Following the massive gains in 2021 so far, traders should not panic if price action retreats. Volatility in equity markets is expected to surge this week, after Friday’s forced selling in US-based hedge fund Archegos Capital Management. Goldman Sachs remains at the Nexus of the unfolding story, with Credit Suisse joining Nomura with warnings about first-quarter earnings related to its exposure to Archegos.

Since Archegos had positions in popular names in the US and China, where retail traders flocked to with leveraged portfolios, a wave of selling may force them to liquidate Bitcoin positions, as happened in the past. Therefore, the BTC/USD is ripe for a minor pullback into string support levels, from where it can resume its ascend for now. Risks remain with governments, including the US, deliberating a ban on Bitcoin, which is slowly becoming a force of its own and threatening fiat currencies like the US Dollar, which is drowning in debt and essentially worthless.

The increased energy consumption of Bitcoin mining at a time the world is going green hangs over Bitcoin, together with excessive transaction fees. While many hope for its as a remittance system, it is far off from it. Costs and speed do not offer Bitcoin the same advantages rival coins grant. Traders should be careful with Bitcoin topping out as dark clouds form over the next few weeks.

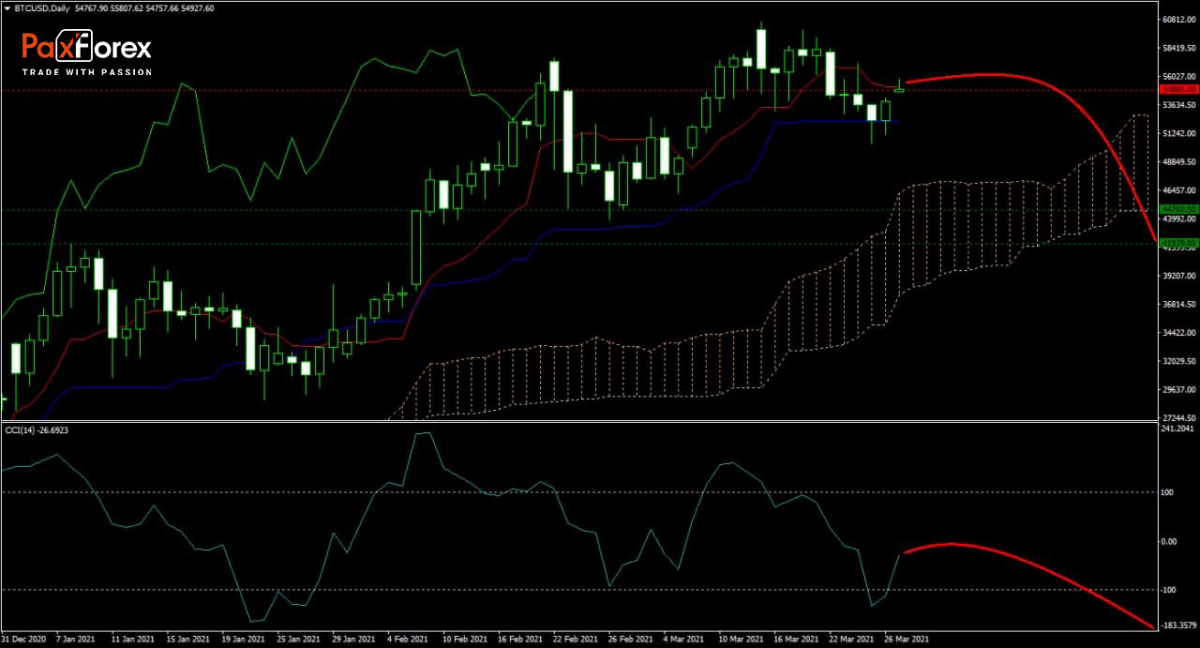

The forecast for the BTC/USD remains bearish in the short-term, but medium-term upside remains. Patient traders should consider buying the dips unless a material change forces heavy selling. The Kijun-sen turned sideways while the Tenkan-sen started to drift lower. A crossover will likely add to selling pressure, but the Ichimoku Kinko Hyo Cloud continues to move higher. After the CCI push out of extreme oversold territory, a secondary contraction could precede a sustained advance.

Should price action for the BTC/USD remain inside the or breakdown below the 54,200 to 55,810 zone, the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 54,885

- Take Profit Zone: 41,920 – 44,760

- Stop Loss Level: 57,100

Should price action for the BTC/USD breakout above 55,810, the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 57,100

- Take Profit Zone: 60,630 – 62,000

- Stop Loss Level: 55,810

Walmart | Fundamental Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis