While the Q2 financial report for Cisco stock was mostly as expected, the April quarterly outlook looks disappointing.

During the COVID-19 pandemic, corporate spending on data networks lagged amid rising office vacancies. According to one viewpoint, corporate networks will be less important if remote work takes hold.

Consequently, CSCO stock needs more investment in next-generation enterprise networks. Cisco is looking to migrate from on-premises data centers to a hybrid cloud computing infrastructure.

One big question is whether Cisco can get a stake in cloud computing data centers. In that market, Arista Networks is Cisco's main competitor.

Also, this technology icon is targeting increased recurring revenue from software and subscription-based services, as well as a move away from its core business of selling network switches and routers. Some CSCO stock supporters believe a big transformational acquisition is needed.

Cisco introduced a new CFO, Scott Herren of Autodesk.

Cisco stock remains one of the top U.S. technology companies in terms of cash on its balance sheet. With a 4% dividend yield, Cisco stock continues to find support among institutional investors. While Cisco stock provides an attractive dividend, the buyback program has slowed.

Much of Cisco's earnings growth has come from acquisitions.

Cisco agreed on Dec. 7 to buy UK-based IMImobile, which sells cloud communications software, in a deal worth $730 million.

In May 2020, Cisco acquired ThousandEyes, a network intelligence company, for $1 billion.

In 2017, Cisco acquired software maker AppDynamics for $3.7 billion. In late 2017, it acquired BroadSoft for $1.9 billion.

In July 2019, Cisco acquired Duo Security for $2.35 billion, its largest cybersecurity acquisition since buying Sourcefire in 2013. The Duo Security acquisition solidified Cisco's position in a new category called "zero-trust cybersecurity."

In addition to the acquisitions, the new accounting rules were a plus for revenue accounting. The rules, known as ASC 606, require prior recognition of multi-year software licenses.

As companies shift workloads to cloud computing, such as Amazon Web Services, a division of Amazon, they can spend less on internal computer networks. Besides, Cisco has lost share in several large markets, though it is committed to rebuilding cybersecurity.

Amid the coronavirus emergency, companies have cut back on information technology spending.

Cisco posted fiscal Q2 earnings that beat analysts' forecasts, while its earnings forecast for the current April quarter met expectations.

In the quarter ended Jan. 23, Cisco's earnings rose 2 percent to 79 cents a share compared with the same period a year ago. Revenue was $12 billion, almost unchanged from a year ago.

Analysts had expected Cisco earnings of 76 cents on sales of $11.92 billion.

For the current quarter, Cisco's earnings are estimated to be 81 cents at the median of management's forecast. Cisco expects revenue to grow 4.5 percent. Analysts had projected revenue to grow about 3 percent to $12.36 billion.

However, Cisco will have 14 weeks in the third quarter of 2021, compared to 13 weeks in the same quarter in fiscal 2020. Cisco said in a release that this is "reflected in the forecast."

Cisco bought back $801 million of its stock in January. Cisco has $9.2 billion left in its share repurchase program.

One positive point for CSCO stock was the sale of Catalyst 9000 computer network switches.

Cisco also had an opportunity to upgrade its data centers. The so-called "Internet cloud" consists of warehouse-sized data centers.

They are filled with racks of computer servers, storage systems, and networking equipment. Most data centers that use cloud computing currently use communications equipment at 100 gigabits per second. The data center upgrades cycle to 400G technology has been suspended. The big question is whether Arista Networks or Cisco will get a stake in the 400G upgrade cycle.

Cisco agreed in 2019 to buy Acacia Communications, a 400G device maker, for $2.6 billion in cash. The Chinese government deferred approval of the deal. In January, Cisco raised its offer to buy Acacia to $4.5 billion, and the deal was finally closed.

Arista outpaced Cisco in the cloud data center market, capturing Microsoft, Facebook, and Amazon as customers. However, Cisco reportedly gained business from Microsoft.

Also, analysts say Cisco is also well-positioned as enterprise customers move to a networking technology called software-defined global networks, or SD-WANs. This technology often takes advantage of bandwidth on the public Internet.

With SD-WAN, companies have less need for expensive private data networks leased from telcos. Cisco competes in the SDN market with VMware, startup Aryaka, Fortinet, and

CloudGenix. Palo Alto Networks recently acquired CloudGenix.

Given the disappointing outlook for the future report, investors should be cautious in opening new positions.

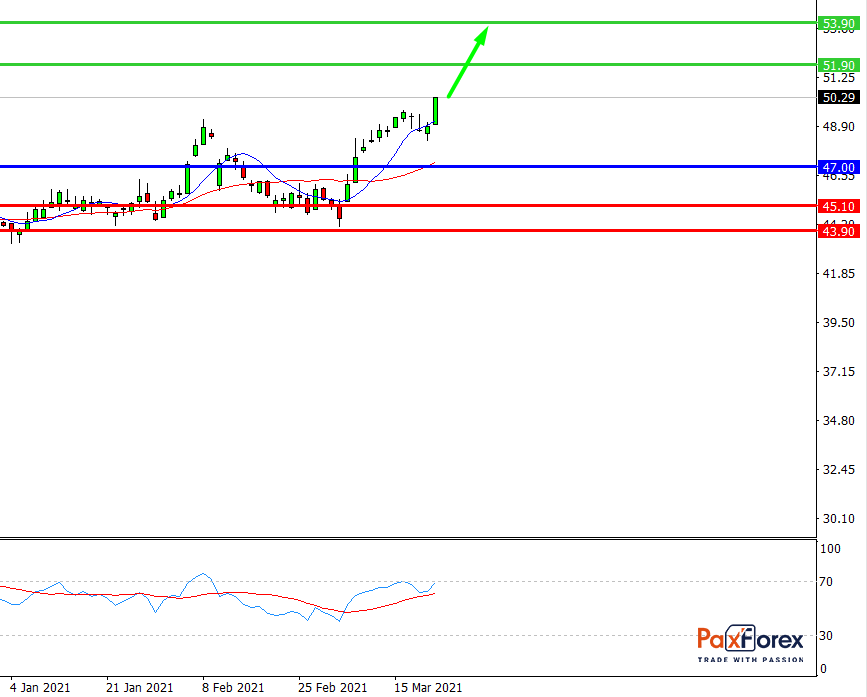

While the price is above 47.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 48.80

- Take Profit 1: 51.90

- Take Profit 2: 53.10

Alternative scenario:

If the level 47.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 47.00

- Take Profit 1: 45.10

- Take Profit 2: 43.90

US30 | Trading Analysis of Dow Jones 30 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis