The Fed kept the interest rate on federal funds rate in the range from 0% to 0.25% per annum, according to the communique of the Federal Open Market Committee (FOMC) after its meeting on March 16-17. The decision coincided with the forecasts of economists and market participants. The Nasdaq Composite added 53.64 points (0.4%) to settle at 13525.20 points.

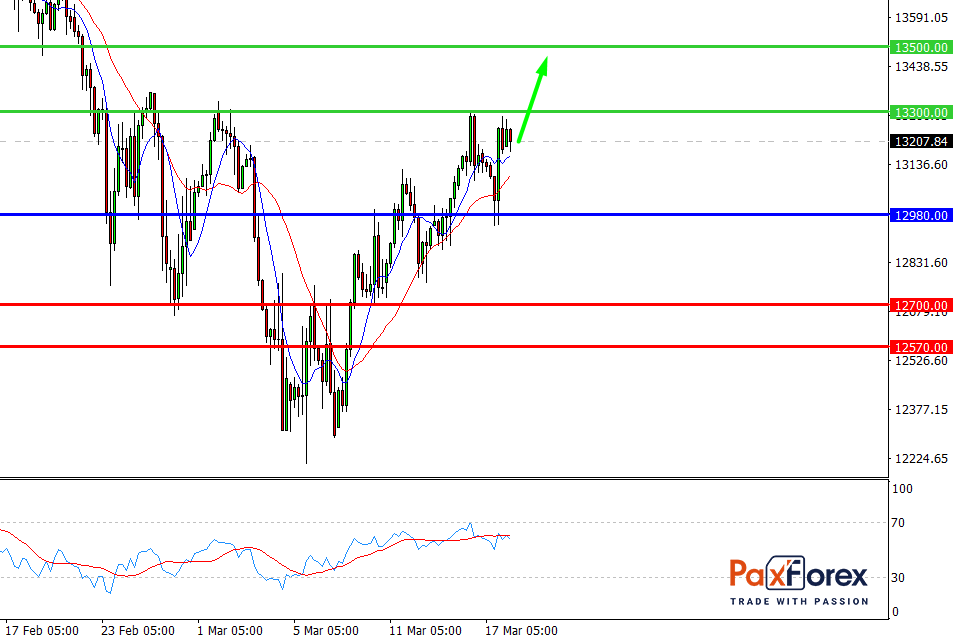

Nasdaq 100, H4

Pivot: 13202.00

Analysis:

Provided that the index is traded above 12980.00, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 13202.00

- Take Profit 1: 13300.00

- Take Profit 2: 13500.00

Alternative scenario:

In case of breakdown of the level 12980.00, follow the recommendations below:

- Time frame: H4

- Recommendation: short position

- Entry point: 12980.00

- Take Profit 1: 12700.00

- Take Profit 2: 12570.00

Comment:

RSI indicates an uptrend during the day.

Key levels:

Resistance Support

13700.00 12980.00

13500.00 12700.00

13300.00 12570.00

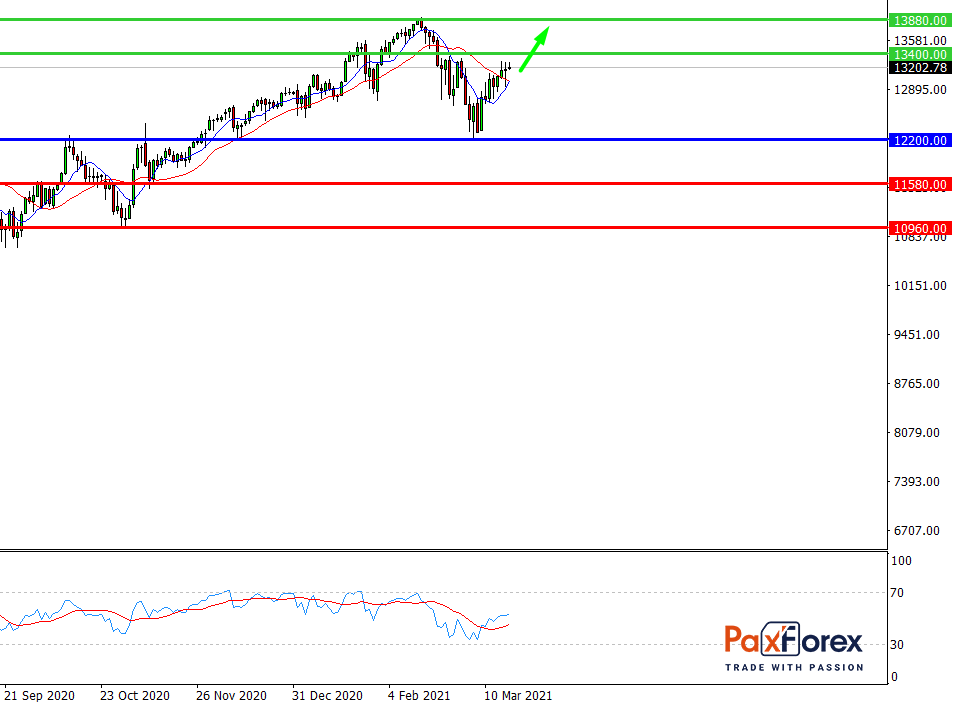

Nasdaq 100, D1

Pivot: 12886.00

Analysis:

Provided that the index is traded above 12200.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 12886.00

- Take Profit 1: 13400.00

- Take Profit 2: 13880.00

Alternative scenario:

In case of breakdown of the level 12200.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 12200.00

- Take Profit 1: 11580.00

- Take Profit 2: 10960.00

Comment:

RSI is bullish and indicates further increase.

Key levels:

Resistance Support

14650.00 12200.00

13880.00 11580.00

13400.00 10960.00

AUD/USD | Australian Dollar to US Dollar Trading Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis