Undoubtedly, all those who were optimistic about the company's prospects were right. But it's not too late to buy stock with such a beloved name. (Disney theme parks are the top four most visited in the world, according to Statista). Today, we offer insights into a few reasons why Disney stock is a great investment option.

The company recently announced that Disneyland and Disney's California Adventure will reopen on April 30. The parks were closed more than a year ago due to the pandemic. At first, they will be open only 15% of their capacity, Disney CEO Bob Chapek told CNBC. But it's an important first step toward restoring revenue.

The parks, experience, and products segment tend to be the biggest contributor to Disney's sales. In 2019, this segment accounted for nearly 40 percent of annual revenue. The company also generates sales of movies, streaming services, and cable networks. Last July, Disney reopened its theme parks in Florida.

These parks and Shanghai Disney opened during the last quarter. The Paris and Hong Kong parks were partially open. According to Disney officials, even with reduced capacity, sales exceeded opening costs at all facilities. So it would make sense to expect the same result in California.

Visitors may flock to California parks this spring. A decline in coronavirus cases and an increase in vaccinations may also encourage Disney entertainment fans to return to the parks.

Last month, analysts presented a view that Disney+ streaming service could surpass Netflix by 2026. The digital TV study predicts that Disney subscribers will reach 294 million by then. That compares to an estimate of 286 million for Netflix.

One can't help but agree that Disney+ is going to reach the level of Netflix or even overtake it. Disney+ recently reached more than 100 million subscribers worldwide -- that's after only 16 months of operation. Chapek recently called the direct-to-consumer business, which includes Disney+, "the company's top priority." He also noted that the company's goal is to launch more than 100 projects a year in its streaming service.

In the most recent quarter, direct-to-consumer service sales were up 73% over the previous year. Investments in Disney+ expansion, however, significantly impacted earnings. The segment had an operating loss of $466 million in the quarter.

That figure, however, was down from a $1.1 billion loss a year earlier. No doubt, big investments are now expected to lead to big profits in this segment.

Disney recently said it will close at least 60 physical stores in North America this year -- and shift its focus to e-commerce. It's a smart move, given the growing demand for online shopping.

Last year, the pandemic caused a significant surge in online shopping activity. Even as the recession eases, consumers may still favor this method of shopping for necessities and discretionary items. McKinsey & Co. research shows that consumers intend to continue shopping online after the pandemic. According to the National Retail Federation, online shopping grew 21.9 percent last year and could increase 18 percent to 23 percent this year.

Also, Disney will be able to benefit by picking up fans where they are likely to shop now and in years to come -- in the comfort of their homes.

Undoubtedly, investors will have to be patient to see the fruits of all three aspects reflected in Disney's earnings reports. It will take time to rebuild revenue and earnings levels. But Disney has the tools it needs to do so. And so now is the time to invest in the future success of Mickey's house.

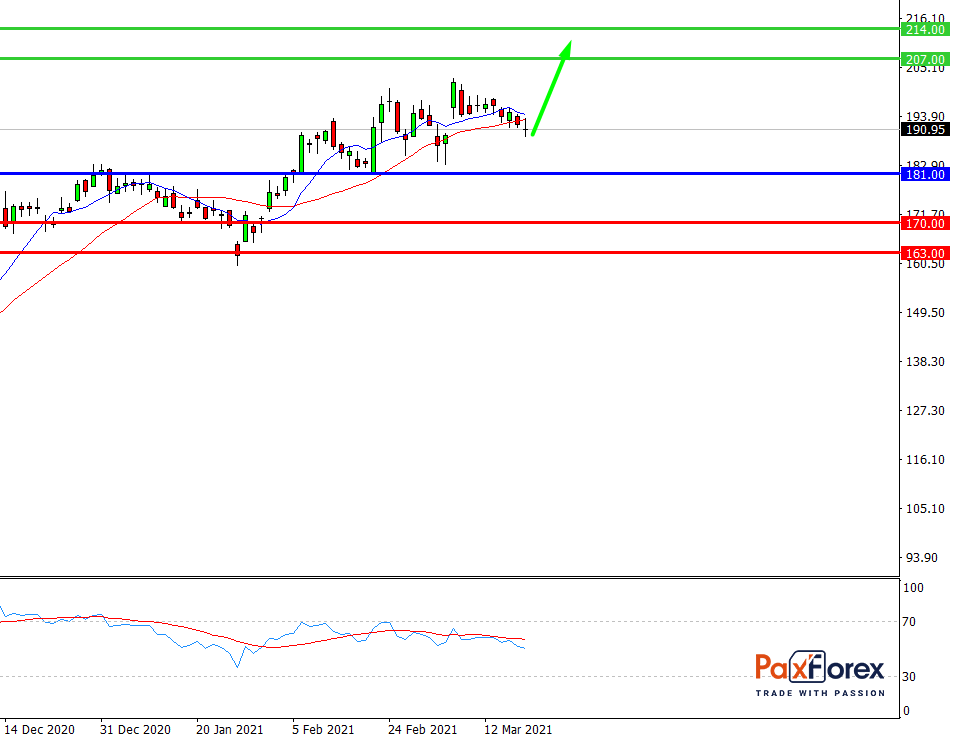

While the price is above 181.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 191.00

- Take Profit 1: 207.00

- Take Profit 2: 214.00

Alternative scenario:

If the level 181.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 181.00

- Take Profit 1: 170.00

- Take Profit 2: 163.00

SPX500 | Trading Analysis of S&P 500 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis