- Employment is back to pre-pandemic levels;

- Unemployment rate 5.8% vs. forecast 6.3% and pre. 6,4%;

- Full-time employment +89.1k vs. pre. +59.0k;

- Part-time employment -0.5k vs. -29.8k;

- The labor force participation rate is 66.1% vs. the forecast 66.1% and pre. 66,2%;

- Hidden unemployment rose to 8.4% - a fly in the ointment report.

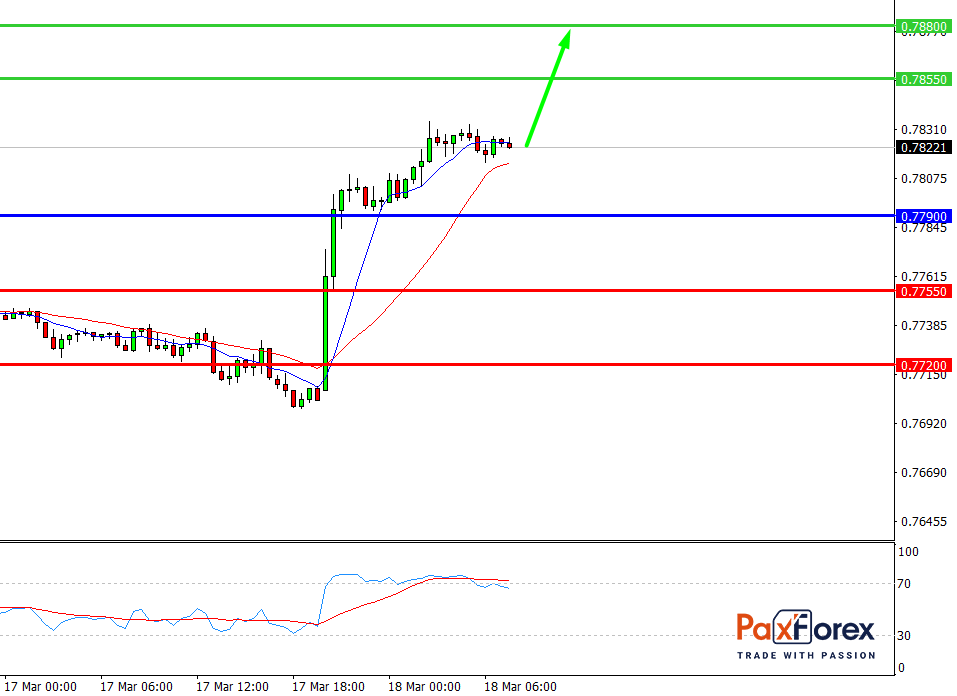

AUD/USD, 30 min

Pivot: 0.7832

Analysis:

Provided that the currency pair is traded above 0.7790, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.7832

- Take Profit 1: 0.7855

- Take Profit 2: 0.7880

Alternative scenario:

In case of breakdown of the level 0.7790, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.7790

- Take Profit 1: 0.7755

- Take Profit 2: 0.7720

Comment:

RSI shows the possibility of ascending momentum during the day.

Key levels:

Resistance Support

0.7900 0.7790

0.7880 0.7755

0.7855 0.7720

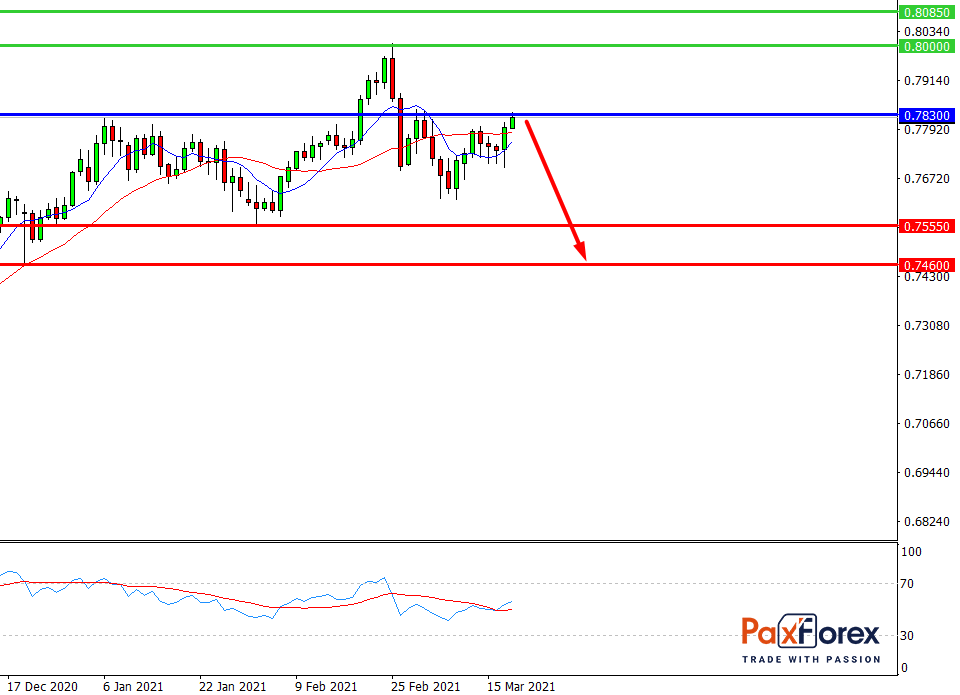

AUD/USD, D1

Pivot: 0.7707

Analysis:

While the price is below 0.7830, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 0.7707

- Take Profit 1: 0.7555

- Take Profit 2: 0.7460

Alternative scenario:

If the level 0.7830 is broken-out, follow the recommendations below.

- Time frame: D1

- Recommendation: long position

- Entry point: 0.7830

- Take Profit 1: 0.8000

- Take Profit 2: 0.8085

Comment:

RSI shows a bearish sentiment.

Key levels:

Resistance Support

0.8085 0.7555

0.8000 0.7460

0.7830 0.7340

AUD/NZD Forecast Fundamental Analysis | Australian Dollar / New Zealand Dollar

Prev article

EUR/JPY | Euro to Japanese Yen Trading Analysis

Next article

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis

ECB head Lagarde: so far we see no signs that inflationary pressures are becoming widespread.

GBP/JPY | British Pound to Japanese Yen Trading Analysis

GBP/JPY is declining from 2-week highs, approaching 151.50.