For many, the business is synonymous with social media, and its platforms (Facebook, Instagram, WhatsApp) have billions of users worldwide, which underpins its high-margin business model.

While Facebook's advertising business has made it one of the most profitable and valuable businesses in the world, CEO Mark Zuckerberg sees his brainchild growing into another company in the future.

During Facebook's fourth-quarter earnings report call, Zuckerberg introduced his vision for the company's immediate future to shareholders:

"Finally, let's discuss our work on the next computing platform. This is one of the areas I'm most passionate about this year. If you look at the history of computing, every 15 years or so there is a new major platform that integrates technology more naturally and ubiquitously into our lives -- starting with mainframes, then PCs, then browser-based computing, and then mobile. I think the next logical step here is to immerse yourself in a computing platform that just delivers that magical sense of being there - that you're really there, with another person or in another place."

As it follows, Zuckerberg's next major platform relates to virtual/oriented reality (VR) and Facebook's Oculus platform, also known as Facebook Reality Labs. Taking into account the terms mentioned, which accurately shows the progress of past computer advances, the emergence of virtual reality may not be far off. After all, Apple's iPhone, which ushered in the mobile era, was launched in 2007, or 14 years ago.

If Zuckerberg is right, the VR era should begin as soon as next year. The inevitability of VR, as Zuckerberg sees it, is one of the reasons the head of Facebook is sure his business and Apple are on a collision course in hardware.

Facebook Reality Labs is a division of the social media giant dedicated to virtual and augmented reality experiences. In its five reality labs around the world, Facebook engineers are developing technologies and experiences envisioning a world in which a "light, stylish pair of glasses" would replace a device like a computer or a smartphone, removing a layer of human interaction with a computer and a barrier to communication with others, allowing one to feel physically present even when one is not.

The applications of such technology are vast: on-the-job training, education, gaming, exercise, a work meeting or simply sharing experiences with friends.

Facebook is the market leader in virtual reality headsets with a 35 percent share last year according to TrendForce, and that was before the company launched Oculus Quest 2 last October, which Zuckerberg said was "on its way to being the first virtual reality headset," and noted that it was a popular holiday gift. Overall, the headset received strong reviews, rating it an average of 4.7 stars out of five stars from more than 8,000 Google reviewers.

When it comes to determining the company's stock price, Oculus and Facebook's other investments in VR and AR (augmented reality) seem almost totally neglected, as Facebook's social media properties and advertising business considerably shadow them.

One way or another there is some logic behind that. After all, advertising accounted for 98% of Facebook's total revenue last year, but its other revenue segment, which consists mostly of hardware products such as Oculus and Facebook Portal, is growing rapidly. Earnings in the division surged 72% to $1.8 billion in 2020, and, showing the popularity of Quest 2, other revenue rose 156% to $885 million in the fourth quarter, the quarter in which it was released.

What's more significant than the current results in the VR segment is the potential of the platform. If Zuckerberg is right that VR/AR represents the next big computing platform, then Facebook investors are sitting on a virtual gold mine here. Facebook Reality Labs' valuation does not reflect on Facebook's market value, which by most measures is already cheap.

Facebook just finished the year with a 22% increase in revenue to $86 billion and earnings per share jumped 57% to $10.09, but the stock is trading at a discount to the S&P 500, valued at a price-to-earnings ratio of less than 30.

Of course, it is too early to tell what will become of Oculus and Facebook Reality Labs, but the coronavirus situation has changed perceptions of such tools and elevated the status of useful video conferencing software such as Zoom. Zuckerberg himself seems to believe that the platform has the potential to become the next iPhone, and it is clearly a passion project for him, as he told investors, "It will open up the kinds of social experiences I've dreamed about since I was a kid."

He may not be right about VR being on the cusp of a breakthrough, but taking into account his track record, it would be a mistake to bet against it.

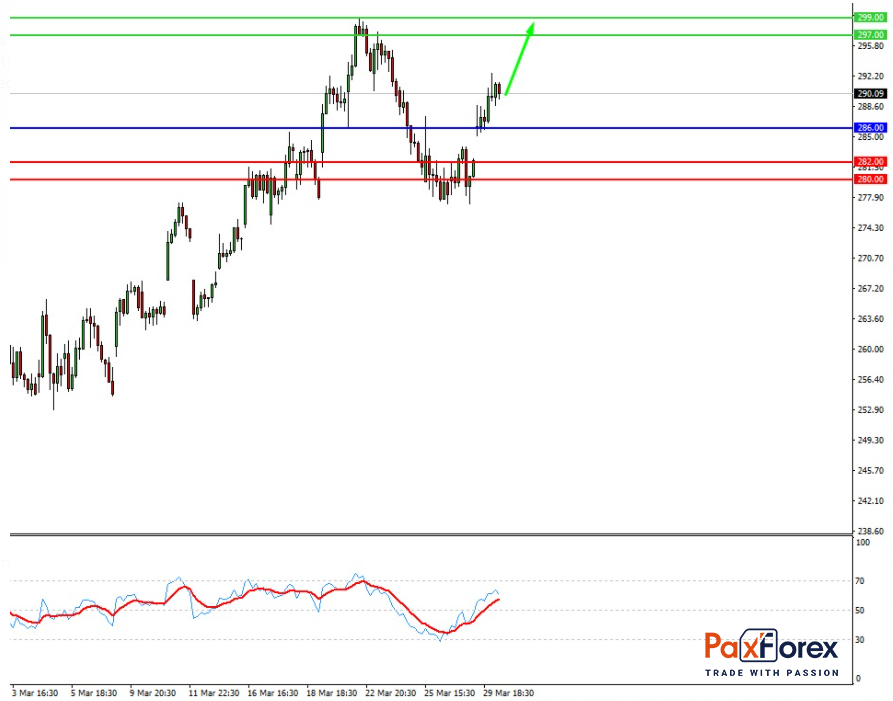

Provided that the company is traded above 286.00, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 290.09

- Take Profit 1: 297.00

- Take Profit 2: 299.00

Alternative scenario:

In case of breakdown of the level 286.00, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 286.00

- Take Profit 1: 282.00

- Take Profit 2: 280.00

Nas100 | Trading Analysis of Nasdaq 100 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis