The US dollar will keep rising until the Fed introduces a yield curve control tool, which will be the beginning of a long-term decline. Before Powell's speech, the markets were expecting him to announce something like that, but it looks like the time has not come yet. From this point of view, the important thing is the March 7 meeting, during which the views on the bond market may be voiced, but until then, the Fed will keep the status quo.

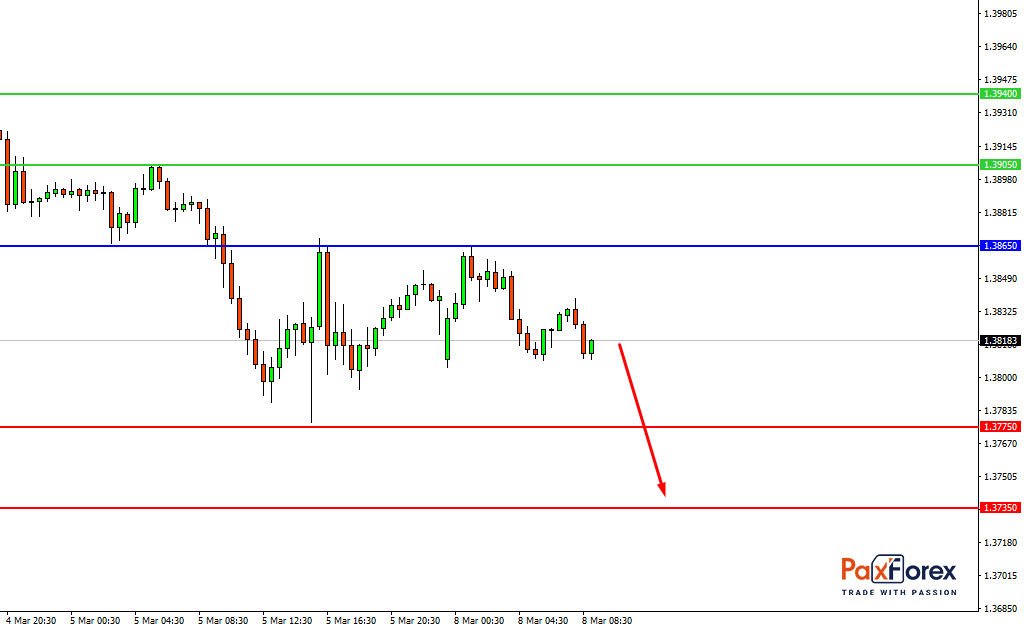

GBP/USD, 30 min

Pivot: 1.3825

Analysis:

Provided that the currency pair is traded below 1.3865, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 1.3825

- Take Profit 1: 1.3775

- Take Profit 2: 1.3735

Alternative scenario:

In case of breakout of the level 1.3865, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 1.3865

- Take Profit 1: 1.3905

- Take Profit 2: 1.3940

Comment:

RSI shows descending momentum during the day.

Key levels:

Resistance Support

1.3940 1.3775

1.3905 1.3735

1.3865 1.3700

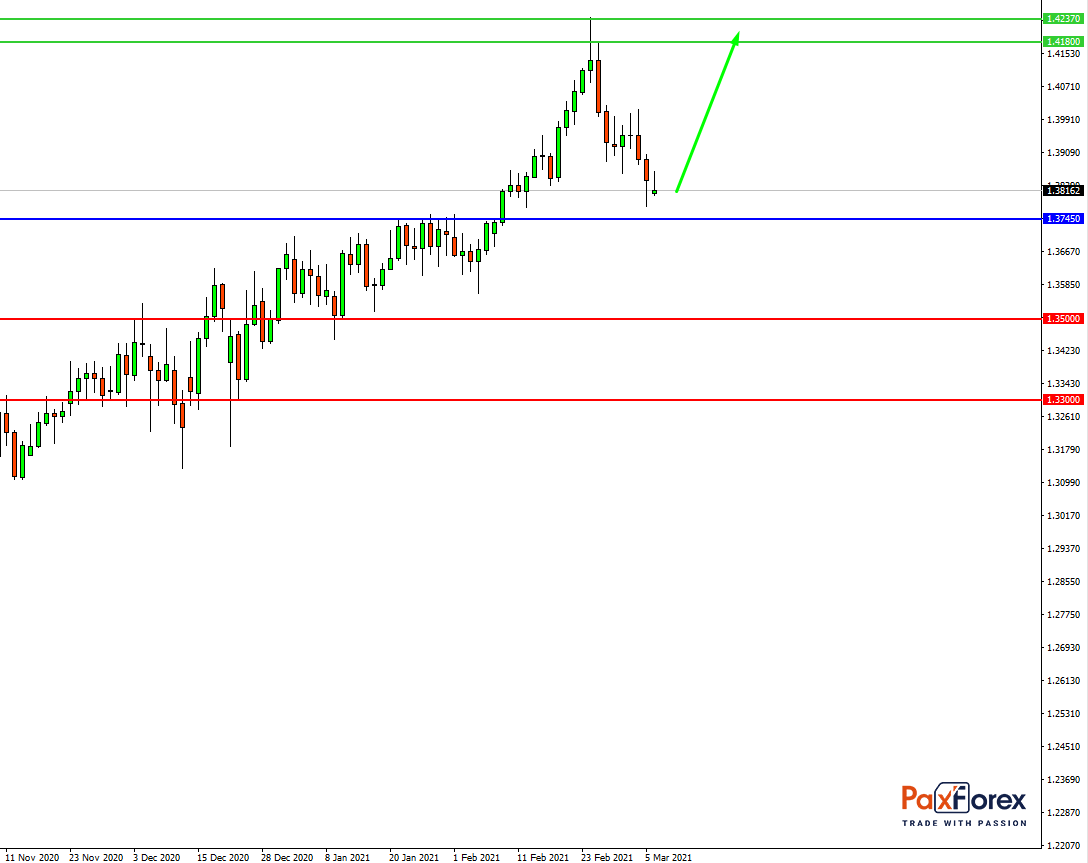

GBP/USD, D1

Pivot: 1.3936

Analysis:

While the price is above 1.3745, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 1.3936

- Take Profit 1: 1.4180

- Take Profit 2: 1.4370

Alternative scenario:

If the level 1.3745 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 1.3745

- Take Profit 1: 1.3500

- Take Profit 2: 1.3300

Comment:

RSI indicates that an uptrend continues in the medium term.

Key levels:

Resistance Support

1.4550 1.3745

1.4370 1.3500

1.4180 1.3300

EUR/JPY Forecast Fundamental Analysis | Euro / Japanese Yen

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis