The German Trade Balance for January is predicted at €16.4B. Forex traders can compare this to German Trade Balance for December, reported at €16.1B. Exports for January are predicted to decrease by 1.2% monthly and Imports by 0.5% monthly. Forex traders can compare this to Exports for December, which increased by 0.1% monthly, and Imports, which decreased by 0.1% monthly. Italian Industrial Production for January is predicted to increase by 0.7% monthly, and to decrease by 4.2% annualized. Forex traders can compare this to Italian Industrial Production for December, which decreased by 0.2% monthly and by 2.0% annualized.

The final Eurozone Employment for the fourth quarter is predicted to increase by 0.3% quarterly, and to decrease by 2.0% annualized. Forex traders can compare this Eurozone Employment for the third quarter, which increased by 1.0% quarterly and decreased by 2.3% annualized. The advanced Eurozone GDP for the fourth quarter is predicted to decrease by 0.6% quarterly and by 5.0% annualized. Forex traders can compare this to the Eurozone GDP for the third quarter, which increased by 12.4% quarterly and decreased by 4.3% annualized.

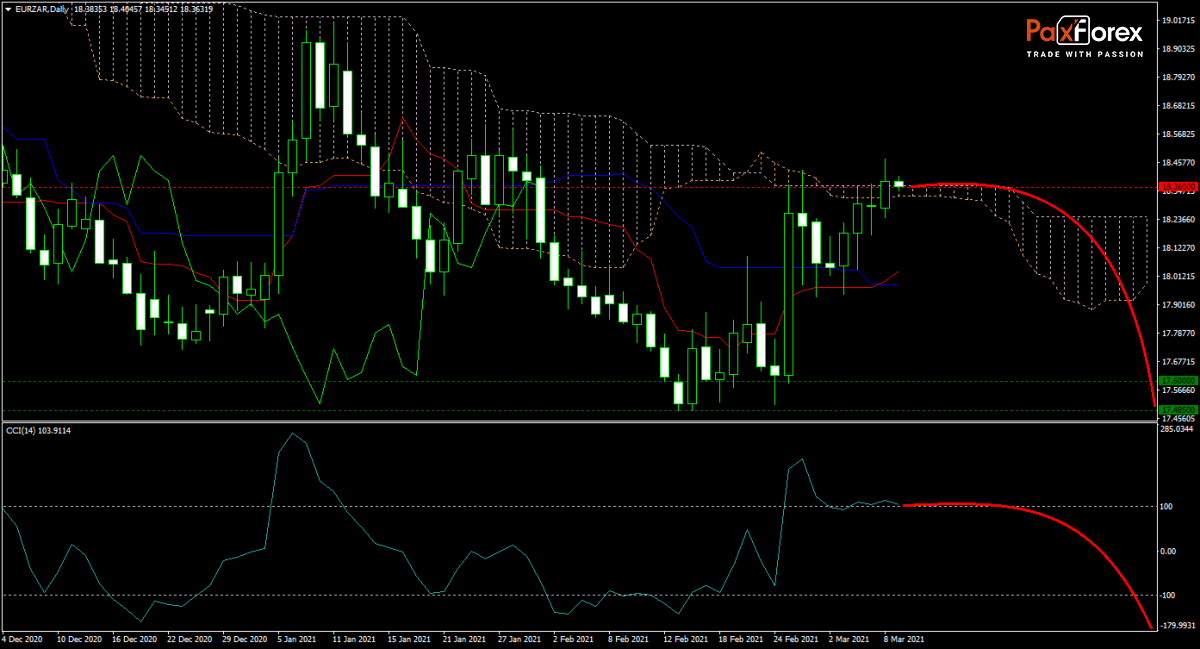

The forecast for the EUR/ZAR turned bearish after its recent price spike took into its Ichimoku Kinko Hyo Cloud. Economic data out of the Eurozone continues to show weakness, and debt rises with inflationary pressures. While the Tenkan-sen moved above its flat Kijun-sen, the CCI is retreating from its peak. A move out of extreme overbought territory can spark a broader sell-off.

Should price action for the EUR/ZAR remain inside the or breakdown below the 18.3250 to 18.4050 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 18.3700

- Take Profit Zone: 17.4850 – 17.6000

- Stop Loss Level: 18.6000

Should price action for the EUR/ZAR breakout above 18.4050 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 18.6000

- Take Profit Zone: 18.9265 – 19.0000

- Stop Loss Level: 18.4050

ExxonMobil | Fundamental Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis