The first reason relates to the way the markets work. No product can win the global market unquestioningly. It is particularly accurate in an industry where it can take two to five years to get a new product from idea to target customer. Add in annual capital expenditures of up to 10% of revenue, and you can see why innovation in the automotive industry tends to be slow and very gradual.

At the same time, electric cars are rapidly gaining share of the entire automotive market. The 2.6 percent market share of electric cars set a record last year, and that leaves plenty of room for further growth. The market for electric cars is beginning to look a lot like that of the traditional auto industry. The competition includes GM, which has pledged to introduce 30 new EV models by 2025, and Volkswagen's Porsche-owned Taycan with 250,000 616 hp, as well as such stars as Chinese EV company NIO, American-made Fisker, and Amazon-backed Rivian.

The global auto market is valued at $2 trillion, and Tesla's market capitalization of $680 billion is investors giving the company credit for getting more profit before it happens. Tesla delivered only half a million cars last year, compared to the 70 million produced by the entire industry.

One of the reasons Tesla can get so much credibility is autonomous driving. The company logged about 3 billion miles of data on its cars last year. This data is key to training machine learning algorithms. That's about 150 times 20 million more than its closest competitor, Alphabet's Waymo. Also compelling is the debut of the Tesla Semi. This electric tractor-trailer will target the $4.2 trillion global trucking market. If Tesla CEO Elon Musk can transform the world's fleet of tractor-trailers into an autonomous trucking network, investors will need to add $600 billion to the global rail industry as a potential market opportunity.

All of this could happen, but it would require far more time and funds than most investors are ready to provide. Even Amazon stock has fallen 30 percent four times in the past decade. In 2001, AMZN stock even fell 90%. Investors are patient until that happens, and few would be surprised by a similar shakeout for Tesla shareholders in the next market crash, even if the company is ultimately successful.

The second reason concerns Musk. There have been several articles comparing Musk to P.T. Barnum and Steve Jobs. It's not hard to see him as the embodiment of both. Many people are concerned about his actions and decisions, which seem less mature than those of a typical 49-year-old CEO, even if he is one of the richest men in the world.

At the same time, after he made a controversial acquisition of his cousin's solar panel business five years ago and settled fraud charges with the SEC in 2018, investors should expect more responsible behavior in the future.

Instead, Musk continues to push the boundaries between hilarity and market manipulation on social media, and he's adding fuel to the fire that he's just as interested in trolling the establishment as he is in running Tesla. Further proof in the last few days has come in the form of a tweet endorsing Dogecoin, a cryptocurrency that began as a joke based on a meme calling a Shiba Inu dog Dodge, and then a tweet hinting at buying a cryptocurrency called Shiba Inu, after which confused investors mistakenly traded it higher in response to a tweet with

Dogecoin. Now the fun-loving billionaire has changed his official title from CEO to " Technoking of Tesla" and CFO to "Master of Coin."

Behind all the jokes, most analysts seem to miss two very significant factors. First, Musk is brilliant. He is now either the founder or the first investor (he did not found Tesla) of three companies that have redefined the industry: PayPal Holdings, Tesla, and SpaceX. Second, he is not an incrementalist. After he made his money selling PayPal and putting all his money into Tesla and SpaceX, he ran out of cash. Fortunately, he got a loan from the Department of Energy to support Tesla. It's a mentality that few people have, and it leads to drastic consequences.

Sure, the automaker could have gone bankrupt, but he was willing to go all in.

Although he is a one-of-a-kind entrepreneur, and there is growing evidence that all modes of transportation are included in the company's addressable market, many would agree that Musk likes to make big, potentially dangerous bets. So far they've worked, but the line between unconventional and irresponsible is often hard to distinguish. Some people would never agree to buy stock in a company so dependent on one person, especially when that person is so unpredictable. The choice, of course, is yours.

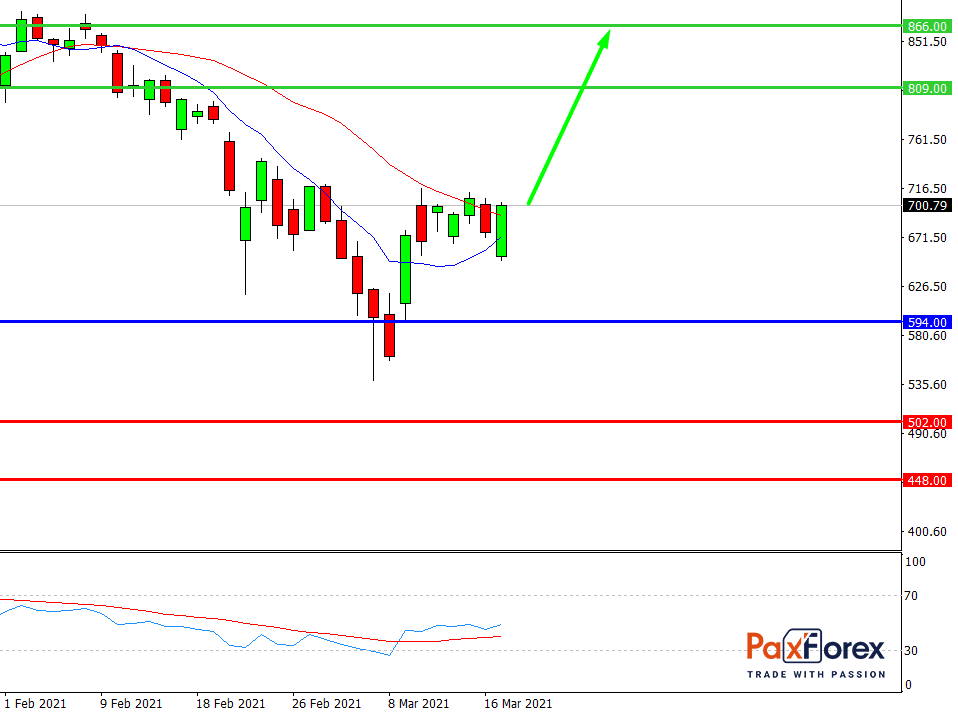

Provided that the company is traded above 594.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 693.00

- Take Profit 1: 809.00

- Take Profit 2: 866.00

Alternative scenario:

In case of breakdown of the level 594.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 594.00

- Take Profit 1: 502.00

- Take Profit 2: 448.00

Nas100 | Trading Analysis of Nasdaq 100 Index

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis