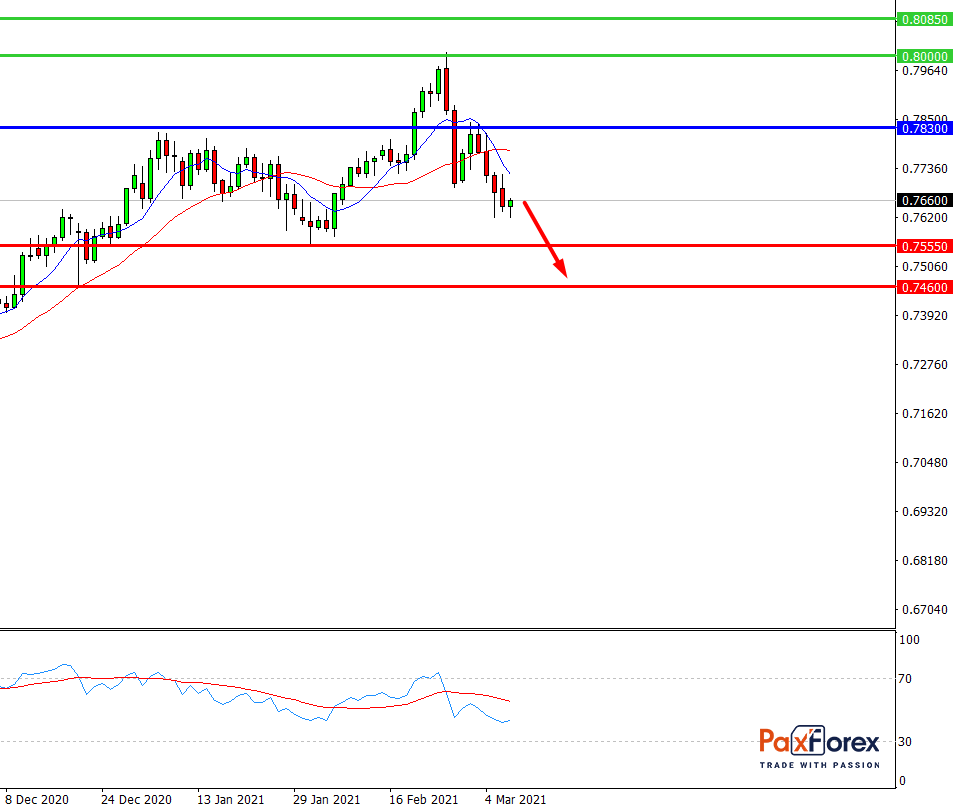

AUD/USD, D1

Pivot: 0.7711

Analysis:

While the price is below 0.7830, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 0.7711

- Take Profit 1: 0.7555

- Take Profit 2: 0.7460

Alternative scenario:

If the level 0.7830 is broken-out, follow the recommendations below.

- Time frame: D1

- Recommendation: long position

- Entry point: 0.7830

- Take Profit 1: 0.8000

- Take Profit 2: 0.8085

Comment:

RSI shows a bearish sentiment.

Key levels:

Resistance Support

0.8085 0.7555

0.8000 0.7460

0.7830 0.7340

EUR/ZAR Forecast Fundamental Analysis | Euro / South African Rand

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis