The company has only equaled the S&P 500 over the past three to five years, even though the company has delivered solid comparable sales growth, increased its market share, and boosted its e-commerce business.

The biggest challenge facing the company is perception. Investors mostly seem to think of the company as a seasoned, even squat, retailer that is so big it can only grow slowly. The growth of Amazon, now considered the dominant retail business, has also influenced investors to think of Walmart as the thousands of super-centers behind the business and has become something of a liability in the age of e-commerce. Walmart, however, has a plan to change that.

At a last investor community meeting, company executives detailed how they are diversifying their business from physical store retailing to services such as health care, advertising, and high tech, as well as e-commerce services like the third-party marketplace and fulfilling their obligations. None of these endeavors, however, would be possible without the strength of its offline business.

This announcement is an extension of a strategy that has already been in place for years. The company ceased opening new stores several years ago and invested the capital in its omni-channel business, building product receiving stations and delivery infrastructure, enhancing its supply chain, and adjusting its super-centers to boost e-commerce.

Walmart management views its stores as the centerpiece of a much more expansive business that encompasses some other industries outside of retail. For instance, Walmart currently has 20 medical clinics, which enjoy a huge stream of company customers, as well as stores located within 10 miles of 90 percent of the U.S. population. In addition to being the largest retailer in the country, Walmart is also the largest grocer, which is a frequent driver of transportation and what CEO Doug McMillon described as a natural complement to health care, especially in areas such as wellness.

Similarly, McMillon said, customers have turned to the company for additional financial services, which is another area in which it can leverage its relationships with customers who are un-reached or under-served by banking. That's why in January the company partnered with Ribbit Capital, a sponsor of Robinhood and Coinbase, to launch a new high-tech startup.

Finally, the company is looking at improved possibilities and advertising as it leverages its digital real estate and valuable data. Walmart U.S. CEO John Furner projected that in five years the company would easily be among the top 10 advertising platforms, surpassing media companies such as Twitter, Fox, and Hearst.

Walmart's most significant push into services could be e-commerce as the marketplace and fulfillment business develops. Its global e-commerce business could reach $100 billion in revenue in two years and $200 billion a few years after that.

Though, there are examples for this shift in perception. Automakers, for example, have stayed in the market for a long time, but Volkswagen's stock recently soared after the company predicted it would sell 1 million electric cars this year, topping the market, overtaking the market favorite, Tesla. Other automakers, such as General Motors, also saw their stock rise as investors recognized their investments in new technologies such as EVs and autonomous cars.

Thus, for Walmart, the challenge it faces is convincing the market that it is not the company it was in the past. McMillon said at the conference, "We're not the business we were just a few years ago, and we're not the business you're going to see in the coming years; we're moving."

What will make the stock skyrocket is if the business can alter market perceptions to recognize its move into higher-margin services and growth industries like e-commerce, and price it accordingly. At this point, Walmart may not have made enough improvement to earn such recognition, but it should finally get it.

Management has said that it will make an operating profit after making investments this year, forecasting that it will generate at least 20 basis points per year in operating margins and increase organic sales by at least 4 percent. That projection does not seem to take into account the growing business, which is too small to have an impact on the bottom line.

Investors will have to watch to see if other new businesses, such as health care and financial services, pay off, but ultimately Walmart should be recognized for the changes the company is making to its business model. Volkswagen, for example, is already up 70 percent so far. You could say that Walmart stock looks poised for such a surge.

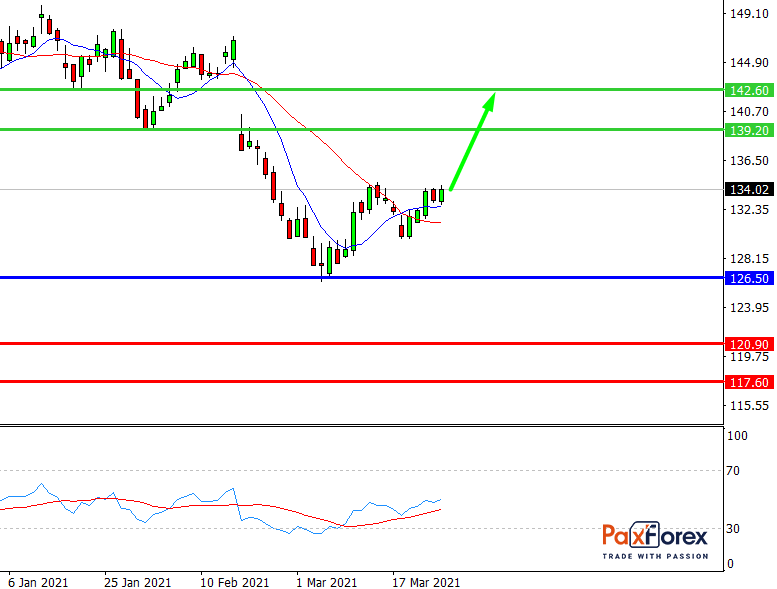

While the price is above 126.50, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 132.42

- Take Profit 1: 139.20

- Take Profit 2: 142.60

Alternative scenario:

If the level 126.50 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 126.50

- Take Profit 1: 120.90

- Take Profit 2: 117.60

SPX500 | Trading Analysis of S&P 500 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis