Indeed, Disney seems to meet every possible criterion that would make the company a worthwhile investment. It is the undisputed leader in various entertainment markets. The stock has also roughly doubled in the last year, so the momentum is also on the company's side. What's scary (in a good way) is that Disney isn't even running at full capacity right now. With catalysts in place for lagging segments to start recovering in 2021, it will be hard to dispute the fact that Disney is not a revenue generator.

A key factor in Disney's resurgence on Wall Street is obviously the pivotal success of Disney+. Indeed, the company used the coronavirus pandemic as an opportunity to recharge its streaming platform, which is emerging as a market leader because of its wealth of original content. The streaming platform launched in late 2019, and just over a year later, it has 94.9 million premium subscribers worldwide.

Disney's decision to completely reinvent itself is commendable, but let's take a look at some things that may surprise or perhaps even bother you.

Disney+ currently accounts for only 7% of revenue. In fact, Hulu generates twice as much revenue as

Disney+, between its flagship platform and its live TV streaming service.

The average revenue per user is declining as Disney enters densely populated but less lucrative markets.

At a media event in December, Disney confirmed that Disney+ would not be profitable until 2024.

Disney+'s success comes at the expense of some traditional businesses, including box office receipts and service fees the company receives from cable and satellite television companies.

Don't worry. You just haven't fallen into a well-disguised bear trap.

Disney+ is a dramatic game-changer, but it will leave an imprint on many other areas of the media giant's business.

Disney+ boasts an upbeat performance. The price of Disney+ is set to rise in the U.S. this month, so there could be a reversal in average revenue per user. The live streaming platforms Disney+, Hulu, and ESPN+ already makeup about a quarter of Disney's total revenue and will continue to grow. Streaming should more than makeup for the decline in the segments it displaces.

In a week we will be celebrating the grim anniversary of the closure of all Disney resorts due to the pandemic. By next month, the sixth and final resort to reopen will finally open the turnstiles to its theme parks. Disney's four-ship cruise line could also return to service in the spring.

Last weekend, Disney returned to the local multiplex for the first time in a year. The cartoon Raya and the Last Dragon came in the first place, but now Disney is capitalizing on theatrical and digital distribution at the same time by charging $30 to people who prefer to stay home, providing unlimited family streaming access to full-length animation for three months.

Also, weaker segments of the Disney market will start showing year-over-year growth later this month, but they'll also start doing it in a more intelligent way. The emphasis now is on more expensive one-day tickets and encouraging resorts to stay at their theme parks on annual passes for easier access. Each hit movie now generates more than one initial revenue.

The company may lose advertising revenue and carriage fees as consumers move to streaming on linear television, but all this will lead to Disney gaining more control over viewers and better data collection, making it even more responsive to viewers.

You may not be able to tell the difference between the last couple of questionable quarterly financial reports, but Disney is much smarter now than it was a year ago. Disney is in better shape to be a leader in the future.

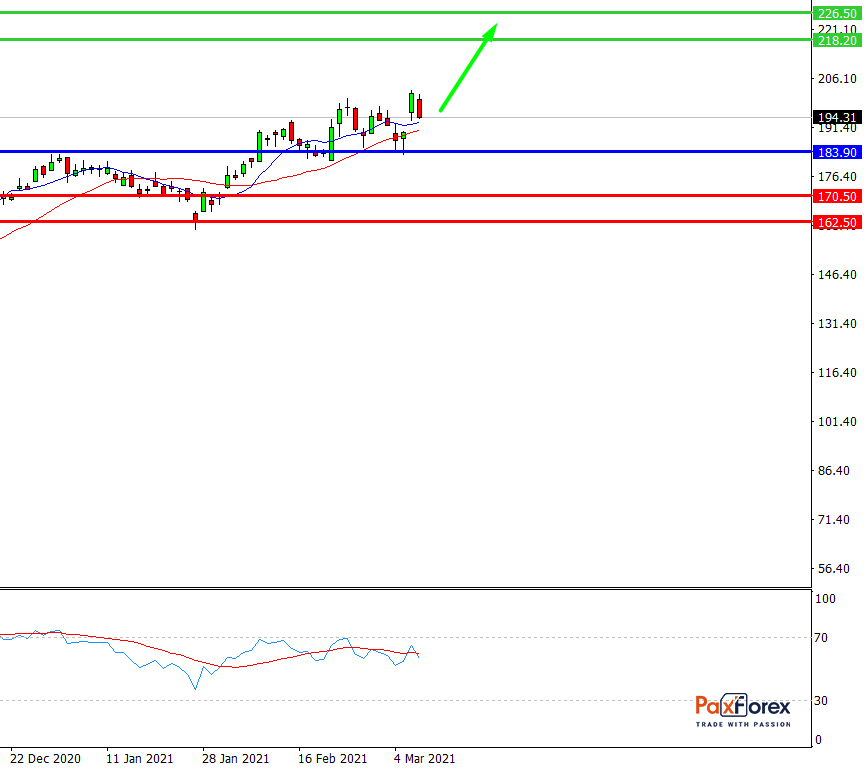

While the price is above 183.90, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 194.51

- Take Profit 1: 218.20

- Take Profit 2: 226.50

Alternative scenario:

If the level 183.90 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 183.90

- Take Profit 1: 170.50

- Take Profit 2: 162.50

Trading Analysis of S&P 500 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis